Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 05, 2017

Czech manufacturing sector performs strongly at the start of 2017

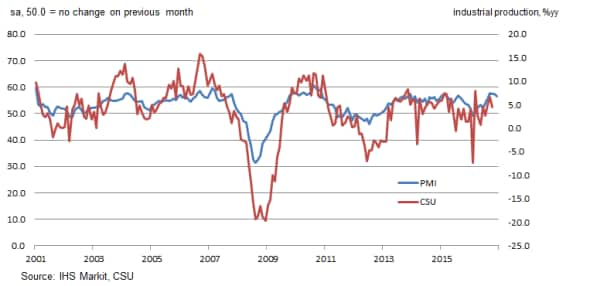

Manufacturers in the Czech Republic have signalled a strong start to 2017. The Czech Republic Manufacturing PMI has indicated a marked growth rate since January, with official data adding to the upbeat picture, stating year-on-year growth of 2.9% in the first quarter. On the European (and global) stage, the Czech Republic's manufacturing performance has ranked highly so far in 2017.

IHS Markit Czech Republic Manufacturing PMI and official industrial production

Growth is expected to continue throughout the second-half of 2017 at a solid pace, with the latest IHS Markit prediction forecasting a 3.3% year-on-year rise in GDP in both quarter three and four. That said, constraints on growth potential may come into play as the year progresses. Labour shortages and possible currency fluctuations could have wide-ranging effects on the ability of the Czech economy to achieve its full potential.

Trends in 2017

The IHS Markit Czech Republic Manufacturing PMI for the period January to May signalled an average reading of 56.9, indicating the strongest upturn in the Czech manufacturing sector since 2011. A rise in the overall figure was supported by higher levels of in output, new orders, exports and employment.

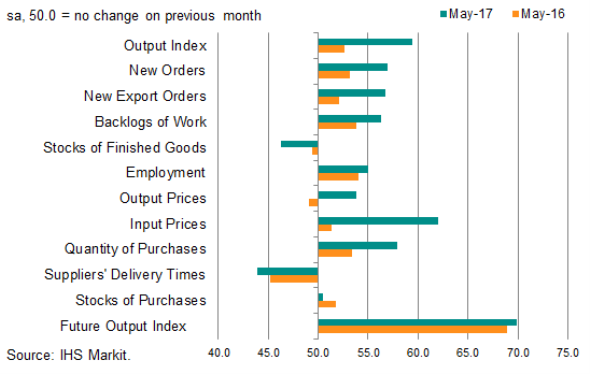

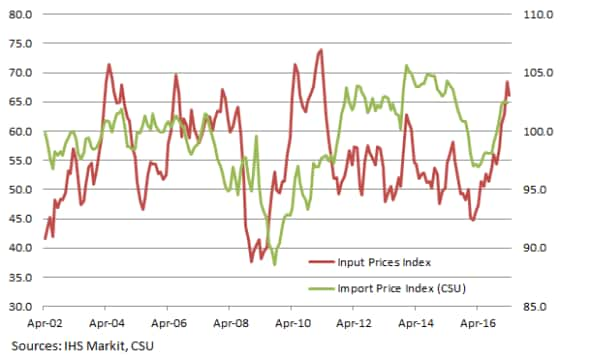

Although input prices have softened since March's near six-year high, the pace of inflation remained steep. Responding to increasing world prices for raw materials and lower supply at distributors, goods producers have been forced to raise their prices charged to clients.

Official data from the Czech Statistics Office and Eurostat show that industrial producers experienced input price increases of 0.3% month-on-month in April, and a 3.2% rise compared to April 2016. Products with the greatest annual change were chemicals and chemical goods, which rose by 8.2% year-on-year, closely followed by a 7.9% upturn in the cost of metals and fabricated metal products. The PMI's Input Prices Index for May signalled one of the fastest increases in prices since January 2016.

Changes in PMI indexes May 2016 vs. May 2017

Czech growth in the European context

Many of the main economies within Europe have experienced accelerated growth in 2017 so far. Much like the Czech Republic, Manufacturing PMI data for Germany, the Netherlands, Italy and Poland have followed a solid progression of output expansion. A similar, but less smooth, trend was seen in the French and British economies.

The average Manufacturing PMI figure for the Czech Republic was above the Eurozone average, and only slightly lower than Germany. Therefore, the Czech Republic's main trading partners and their manufacturing sectors are performing strongly. The latest IHS Markit forecast for overall economic growth in the Czech Republic in 2017 is 2.9%, largely based on solid underlying demand in Europe.

Points of interest for the rest of 2017

In the medium-to-long term the Czech economy faces obstacles from both the labour and currency markets. These constraints could affect growth potential and competitiveness.

Following the koruna cap exit, it was expected the currency would fluctuate as the currency stabilises. When the decision was first made to abandon the cap it was feared that volatility would be high. Following vast speculative interest in the currency in the period leading up to the exit, it has been forecast that the koruna will weaken in the short term. In the medium term, IHS Markit has forecast the currency will strengthen. This should allow the economy to benefit from a surplus on the current account and low external debt.

IHS Markit Input Price Index vs. Official Import Price Index

Unemployment rates have been falling quickly among both skilled and unskilled workers. In January 2017 there were 150,000 unfilled roles within the Czech economy. Provisional figures show unemployment at only 3.2% in April. Although many firms have gained international competitiveness through low wage costs, wages may need to rise to attract migrant workers to the Czech Republic. As birth rates have slowed over recent years the country has struggled with demographic challenges.

As growth in new business and output increases, pressures on capacity at Czech manufacturing firms could hamper the ability to meet orders. In the medium term, firms may have to seek greater efficiencies and increased productivity. In the long-run, growth could be held back as firms struggle to cope with strong underlying demand from domestic and foreign markets.

Looking towards 2018

The current Czech government is seeking entrance to the ERM 'waiting room' in 2018, ideally adopting the Euro by early in the next decade. This will reduce the ability of the Czech National Bank to step in when currency volatility strikes. Such help will not be readily given when part of the eurozone.

Concerns regarding labour shortages and currency fluctuations will be monitored due to the impact on both growth potential and trade competitiveness. That said, the growth performance seen in the first half of 2017 has been solid and there are very few signs of this abating naturally. The latest forecasts from IHS Markit point towards continued strength in quarters three and four. It is expected this will extend through into next year, with overall growth in 2018 placed at 2.8% year-on-year.

Forthcoming economic data releases:

- June 7th: Final industrial production data for 2016, Q1 2017 and April

- June 30th: Gross Domestic Product (YoY) Q1

- July 3rd: IHS Markit Czech Republic Manufacturing PMI

Sian Jones | Economist, IHS Markit

Tel: +44 14 9146 1017

sian.jones@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-czech-manufacturing-sector-performs-strongly-at-the-start-of-2017.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-czech-manufacturing-sector-performs-strongly-at-the-start-of-2017.html&text=Czech+manufacturing+sector+performs+strongly+at+the+start+of+2017","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-czech-manufacturing-sector-performs-strongly-at-the-start-of-2017.html","enabled":true},{"name":"email","url":"?subject=Czech manufacturing sector performs strongly at the start of 2017&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-czech-manufacturing-sector-performs-strongly-at-the-start-of-2017.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Czech+manufacturing+sector+performs+strongly+at+the+start+of+2017 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062017-economics-czech-manufacturing-sector-performs-strongly-at-the-start-of-2017.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}