Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 05, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Restoration Hardware leads the seven heavily shorted retailers announcing earnings this week

- UK asset managers Ashmore Group and Hargreaves Lansdown see heavy short interest leading up to earnings

- Biometric software firm Morpho has 10.7% of its shares shorted

North America

Retailers are a key focus of North American short sellers this week despite the shortened trading week with seven of the 19 short targets coming from the sector.

The key target this week is Restoration Hardware which has over a quarter of its shares shorted. The firm reported an unexpected loss in its first quarter earnings on below consensus revenues which sent its shares down by more than a fifth. Short sellers are betting for a further disappointing set of earnings this time around as demand to borrow Restoration Hardware shares has increased by over 20% in the last month despite the fact that they have recovered most of the ground lost in the wake of last quarter's disappointing earnings.

The other retailers announcing earnings this week include Tailored Brands, Saks owner Hudson's Bay and Mattress Firm Holdings. The latter of the three's short interest has more than halved in the last month after South African group Steinhoff International announced its desire to acquire the company.

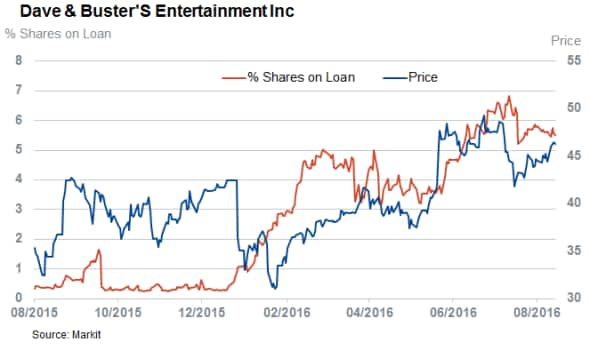

Arcade and casual dining operation Dave & Busters, the largest non-retail short target in this week's list by value, is exposed to the same forced driving short sellers to retailers due to its large exposure to consumer spending. Its short interest has increased by over 20 fold since the start of the year to the current 6% of shares outstanding.

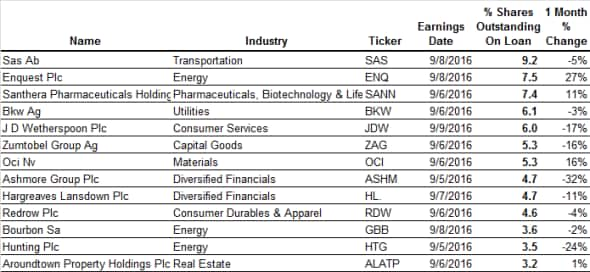

Europe

The main European short target announcing earnings this week is Scandinavian airline Sas which has 9.2% of its shares out on loan. The firm has been locked in a heated battle with regional upstart Norwegian Air Shuttle which has spurred heavy shorting activity in both firms. Short sellers have been less active in SAS shares since it announced underwhelming results back in June which sent its shares down sharply.

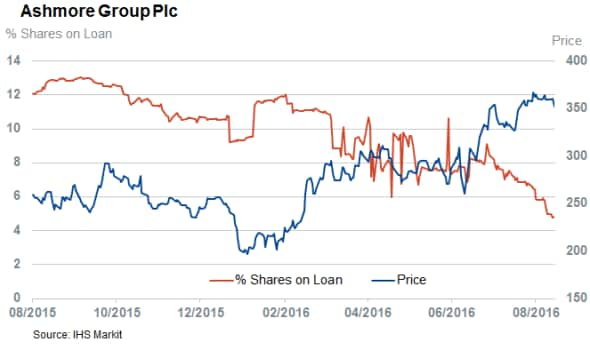

UK asset managers are another key short trade this week with Ashmore and Hargreaves Lansdown both making the list of heavily shorted firms announcing earnings.

The former of the two has experienced sustained short covering as investors regain their faith in emerging markets especially as UK gilt yields have sunk to new all-time lows in the weeks since the EU referendum.

Energy exploration firm Enquest comes on the other side of the short selling momentum scale as short sellers have increased their positions by over a quarter in the four weeks leading up to its earnings announcement on Thursday.

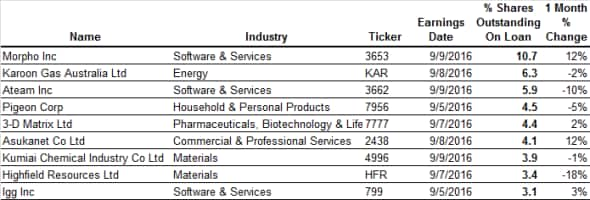

Apac

Japanese image processing and biometrics firm Morpho is the most shorted Asian company announcing earnings this week with 10.7% of its shares out on loan. Its shares are down by more than 50% from the highs set back in April and short sellers have been steadily adding to their positions after covering during a rally in Morpho's share price in the opening four months of the year.

Software firms make several of this week's key short targets in Asia as games developers Ateam and IGG also make the list of heavily shorted names leading up to earnings.

The largest rise in short interest leading up to earnings is seen in publishing company Asukanet whose short interest has climbed by 12% in the last month. Asukanet's has been trying to diversify away from its core funeral and personal photography business into the aerial photography space, but short sellers are yet to be convinced given the recent rise in demand to short the firm's shares which are trading at less than a quarter of the recent highs set back in 2014.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092016-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092016-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05092016-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}