Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 05, 2015

Greek recession looms as PMI signals steepest downturn for almost two years

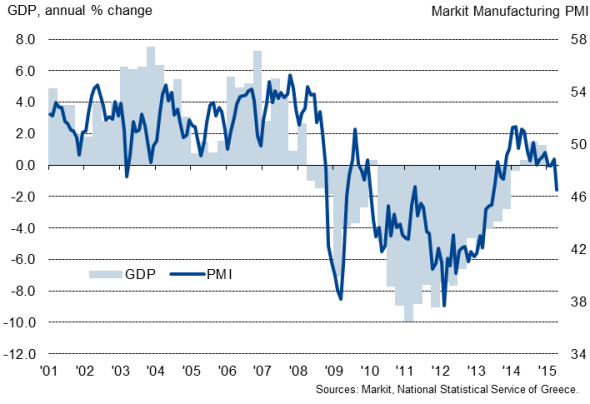

Greece shows further signs of having slid back into recession, adding to indications that the economy is suffering as tensions mount ahead of a scheduled €1bn debt repayment to the IMF on 12 May. The Markit Manufacturing PMI fell from 48.9 in March to 46.5 in April, signalling an eighth successive monthly deterioration of business conditions and the steepest rate of decline since June 2013.

The economy was 1.3% larger than a year ago in the final quarter of last year, but the downturn in the PMI indicates that growth has deteriorated markedly this year, with the April PMI reading broadly consistent with GDP contracting at an annual rate approaching 2%.

Economic growth and the PMI

The business sector downturn is matched by a similar slump in consumer confidence, as indicated by the European Commission consumer confidence survey, which paid back recent gains in April.

The survey data therefore indicate that both businesses and households have become increasingly concerned by the debt crisis facing the Greek government, with a retrenchment of spending set to drive the economy back into recession. Reduced spending of course hits tax revenues, causing further pain in terms of deficit reduction.

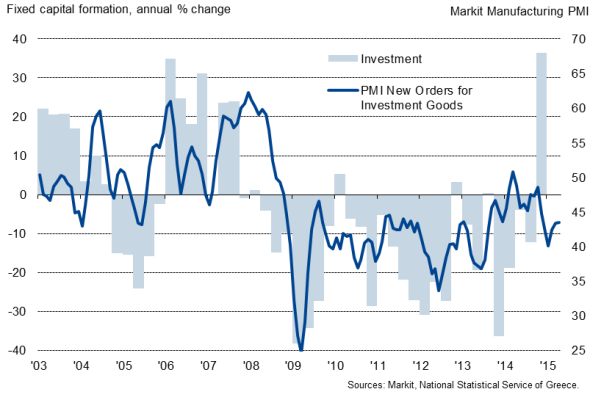

There were no bright spots in the latest PMI report. Output fell at the steepest rate since June 2013, with new orders collapsing at the strongest pace for over two years, led down by a slump in export orders.

Business investment

Input costs meanwhile showed the largest monthly rise since June 2014, in part reflecting higher import costs arising from the weakened euro, but a lack of pricing power meant average charges levied by goods producers fell at a faster rate. With costs rising and prices charged falling, the survey points to an intensifying squeeze on profit margins.

With order books falling and profits being squeezed, firms were forced to cut staffing levels (albeit only modestly) for the first time in five months, pointing to a reversal of recent labour market gains. The unemployment rate eased to 25.7% in January, but clearly remains worryingly high and is the worst in the EU.

A downturn in business activity, and therefore economic growth, as well as the spectre of increased unemployment means lower tax revenues, boding ill for Greece's debt situation. With debt levels likely to start rising again, pressure will inevitably mount for creditors to accept that existing debt needs to be restructured and haircuts accepted.

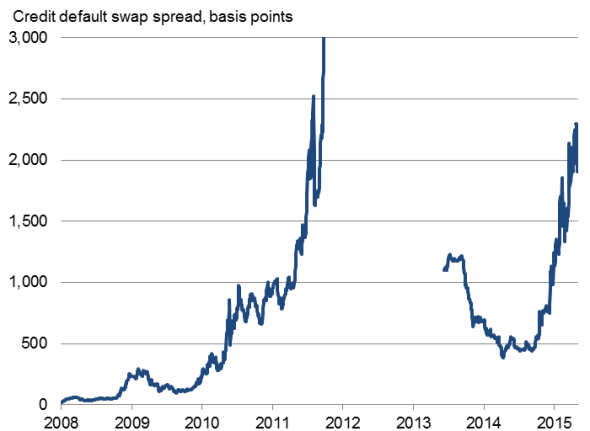

The cost of insuring Greek debt has consequently remained elevated in recent sessions. Although still below the peaks seen during the 2011-12 crisis, the credit default swap market is currently pricing in a 71.5% probability of default over the next five years, according to Markit data.

Cost of insuring against Greek default*

Source: Markit.

* pricing data were not available between late-2011 and early-2013.

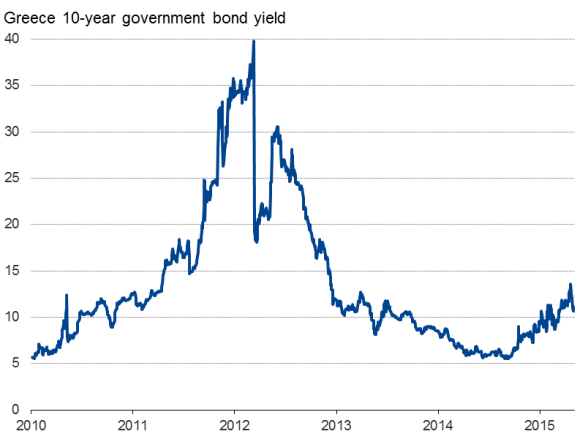

Government borrowing costs

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Greek-recession-looms-as-PMI-signals-steepest-downturn-for-almost-two-years.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Greek-recession-looms-as-PMI-signals-steepest-downturn-for-almost-two-years.html&text=Greek+recession+looms+as+PMI+signals+steepest+downturn+for+almost+two+years","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Greek-recession-looms-as-PMI-signals-steepest-downturn-for-almost-two-years.html","enabled":true},{"name":"email","url":"?subject=Greek recession looms as PMI signals steepest downturn for almost two years&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Greek-recession-looms-as-PMI-signals-steepest-downturn-for-almost-two-years.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Greek+recession+looms+as+PMI+signals+steepest+downturn+for+almost+two+years http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05052015-Economics-Greek-recession-looms-as-PMI-signals-steepest-downturn-for-almost-two-years.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}