Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 05, 2015

US jobs boom strengthens case for September rate rise

An impressive, consensus-smashing, rate of US hiring puts a September rate hike firmly on the table. Job creation is surging as the economy shows signs of rebounding strongly from the weak spell seen at the start of the year, pulling wages higher and allaying worries that the upturn lacks sustainability.

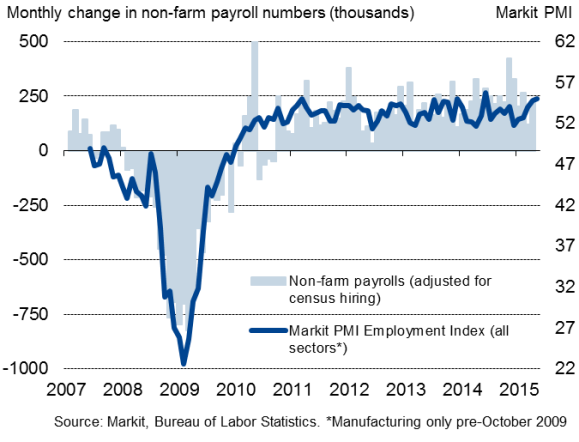

US hiring

Job creation booms

Non-farm payrolls increased by 280,000 in May against expectations of a 225,000 rise. That was the largest rise so far this year. Prior months also saw a net upward revision of 32,000 jobs created.

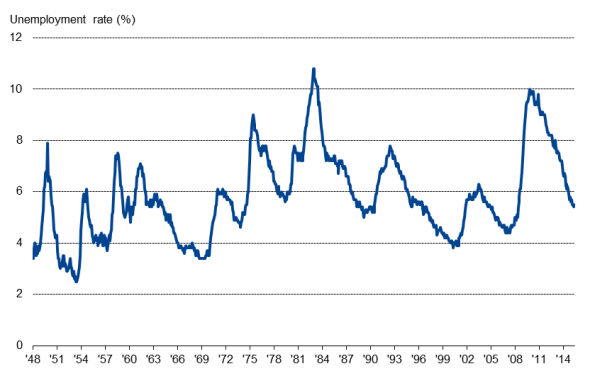

US unemployment

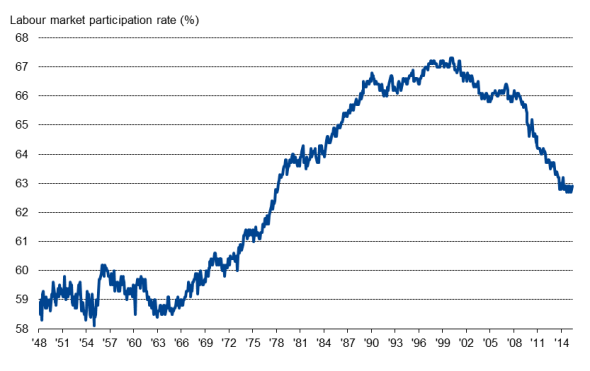

The unemployment rate ticked higher from the near seven-year low of 5.4% in April, edging up to 5.5%, but that was due to more people entering the job market looking for work. Importantly, from a policy perspective, people are encouraged to start looking for work and the jobless rate remains close to the 5.0-5.2% range that is widely seen as indicative of full employment.

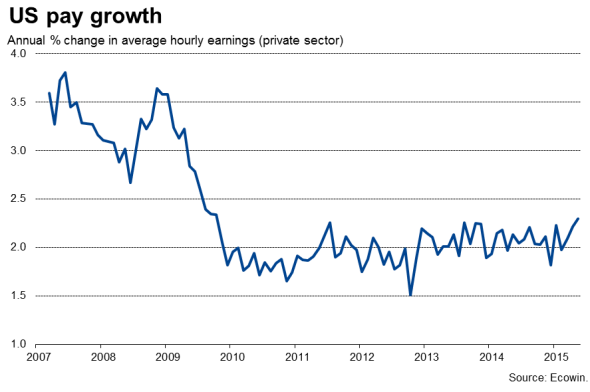

Wage growth also nudged up to 2.3% as the labour market tightened. While clearly remaining subdued by historical standards, the revival of wage growth - if sustained in coming months - is a key factor likely to persuade policymakers that the economy is ready for higher interest rates.

Second quarter rebound

The job market data add to growing evidence that the economy is enjoying an impressive rebound after a weak start to the year. Markit's PMI survey data are signalling annualised GDP growth of 2-3% in the second quarter as well as ongoing enthusiasm among companies to hire amid widespread optimism about the outlook for the economy. Markit's "all-sector' PMI employment index rose in May to signal one of the strongest rates of job creation seen since the financial crisis, corroborating the upbeat official jobs report.

However, the surveys also suggest that the rate of expansion may be settling down to a more modest pace as the economy loses some of the bounce from the initial rebound after the first quarter's weakness. The May surveys indicated the slowest pace of output expansion since January.

While today's jobs report therefore substantially raises the likelihood of the Fed taking the first step towards normalising policy and hiking rates in September, the FOMC will be watching the data keenly in coming months to seek reassurance that the economy is not losing too much momentum, with eyes on the impact of the strong dollar in particular.

Participation rate

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-economics-us-jobs-boom-strengthens-case-for-september-rate-rise.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-economics-us-jobs-boom-strengthens-case-for-september-rate-rise.html&text=US+jobs+boom+strengthens+case+for+September+rate+rise","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-economics-us-jobs-boom-strengthens-case-for-september-rate-rise.html","enabled":true},{"name":"email","url":"?subject=US jobs boom strengthens case for September rate rise&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-economics-us-jobs-boom-strengthens-case-for-september-rate-rise.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+jobs+boom+strengthens+case+for+September+rate+rise http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-economics-us-jobs-boom-strengthens-case-for-september-rate-rise.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}