Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jul 05, 2017

Activists fail to inspire Hong Kong short sellers

Despite a slew of recently released activist short reports, average short selling across the constituents of Hong Kong's HSI index has fallen to the lowest level in nearly two years

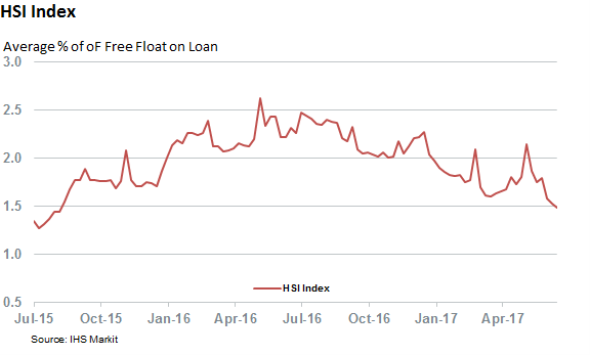

- Average shorts across the HSI index fell by a third ytd to 1.5% of free float

- Recent short targets AAC and Man Wah have seen sustained short covering

- High convictions shorts Evergrande and Great Wall turn against short sellers

Observers could be forgiven for thinking that Hong Kong has turned into a free for all for short sellers after witnessing the seemingly never ending stream of activist short campaigns have targeted the territory's listed stocks over recent weeks. Markit Securities Finance data shows this is far from being the case given that the average borrow activity across constituents of the Hong Kong's reference HSI index has failed to rise despite recent developments. In fact the opposite looks to be happening given that the average demand to borrow shares of the index's constituents has recently fallen below 1.5% of freely traded shares for the first time in nearly two years. This milestone was possible due to the fact that shorts have covered a third of their positions on average since the start of the year.

This relentless covering only leaves one company with a short interest representing more than 10% of its free float, food conglomerate Want Want China. Even this may not hold for long however given that Want Want short sellers have covered a quarter of their positions year to date to take their interest in the company to the lowest in over two years.

New short reports fail to convince shorts

Activists have done little to change this newfound status quo given that AAC Technologies, the one HSI constituent to have been targeted by activist shorts in recent weeks, has a relatively low 4.2% of its free float out on loan. Short sellers were initially willing to follow Gotham Research's advice after it accused AAC of artificially inflating its profit margin back in early June. This faith looks to have eroded in the however, as the latest demand to borrow AAC shares is less than half of the levels seen in the days immediately following the release of the Gotham report.

Carson Block of Muddy Waters has seen an equally lukewarm reception when he went public with a short in sofa manufacturer Man Wah Holdings. The firm saw short sellers borrow over 15% of the company's free float immediately following the Muddy Waters report. As with AAC, this proved equally fleeting given that demand to borrow Man Wah shares has since fallen to less than a quarter of its post report high.

The rapid covering experienced by both firms looks to have been a prudent move given that their share price went on to recover the majority of the slump experienced in the immediate aftermath of the reports coming to light. Whether Gotham or Muddy Waters get proven right in the end remains to be seen however short sellers seem to be taking a cautious approach for now.

Short sellers could be excused for taking this cautious stance given that shorting Hong Kong stock has been a relatively tricky game of late after two of Hong Kong's most high conviction shorts, China Evergrande and Great Wall Motor, have quickly turned against them in recent weeks. The former of the two was especially painful for shorts as they now sit on a $600m paper loss after the real estate developer's shares unexpectedly doubled after it announced that it was paying off its debt and listing some its assets in mainland China.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-equities-activists-fail-to-inspire-hong-kong-short-sellers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-equities-activists-fail-to-inspire-hong-kong-short-sellers.html&text=Activists+fail+to+inspire+Hong+Kong+short+sellers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-equities-activists-fail-to-inspire-hong-kong-short-sellers.html","enabled":true},{"name":"email","url":"?subject=Activists fail to inspire Hong Kong short sellers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-equities-activists-fail-to-inspire-hong-kong-short-sellers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Activists+fail+to+inspire+Hong+Kong+short+sellers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05072017-equities-activists-fail-to-inspire-hong-kong-short-sellers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}