Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jan 05, 2015

Cruising airlines buoyed by lower costs

Markit's securities financing data together with company performance analysis indicates that European airlines are not able to take advantage of the windfall provided by dramatically lower oil prices.

- Low cost European airlines are the best performers, having seen relatively less short interest than larger national carrier rivals

- Oil's 32% decline since November 2014 is clearly visible as a positive impact on airline stocks

- Labour costs and the weak Euro have erased gains derived from lower oil prices while American airlines capture the full benefit

Destination: Meagre Returns

The low oil price, almost 50% cheaper than it was at the beginning of the year should be great news for airlines going forward as the commodity makes up almost 30% of operating costs. As investor's hopes are raised for increased margin capture falling to bottom line returns - "all else' is not equal as history has proven from an investors perspective.

Historical analysis of returns should dampen long term or long haul investors' expectations. Meagre average returns of 1% registered over the last 60 years means the industry, as a whole has performed dismally. This is also due to the structure of many national airlines that previously pursued national pride ahead of profits.

Post the 80s, the industry liberalised and cutthroat low cost airlines entered the market attacking short haul routes with new, more efficient planes. Compounding the increased competitive environment was the launch of new state owned airlines in the Persian Gulf such as Emirates, Qatar and Etihad.

Oil slides into place

Euro currency weakness has offset some of the gains in the oil price declines but European airlines are also counting the cost of labour disruptions. Labour is the second largest operating cost after oil and has negatively impacted European carriers.

Air France and Lufthansa are both implementing cost cutting exercises and strategies aimed to fight competition stemming from low the cost airlines, such as Ryanair and easyJet.

These measures caused tensions and subsequent labour strikes. Air France-KLM reported a $630m cost incurred on a two week strike in September. Lufthansa pilots have continued to stage strikes over retirement benefits.

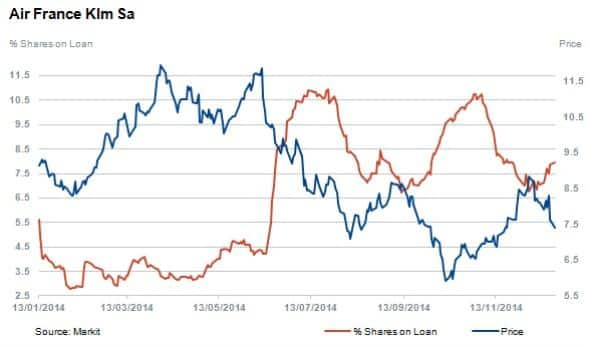

The percentage of Air France-KLM shares out on loan stand at 7.9%, down from the highs of over 10.5% reached during the year. The share price recovered in the second half of the year somewhat as the oil price declined but the stock is down 18.9% for the year.

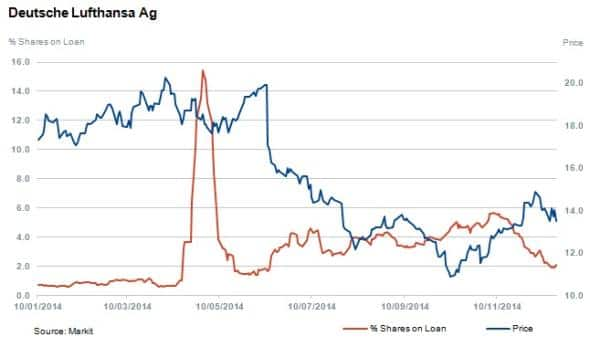

Lufthansa's share price is down 22% year to date. However the stock is up 7.3% since short sellers started covering from the 11th of November. Since then, shares outstanding on loan decreased 59% from 5.7% to 2.3% currently. This is as oil prices fell 32% (European Brent, Source: Thomson Reuters).

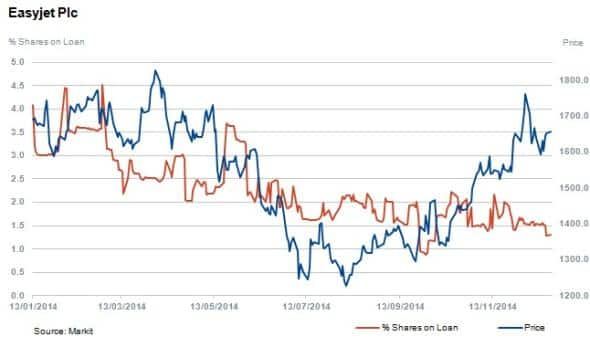

EasyJet's shares outstanding on loan has decreased to 1.3% over the year with the share price increasing over 25% since the middle of the year.

Ryanair is the standout airline performer in Europe in 2014 as the company's share price increased by 43%, accordingly there were negligible levels of shares outstanding on loan during the year, peaking at just 0.3%.

Using Markit Research Signals' Oil Price Sensitivity macro model factor* and screening for firms that are positively affected by declining oil prices reveals relevant key insights on what is occurring with airlines.

US airline operators feature in the top 30% of companies that have outperformed global stocks since September. The top 30% of stocks identified by the factor returned on average 0.83% more per month since September than the average returns of the entire overall universe.

The highlights among this trend are US airlines Delta, United and American Airlines which have outperformed their airline peers so far this year, returning 58%, 51% and 65% respectively.

Oil price declines, which are not diluted by a weaker currency in Europe, have positvely impacted these stocks and over the last month United and Amercan Airlines have advanced a further 14% and 18% repsectively.

Interestingly, Ryanair does not see a convincing factor rank with a strong relationship to oil movements as the firm operated successfuly at higher oil proces and operates a vastly younger fleet compared to airlines such as Delta, according to companystatements.

* Defined as the beta coefficient to Change in Oil Prices, which is estimated by a 60 month multiple regression of returns on several macroeconomic factors.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012015-Equities-Cruising-airlines-buoyed-by-lower-costs.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012015-Equities-Cruising-airlines-buoyed-by-lower-costs.html&text=Cruising+airlines+buoyed+by+lower+costs","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012015-Equities-Cruising-airlines-buoyed-by-lower-costs.html","enabled":true},{"name":"email","url":"?subject=Cruising airlines buoyed by lower costs&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012015-Equities-Cruising-airlines-buoyed-by-lower-costs.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Cruising+airlines+buoyed+by+lower+costs http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f05012015-Equities-Cruising-airlines-buoyed-by-lower-costs.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}