Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Nov 05, 2015

Investors poised for diverging EU/US policies

Investors have opted for European government bonds in favour of US treasuries in anticipation of diverging monetary policies, which may pose challenges to the US economy.

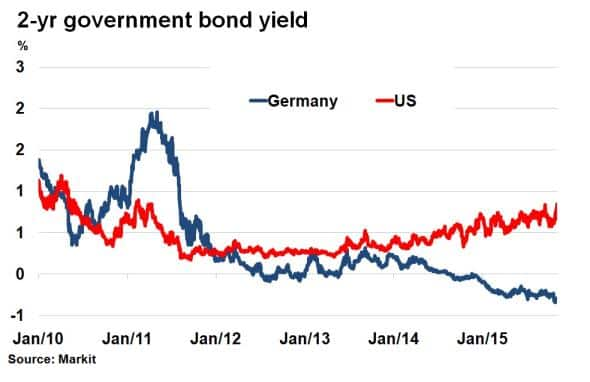

- US treasury 2-yr yields highest seen since April 2011, continue to diverge with bunds

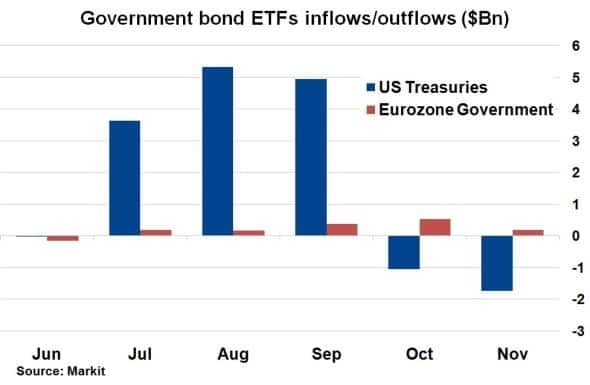

- ETFs tracking US treasuries have seen $1.7bn of outflows in the first week of November

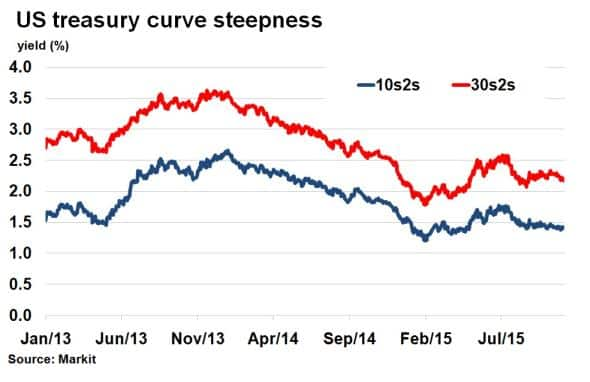

- Short end of the US treasury curve is at its flattest since April

Hawkish comments from Fed chairman Janet Yellen yesterday preceded a selloff in US treasuries, as market expectations of an inaugural rate hike in December rose in tandem.

2-yr US treasury yields, seen as the most sensitive to short term interest rates, rose to 0.84% according to Markit's bond pricing service. This was the highest level since April 2011; just before the Fed concluded its second round of QE.

Yesterday's comments added to the hawkish tones set out in October's FOMC meeting, in which the official statement cited diminishing downside risks to the US economy. But while US sentiment is swaying towards an imminent rate rise, counterparts in Europe have taken the opposite view. Grappling with low inflation, last month the ECB raised the possibility of expanding its current QE programme while also cutting deposit rates. 2-yr German bund yields collapsed to their lowest ever levels, currently -0.34%. The dovish sentiment was matched today by the UK, whose central bank looks to have sided with Europe.

The diverging policies with it challenges, especially for the US, where an already strong dollar could present further problems. The US and Europe remain major trading partners, and a stronger dollar has the potential to import deflation as well as posing currency risks for US multinational firms exposed to the euro.

Investors anticipate divergence

The prospect of further deviation between European and US government bond yields has already been picked up by ETF investors. According to Markit's ETP analytics service, ETFs tracking US treasuries have seen four consecutive weeks of outflows for the first time since June. The trend has gained further traction on the back of the Fed's recent hawkish comments, with the first five days in November already seeing $1.7bn of net outflows; surpassing the whole of October's net outflows. In contrast, ETFs tracking eurozone government bonds have continued to see positive inflows as investors attempt to front run the ECB's rhetoric.

Treasury curve flattens

The recent march in 2-yr US treasury yields has also done much to flatten the short end of US treasury curve, with 10s2s (difference between 10-yr and 2-yr rates) at its lowest level since April. A flatter treasury curve poses risks especially to the banking sector as margins are squeezed, which could lead to potential spill over into the wider economy. Flat yield curves have also been a precursor to impending recessions - yet another risk which the Fed needs to address as it moves to normalise interest rates.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-credit-investors-poised-for-diverging-eu-us-policies.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-credit-investors-poised-for-diverging-eu-us-policies.html&text=Investors+poised+for+diverging+EU%2fUS+policies","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-credit-investors-poised-for-diverging-eu-us-policies.html","enabled":true},{"name":"email","url":"?subject=Investors poised for diverging EU/US policies&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-credit-investors-poised-for-diverging-eu-us-policies.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+poised+for+diverging+EU%2fUS+policies http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05112015-credit-investors-poised-for-diverging-eu-us-policies.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}