Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 06, 2016

Spanish firms see strong growth pre-election

According to the latest Markit PMI data for Spain, manufacturing firms and service providers alike continued to record sharp increases in output in the run up to the general election on December 20th. However, with the result of the election leaving the make-up of the next government in doubt, there is a chance that a prolonged period of political uncertainty could result in a drop-off in economic growth at the start of 2016.

The Markit Spain Composite PMI, a combined index based on surveys of business activity in the manufacturing and service sectors, posted 55.2 in December. This completed a second successive full year of growth in output, with the average reading for 2015 above that seen in 2014. Strong expansion was recorded throughout the final quarter, suggesting that GDP continued to rise at a healthy pace in the last three months of the year, perhaps albeit slowing slightly from the 0.8% quarter-on-quarter rise seen in Q3.

Spanish GDP v PMI

Broadly similar expansions in activity were recorded across the manufacturing and service sectors. Manufacturing production has now expanded in each of the past 25 months, with services activity having risen continuously since November 2013. Increased output was delivered on the back of another monthly rise in new orders. This also led to signs of pressure on operating capacity as backlogs of work increased.

Higher workloads facilitated further job creation at the composite level. Employment has now increased for 21 consecutive months, helping to reduce the high levels of unemployment that characterised the economic crisis in Spain. The latest quarterly labour market survey signalled an unemployment rate of 21.2% in Q3 2015, still high but the lowest since Q2 2011 and down from a peak of 26.9%.

The sustained improvements in the Spanish PMI data through to December signalled that the economic recovery remained on track in the run-up to the general election (the December PMI data were collected prior to the election).

Election result leads to uncertainty

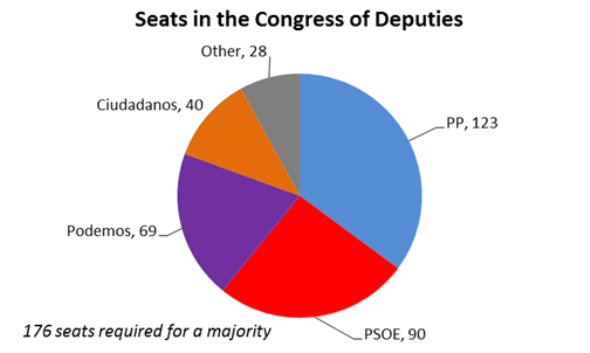

The results of the election held on December 20th resulted in the governing Partido Popular (PP) winning the largest number of seats in parliament, but short of securing an overall majority. The success of new political forces Podemos and Cuidadanos meant that the traditional two-party system in Spain has come to an end. With the electoral arithmetic making the chances of a viable governing coalition uncertain, there is the real possibility of a sustained period of political stalemate and even the need for a re-election. The new parliament will convene on January 13th and vote on the candidate for Prime Minister suggested by the King. If no agreement has been reached after two months then a new election will be held.

Spanish General Election result

The prospect of a period of political instability following the election had been seen as a key threat among Spanish companies in the latest Markit Business Outlook survey, conducted in October. That said, firms remained generally positive about the outlook over the coming 12 months.

Threats to activity over the next 12 months from October's Business Outlook survey

There are also signs that investors may be have been adopting a wait-and-see attitude in recent months, according to Markit data on exchange traded products. Funds exposed to Spain saw strong inflows of money during the middle of 2015 up until August. However, after a fall in September the final three months of the year saw only small net flows.

Funds exposed to Spain see small net flows at end of 2015

The PMI data for January will provide the first indication as to whether the indecisive election result has had any impact on the real economy so far, with data released on the 1st and 3rd of February for manufacturing and services respectively.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-economics-spanish-firms-see-strong-growth-pre-election.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-economics-spanish-firms-see-strong-growth-pre-election.html&text=Spanish+firms+see+strong+growth+pre-election","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-economics-spanish-firms-see-strong-growth-pre-election.html","enabled":true},{"name":"email","url":"?subject=Spanish firms see strong growth pre-election&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-economics-spanish-firms-see-strong-growth-pre-election.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Spanish+firms+see+strong+growth+pre-election http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-economics-spanish-firms-see-strong-growth-pre-election.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}