Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 05, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

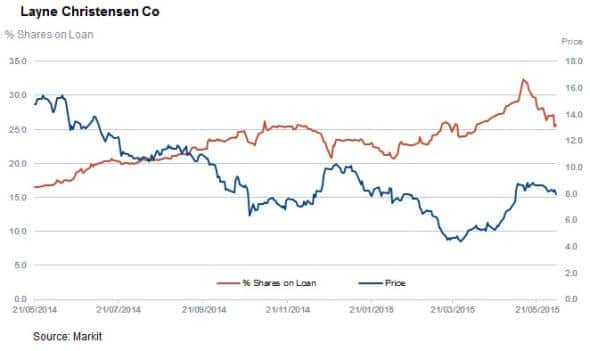

- Layne Christensen is the most shorted company ahead of earning but has seen covering

- Printing Equipment firm Heidelberger Druckmaschinen Ag mpst shorted in Europe

- Low milk global prices sees China Huishan Dairy Holdings Company Ltd targeted

North America

Water firm Layne Christensen tops the list of the 20 North American firms announcing earnings next week with more than 6% of shares out on loan. The firm has been actively trying to shift its corporate focus to the water industry, which has seen it divest its GeoConstruction business last month. Investors have reacted well to the company's recent move, sending its shares up from recent lows and short sell covering. Despite this recent covering, the company still has over a quarter of its shares out on loan which is no doubt driven by the fact that it still has a large exposure to the struggling mineral business.

Energy companies continue to make popular short sales and this week sees three oil, gas & consumable fuels firms make the list of heavily shorted firms ahead of earnings. The energy shorts this week are led by Triangle Petroleum whose shares are down by over 50% in the last 12 months in the wake of the collapse in oil prices.

Energy short sellers are not constrained to the oil & gas segment, as Canadian uranium exploration firm Uranium Energy makes the list of the most shorted ahead of earnings with 7.4% of shares out on loan. The demand to short sell Uranium Energy is down significantly in the last few weeks however after its shares rallied from recent lows.

3D printing is another popular sector for short sellers and this week sees Organovo and ExOne make the heavily shorted list ahead of earnings with 12.7 and 11% of shares out on loan respectively.

Rounding out the list is former perennial short Sears which has 6.5% of shares out on loan. That number has climbed significantly in the month leading up to earnings, but momentum traders may be wary as Sears in has been singled out by Markit's Research Signal short squeeze model as a potential short squeeze and most short sellers are currently losing money on their positions. Any positive earnings news coming out of Sear's Monday announcement could trigger a short squeeze.

Western Europe

German printing equipment company Heidelberger Druckmeschinen, which has 8% of shares out on loan, is the most shorted European firm ahead of earnings. Heidelberger has seen shorts cover in recent weeks however as analysts have increased their expectations for the company's upcoming results. Analysts are now forecasting the firm to turn its first profit in a year after boosting their revenue expectations by over 10% in the last three months.

In the UK, Oxford instruments has 6.9% of shares out on loan ahead of earnings. Short sellers have stayed the course in the nano technology equipment manufacturer despite the fact that its shares have rallied from their lows after the firm announced a profits warning in January.

Asia Pacific

Digital image software firm Morpho is the most shorted Asian name this week with just under 6% of its shares out on loan. Morpho has not been the most successful position for short sellers as the firm's shares are now up by over 270% for the year. This rally has sent shorts covering with demand to borrow now third of the level seen during the April highs.

The second most shorted firm ahead of earnings is China Huishan Dairy which has 5.8% of shares out on loan. Interestingly, short sellers have covered their positions in the run-up to earnings despite the fact that a global milk glut has sent prices to a five year low.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}