Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 05, 2015

US PMI data point to 2.1% annualised GDP growth at start of third quarter

The latest Markit PMI data indicate that the US economy enjoyed a good start to the third quarter, but the survey provides mixed news for policymakers mulling when to hike interest rates for the first time since borrowing costs were slashed to record lows at the height of the recession.

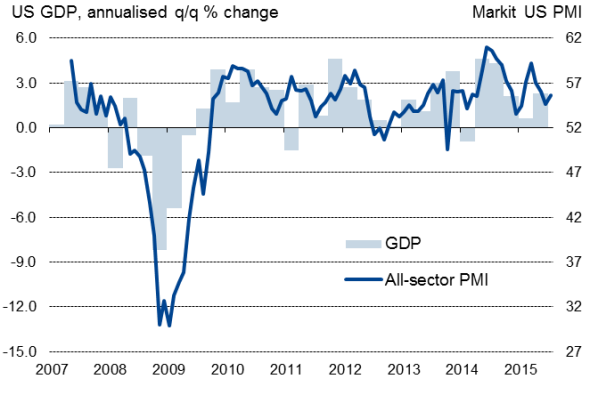

GDP data move into line with PMI

The seasonally adjusted Markit Composite PMI" registered 55.7 in July, above the earlier "flash' reading of 55.2 and up from June's five-month low of 54.6. Faster growth in the service sector accompanied a similar upturn in manufacturing, leaving the economy on course to see a rate of expansion similar to the solid pace achieved in the second quarter.

The survey data had accurately anticipated the improvement in the pace of economic growth in the second quarter, when growth rebounded to 2.3% after a poor start to the year.

What's more, upwards revisions to the official figures have also brought the historical data more into line with the business surveys. Importantly, like the PMI, the official data now indicate that the economy expanded in the first quarter rather than suffered a slide back into contraction.

The third quarter of 2012 was also notable in that growth has been revised down from 2.5% to just 0.5%, in line with the 0.6% increase signalled by the PMI at the time for that quarter.

The upwards revisions to the historical GDP have increased the correlation between PMI and GDP data to 83%. The July data are currently running at a level consistent with 2.1% annualised growth of GDP.

Economic growth & the PMI

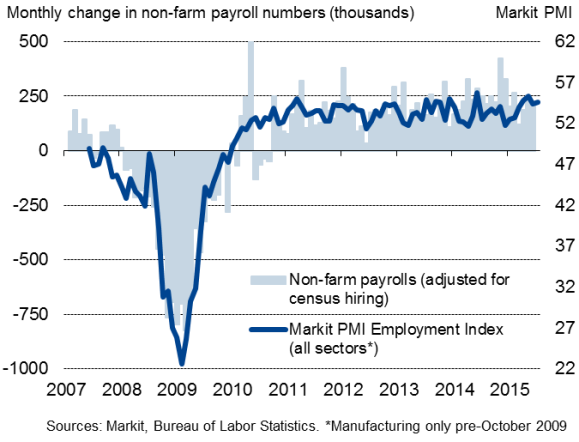

Hiring boom continues amid strong demand

The solid pace of economic growth also continued to translate into further impressive job creation, with a 225,000 non-farm payroll increase signalled by the July PMI survey results.

Inflows of new business across both manufacturing and services also picked up to a three-month high, adding to the upbeat tone of the PMI survey results.

Employment

Mixed news for policymaking

At face value, the sustained robust expansions of GDP, order books and employment signalled in July therefore augur well for a rate hike later in the year. The FOMC has already highlighted the possibility of rates rising as early as September, assuming the data flow (and the labour market in particular) continues to impress in the meantime.

However, dig a little deeper and there are causes for concern which could worry policymakers into deferring any tightening of policy.

Growth has clearly slowed compared to this time last year, and a further drop in service sector companies' optimism about the year ahead to one of the lowest seen over the past five years indicates that firms are expecting growth to slip further in coming months. Hiring could soon wane unless business confidence picks up again, which would have the additional impact of depressing already-weak wage growth.

The survey also illustrates how the strong dollar and falling oil prices add to the argument for holding off with any tightening of policy. Rates of inflation of both firms' input costs and their selling prices eased in July amid lower import costs and falling global commodity prices, according the PMI data. The strong dollar is also continuing to hurt export performance, dampening economic growth prospects.

Finally, policymakers will also be concerned about slumping growth in foreign markets, and emerging markets in particular, which will be exacerbated by higher US interest rates and a stronger dollar. PMI data indicated that emerging market manufacturing slid further into contraction in July, led by a renewed downturn in China which has accompanied economic declines in many other Asian countries as well as Brazil and Russia. Eurozone worries are also causing uncertainty.

While a September rate hike remains a distinct possibility, there are clearly many reasons that policymakers could cite to delay any tightening of policy.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-US-PMI-data-point-to-2-1-annualised-GDP-growth-at-start-of-third-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-US-PMI-data-point-to-2-1-annualised-GDP-growth-at-start-of-third-quarter.html&text=US+PMI+data+point+to+2.1%25+annualised+GDP+growth+at+start+of+third+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-US-PMI-data-point-to-2-1-annualised-GDP-growth-at-start-of-third-quarter.html","enabled":true},{"name":"email","url":"?subject=US PMI data point to 2.1% annualised GDP growth at start of third quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-US-PMI-data-point-to-2-1-annualised-GDP-growth-at-start-of-third-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+PMI+data+point+to+2.1%25+annualised+GDP+growth+at+start+of+third+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-US-PMI-data-point-to-2-1-annualised-GDP-growth-at-start-of-third-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}