Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 05, 2015

Downturn in orders from China pushes Hong Kong PMI further into negative territory

Business conditions deteriorated in Hong Kong for a fifth successive month in July, according to the Markit-compiled Nikkei PMI", with the rate of decline gathering pace again to signal one of the worst performances seen since the global financial crisis.

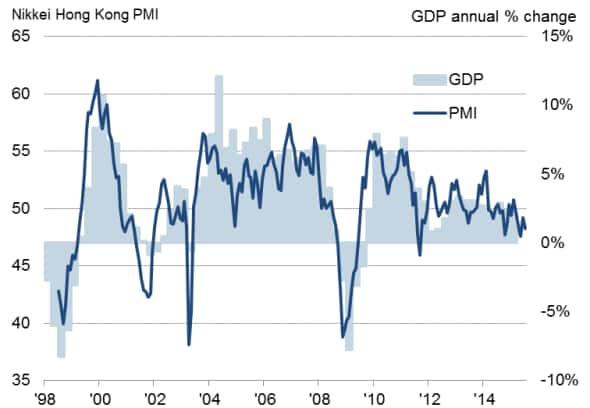

Economic growth in Hong Kong

The headline PMI - a composite of several key survey indices designed to act as a leading indicator of economic growth - fell from 49.2 in June to 48.2 in July, dropping further into negative territory below the 50.0 neutral level.

The latest PMI reading is consistent with the annual rate of economic growth sliding to just 1.3% at the start of the third quarter, down from an average pace of 1.5% signalled for the second quarter (please refer to our note on using the PMI to model GDP growth for further details).

Companies reported that orders and output fell at faster rates in July, leading to further job cuts. Companies also ran down inventory levels, which fell at the steepest rate since 2011, suggesting more pain is expected in coming months and output is likely to drop further.

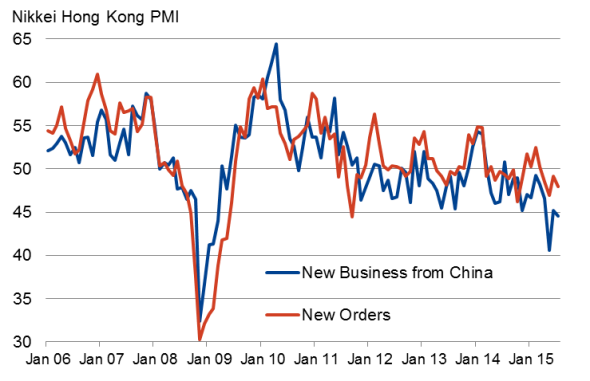

New orders

A key source of weakness has been a steep decline in new orders from mainland China. Although the rate of decline has eased compared to a marked drop in May, recent months have seen the largest downturn in demand from China since 2009.

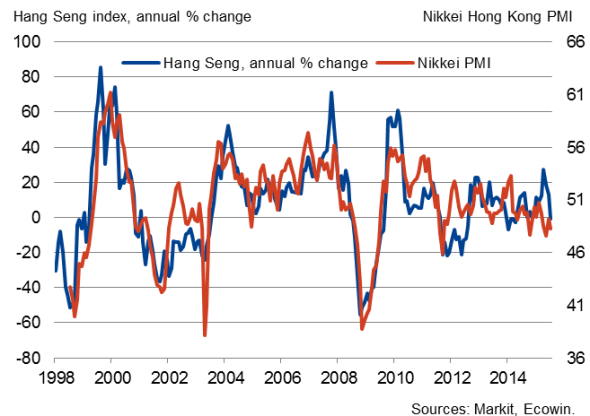

The drop in the PMI poses further downside risks to corporate earnings in Hong Kong and could put further downward pressure on share prices. The Hang Seng Index has already pulled back 13% from its April peak, when it hit the highest level seen since 2007; a rise which the PMI suggested had not been supported by an improvement in underlying economic fundamentals.

Share prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Downturn-in-orders-from-China-pushes-Hong-Kong-PMI-further-into-negative-territory.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Downturn-in-orders-from-China-pushes-Hong-Kong-PMI-further-into-negative-territory.html&text=Downturn+in+orders+from+China+pushes+Hong+Kong+PMI+further+into+negative+territory","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Downturn-in-orders-from-China-pushes-Hong-Kong-PMI-further-into-negative-territory.html","enabled":true},{"name":"email","url":"?subject=Downturn in orders from China pushes Hong Kong PMI further into negative territory&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Downturn-in-orders-from-China-pushes-Hong-Kong-PMI-further-into-negative-territory.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Downturn+in+orders+from+China+pushes+Hong+Kong+PMI+further+into+negative+territory http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05082015-Economics-Downturn-in-orders-from-China-pushes-Hong-Kong-PMI-further-into-negative-territory.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}