Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Dec 04, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Straight Path is the most shorted firm ahead of earnings

- Ashtead Group is the only firm seeing significant shorting activity ahead earnings in Europe

- Japanese software firms make up three of the four most shorted Apac firms

North America

Most shorted ahead of earnings this week in North America is Straight Path Communications with 20.4% of shares outstanding on loan. The company holds a portfolio of spectrum licences for wireless communications in the US and saw a sharp spike in short interest levels during November.

Prior to the jump in short interest in Straight Path, shares experienced a dramatic sell off after a critical report was issued by

Kerrisdale Capital. Since the report was released shares have plummeted some 76%.

US luxury home furnishing brand Restoration Hardware is the third most shorted ahead of earnings in North America with 15.8% of shares outstanding on loan. Shorts have covered 5% of positions since early November while the stock price shed 15%.

Network hardware provider Ciena has seen short sellers track its share price higher in past few months, with shares outstanding on loan reaching 15.2%.

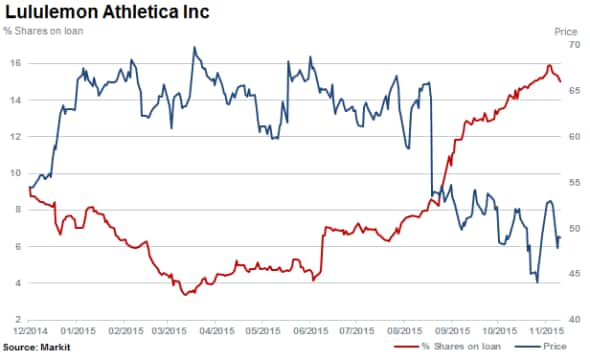

Short interest has been climbing in Lululemon since April rising fourfold to 15% of shares outstanding on loan. Shares have fallen almost a third in the last six months as US clothing retailers continue to struggle against fast fashion outlets and changing tastes.

The other retailers seeing heavy short interest ahead of earnings this week are Mattress Firm, Vera Bradley, Conn's and Childrens Place; all of which have more 10% of their shares out on loan.

Europe

The next week sees very few earnings announcements Europe and we therefore only see two firms see more than 3% of their shares out on loan ahead of earnings.

The leader of this week's pair is UK plant rental firm Ashtead Group which has 5.7% of its shares out on loan. Interestingly the recent surge in demand to borrow has come despite strong construction growth on both Ashstead's core US and UK markets.

The other European firm to see meaningful short interest is German copper recycling Aurubis which has 3.2% of its shares outstanding on loan. The firm's business model looks to have isolated it from most of the recent metals volatility, given that its shares are just off their recent all-time highs. Shorts sellers also look to have lost patience in the firm as demand to borrow has come down in recent weeks despite the fact that copper prices are hovering at multi year lows.

Asia

The entirety of the heavily shorted firms ahead of earnings next week is made up of Japanese firms, with the majority being software firms. These are led by app developer Morpho which has 6.2% of its shares out on loan. The company, which develops software for mobile phone cameras, has seen as surge in demand to borrow as its shares fell after a strong run. The other software makers making the list are Ateam and Gumi which both have more than 4% of shares shorted.

The most shorted non software firm is Akebono which has 5.9% of shares shorted. The firm recently came clean about accounting irregularity which had seen the company inflating its earnings. These developments sent bears circling around its shares as current demand to borrow stands at three times the levels seen six months ago.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04122015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}