Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

May 05, 2015

German bunds surrender QE gains

Investors were perplexed by the bund's unexpected retreat over the last two weeks. The motivation appears to stem from an accumulation of factors, but volatility could be the new norm.

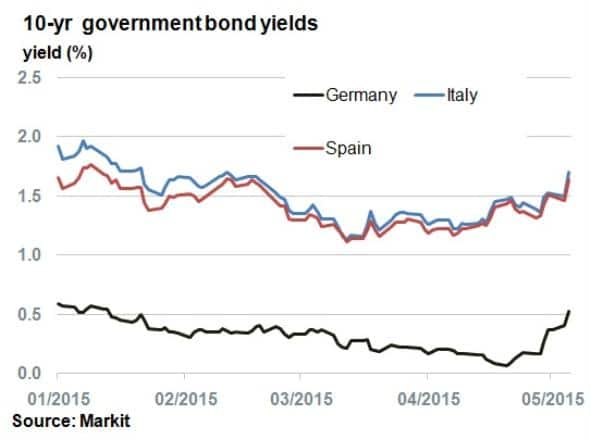

- 10-yr bund yields have retreated from 0.07% to 0.52% over the last two weeks

- Spain's and Italy's 10-yr government bonds yield 42bps, 45bps wider than at the start of QE

- Grexit fears, illiquidity and technical movement s are cited as possible reason

Exactly two weeks ago today, legendary bond investor Bill Gross tweeted that German 10-yr bunds were "the short of a lifetime" and that the secular bull run in bonds was coming to an end. Since then the German 10-yr bund has sold off, with yields rising from 0.07% to 0.52%; catching many market participants off guard.

To put the yield rise into perspective, the last time the 10-yr benchmark bund (0.5% 2025) yielded 0.44% was on the eve of the ECB's QE announcement (January 21st). Following the QE announcement which was more aggressive than expected, yields fell dramatically to 0.35% and continued to move lower. With the ECB acting as a guaranteed buyer in the market, yields inched negative along the curve and appeared to be heading towards the 10-yr rate. The recent uptick wiped out much of the QE attributed gains in just ten days.

Bond yields in the periphery have also widened significantly from all-time lows. Italian and Spanish 10-yr bonds have gained 45bps and 42bps respectively since the ECB began purchasing bonds at the beginning of March.

Selloff contributors

But what can cause such a dramatic move in the bond markets? Large unexpected moves in the markets can point towards a lack of liquidity. Bond liquidity is perceived to be lower than what it was before the financial crisis with banks having retreated from bond trading, imposed on them by regulators. Sharp movements in government bond yields are becoming more common. In October last year for example, the US 10-yr treasury moved 40bps intraday in a jump which JP Morgan chief executive Jamie Dimon called "unprecedented".

One possible contributing factor is the ongoing speculation around a possible Grexit. Credit swaps still imply a 72% probability of default over the next five years. The last couple of weeks however have seen some positive developments, with hardline Greek finance minister Yanis Varoufakis sidelined and Greece's PM suggesting a possible referendum. This may have prompted rise in in bund yields, which were previously bid down as investors rushed for safety.

Another factor may be a shift in the risk return dynamic; suggesting that the bund sell off was technical, rather than fundamental. Corporate credit has remained resilient, with the Markit iTraxx Europe Main having tightened 2bps over the last two weeks. The Markit iBoxx € Overall has seen its annual benchmark spread fall from 62bps to 55bps.

Profit taking may have also played a factor in the recent spike and sell off. Bunds have enjoyed a sustained positive run over the past 16 months, which has seen 10-yr yields drop from 2% to close to zero.

The low yields may have also sparked concern that downside risk may be starting to outweigh any upside. With the ECB saying that it is unwilling to buy bonds below its deposit rate (-0.2%), near zero yields were running out of room. Re allocation into higher yielding safe haven assets such as gilts, OAT's and US treasuries may have also played a part in the sharp bund selloff.

Shifting away from bonds

Or is the selloff part of a wider rotation out of bonds? 10-yr US treasuries have also moved wider in tandem and while it's too early to call, this could be related to an overall downturn in bonds. Japan's government bond market also experienced spates of higher than normal volatility during its period of very low interest rates in the 2000s, an experiment now mirrored in the west. Following this pattern, increased bund volatility could become common place.

Neil Mehta, Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-credit-german-bunds-surrender-qe-gains.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-credit-german-bunds-surrender-qe-gains.html&text=German+bunds+surrender+QE+gains","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-credit-german-bunds-surrender-qe-gains.html","enabled":true},{"name":"email","url":"?subject=German bunds surrender QE gains&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-credit-german-bunds-surrender-qe-gains.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+bunds+surrender+QE+gains http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-credit-german-bunds-surrender-qe-gains.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}