Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 05, 2015

Investors rush to cover volatility; Petrobras returns

Further volatility in sovereign bonds has seen investors move to protect against higher yields, while Brazil's Petrobras returns to the markets with a 100-yr bond.

- Volatile bunds and treasuries have investors rushing to protect against downside risk

- Apple takes advantage of lower volatility and yields in Japan by issuing "250bn global bond

- Petrobras returns to debt capital markets, but credit risk double that seen a year ago

Volatility again

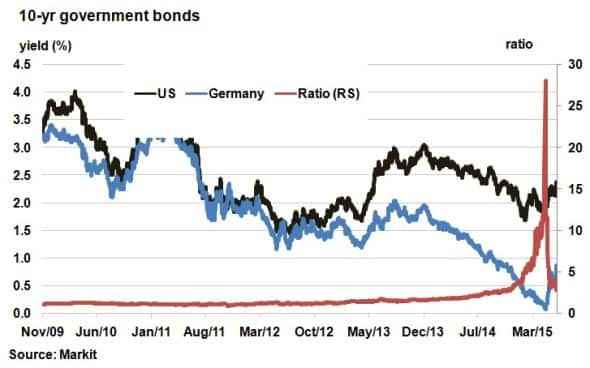

Another round of volatility hit German bunds and US treasuries this week as both assets were sold off. The 10-yr treasury yield jumped 15bps to the highest level since November last year, while 10-yr bunds were also up 30bps to 0.86%. Bund and treasury have been steadily increasing over the last six weeks, led by Europe as QE boosted inflation and growth expectations continue to improve.

On Wednesday, ECB president Mario Draghi reiterated that large moves in bond markets were a consequence of reduced liquidity in the market and technical factors and that further volatility was to be expected.

Bunds and treasuries' concurrent moves highlight the close relationship between the two rates. From 2009 to mid-2014 the yield ratio between these never exceeded two, but as bund yields approached zero earlier this year, this ratio spiked to over 25. The recent correction went some way to restoring the relationship.

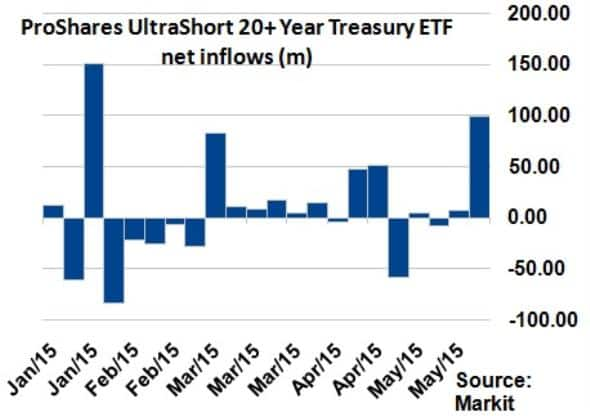

Investors have been reacting to the expectations of further volatility by protecting against further price declines by shorting long treasury bonds.

The ProShares UltraShort 20+ Year Treasury index ETF (TBT) has just seen its second largest weekly net inflow for 2015, totalling $99m. The largest inflow this year was seen in the week that the ECB announced its QE programme.

Apple goes to Japan

Technology giant Apple finally issued its long awaited "250bn ($2bn) bond at a flat spread over swaps. The AA rated firm has been issuing bonds aggressively over the last two years in order to help fund its large stock buyback programme and avoid repatriation taxes on its foreign cash reserves.

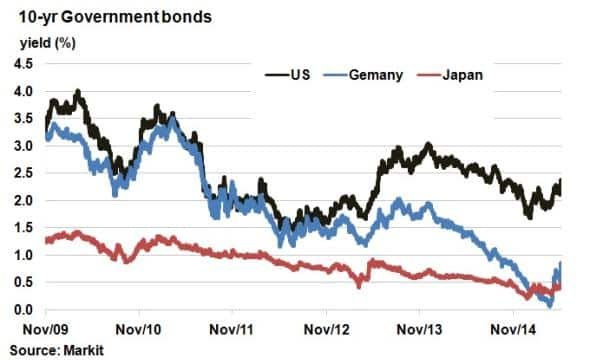

Apple had previously issued in euros and Swiss francs, taking advantage of low yields on offer. The recent volatility in Western sovereign bonds was largely avoided by Japan, with 10-yr Japanese government bonds now yielding less than 10-yr bunds. Apple was able to take advantage of the lowest yields on offer, while also diversifying their investor base.

Petrobras taps capital markets

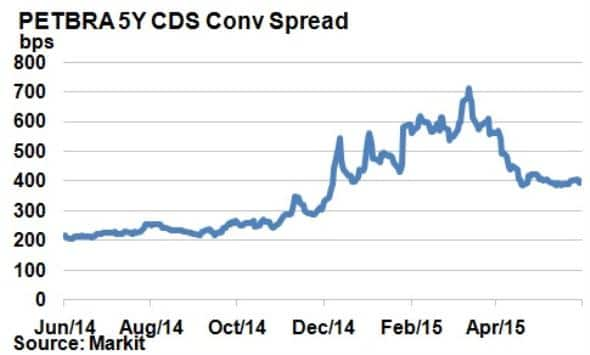

Brazilian state owned oil firm Petrobras made a return to debt capital markets with a 100 year bond issue. The firm was embroiled in a corruption scandal earlier this year and narrowly avoided technical default by finally publishing audited results.

The $2.5bn, 6.875% coupon issue was priced to yield 8.45%. Yields in the secondary market have since tightened to 8.24%, according to Markit's bond pricing service.

Petrobras' 5-yr CDS spread however remains above 400bps. The spread was 220bps just a year ago, which shows that the firm still has some more ground to cover in order to rebuild its reputation in the credit markets. One rating agency, Moody's, has their debt marked as junk.

The new issue did however garner enough interest. The long maturity attracting interest from insurance and pension funds, as well as providing a decent premium over existing long dated Petrobras bonds - currently 71bps over the existing 2044 bond.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-credit-investors-rush-to-cover-volatility-petro.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-credit-investors-rush-to-cover-volatility-petro.html&text=Investors+rush+to+cover+volatility%3b+Petrobras+returns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-credit-investors-rush-to-cover-volatility-petro.html","enabled":true},{"name":"email","url":"?subject=Investors rush to cover volatility; Petrobras returns&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-credit-investors-rush-to-cover-volatility-petro.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Investors+rush+to+cover+volatility%3b+Petrobras+returns http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05062015-credit-investors-rush-to-cover-volatility-petro.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}