Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 06, 2016

Global PMI dips in December to signal weakest quarterly growth for a year

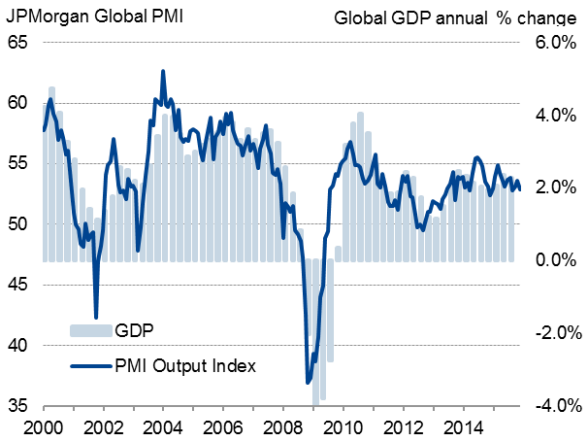

The global economy lost some growth momentum in December, according to survey data which showed rates of expansion slowing in both manufacturing and services. The weak end to 2015 rounded off the worst quarter, albeit by a narrow margin, seen for a year.

The JPMorgan Global PMI, compiled by Markit from its national business survey data, fell from 53.6 in November to 52.9 in December, its lowest since September. At 53.2, the average reading for the fourth quarter was the lowest since Q4 2014, though well above the no-change level of 50 to thereby signal further economic growth. The fourth quarter survey data are broadly consistent with global GDP rising at an annual rate of 2%.

New business meanwhile grew globally at the slowest rate for 11 months, easing in both sectors, a factor restraining employment growth well below pre-crisis trend rates and adding to the sense that companies remain more cost conscious and reluctant to invest in the expansion of capacity in the post-recession world.

Global economic growth

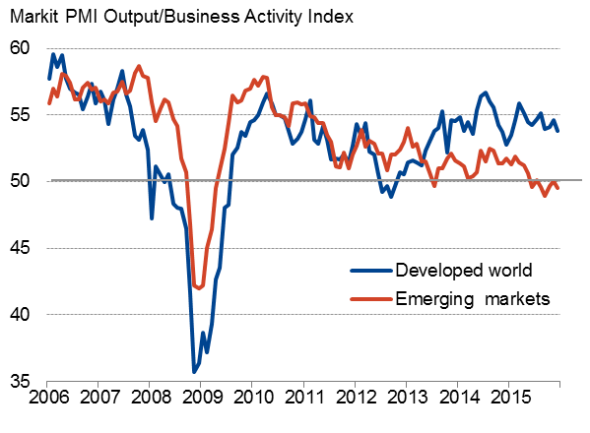

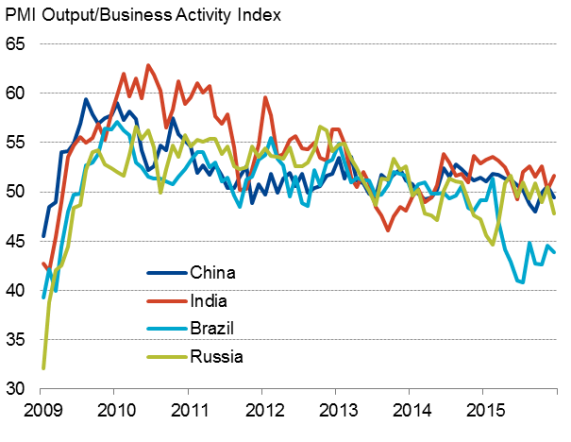

Emerging markets slide back into contraction

Emerging markets remained a major drag on the global economy, slipping back into decline to signal the fifth month of contraction in the past seven months. At 49.5, the PMI for the emerging markets is indicative of just less than 4% annual GDP growth, less than half the average rate of expansion seen in the five years prior to the global financial crisis.

Developed v emerging markets

China slipped back into decline after returning to growth for the first time in four months in November, playing a key role in constraining growth in other parts of Asia. Asia ex-Japan manufacturing saw the worst performance for over a decade in 2015, according to PMI data.

A drop in output from China's factories was accompanied by a near stagnation of services activity.

Downturns were also seen in Russia and Brazil, the former registering the largest drop in activity since March, though it was the latter that continued to see the steepest downturn of all major economies covered by the PMI surveys. India bucked the downturn trend, as a jump in service sector activity offset the most severe drop in manufacturing output since the height of the global financial crisis.

Broad-based developed world expansion

Growth meanwhile eased to an 11-month low in the developed world, the PMI dropping from 54.6 to 53.8 and pointing to annual GDP growth of around 1.5%. While the overall rate of expansion signalled is only modest, the surveys at least point to broad-based growth, with all four largest developed economies firmly in expansion territory.

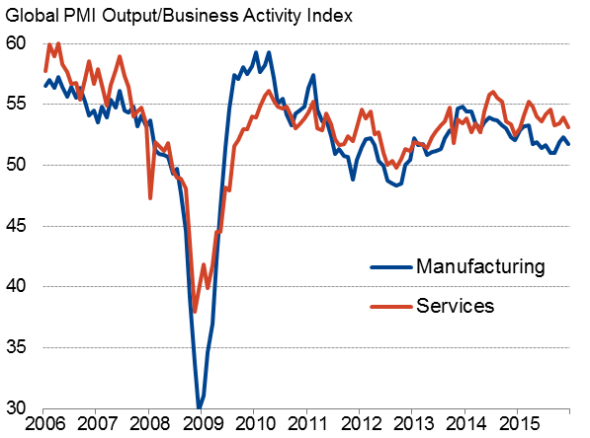

Manufacturing v services

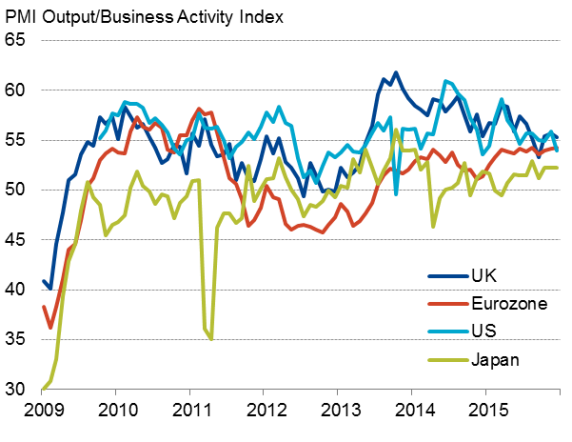

Of the four, the United Kingdom notched up the fastest rate of increase, even though the PMI fell slightly in December. The surveys point to 0.5% GDP growth in the fourth quarter, but a worrying dip in business expectations to a near three-year low suggests the pace of expansion may continue to wane as we move into 2016. As such, the Bank of England looks unlikely to start hiking interest rates any time soon.

Growth also eased in the United States, where the Markit PMI surveys pointed to the weakest monthly expansion for a year. Growth slowed in both manufacturing and services. The surveys nevertheless point to a 0.5% (1.9% annualised) GDP expansion in the fourth quarter. The weak December data suggest, however, that having hiked interest rates for the first time in almost a decade at the end of last year, the Fed will likely err on the side of caution and hold off with further policy tightening until the full extent of the slowdown becomes apparent.

Downturns in the US and UK PMIs contrasted with an increase in the Markit Eurozone PMI to the joint-highest since May 2011, though the survey signals a modest 0.4% increase in GDP in the fourth quarter. The surveys showed Spain, Italy and Germany all enjoying strong economic expansions, but France is showing signs of stalling once again. The improvement in the data will be of only minor encouragement to the ECB, with the central bank looking ready to inject more stimulus if growth fails to accelerate appreciably.

Finally, Japan's Nikkei 'all-sector' PMI edged down only slightly to finish the best quarter since the start of 2014. The data point to another expansion of the economy following the news recent recession has been revised away has been revised away after better than previously thought third quarter growth, in line with the more upbeat PMI. The improved news flow reduces scope for further stimulus from the Bank of Japan.

Developed world

Emerging markets

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Global-PMI-dips-in-December-to-signal-weakest-quarterly-growth-for-a-year.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Global-PMI-dips-in-December-to-signal-weakest-quarterly-growth-for-a-year.html&text=Global+PMI+dips+in+December+to+signal+weakest+quarterly+growth+for+a+year","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Global-PMI-dips-in-December-to-signal-weakest-quarterly-growth-for-a-year.html","enabled":true},{"name":"email","url":"?subject=Global PMI dips in December to signal weakest quarterly growth for a year&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Global-PMI-dips-in-December-to-signal-weakest-quarterly-growth-for-a-year.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+dips+in+December+to+signal+weakest+quarterly+growth+for+a+year http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f06012016-Economics-Global-PMI-dips-in-December-to-signal-weakest-quarterly-growth-for-a-year.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}