Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Nov 04, 2016

US short sellers hold fire heading into election

Average demand to short US stocks has been flat in the month heading into next week's election, but sectors targeted continue to shift.

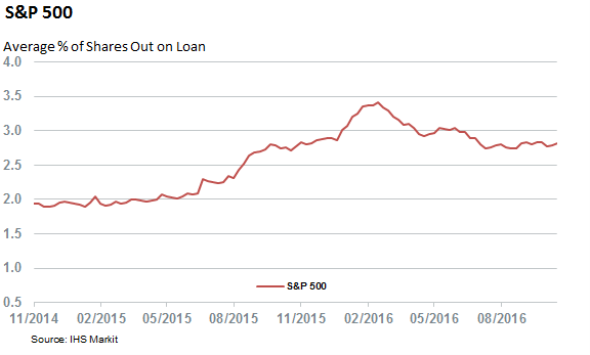

- Average short interest across S&P 500 is flat at 2.8% of shares outstanding

- Telecommunication and transportation firms are high conviction sectors

- Energy short sellers continue to cover with a further 9% cut in positions

US equities have experienced more than their fair share of volatility in the weeks leading up to next Tuesday's election, but market jitters have yet to stir short sellers as the demand to borrow S&P 500 shares has remained relatively flat over the last few months. Short sellers have currently borrowed 2.8% of shares outstanding across the S&P 500 index, in line with the levels seen over the summer.

Conversely, short sellers were much more eager to short the commodities slump in the opening weeks of the year. The uncertain nature of the election, both in its outcome and possible impact on stock market, has not inspired the same consensus as current average short interest across the S&P 500 index is down by 17.5% from the highs set earlier in the year. Despite the recent covering index, the current average shoring activity is still elevated from the levels seen 24 months ago which speaks to the heightened levels of uncertainty in market at present.

Top sectors shift

The flat average demand to borrow does hide some sentiment shifting among short sellers however as several sectors have seen a material change in average short interest over the last month.

Telecommunication firms, are now the most shorted sector, have continued to attract short sellers as demand to borrow share across the sector jumped by 8% in the last month to 7.2% of shares outstanding on average.

This demand to borrow is skewed by merger activity however as the two firms registering the largest jump in demand to borrow over the last month, AT&T and Century Link, have pending tie-ups in which shares make up part of the takeover offer - something that tends to attract non directional arbitrageurs.

Frontier Communication, the most shorted telecommunication stock, looks to be attracting directional short sellers as the firm has seen its price sink by over 18% in the last month following disappointing earnings.

While telecommunication firms continue to top the list of highly shorted sectors, transportation has seen the largest jump in average short interest leading up to earnings after average demand to borrow the sector's shares jumped by 22% in the last four weeks. Trucking firms CR Robinson and Ryder have driven much of the recent increase with 40% and 21% jumps in demand to borrow over the last month respectively.

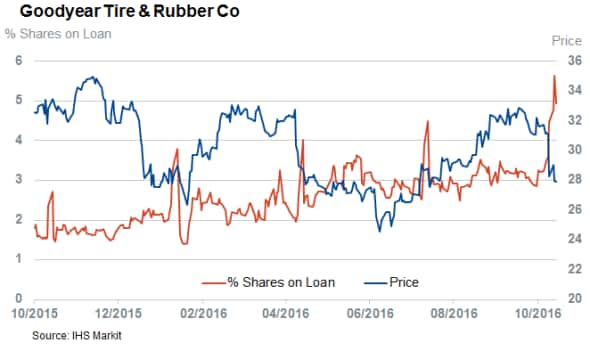

Auto related stocks have also come under increased scrutiny in recent weeks, with short sellers increasing their borrow in both Goodyear Tire and BorgWarner by over two thirds in the last month.

The surging demand to borrow Goodyear can be linked to the earlier mentioned trucking short selling as the firm mentioned weakness in its truck tire business as one of the reason for lowering its forward guidance in its latest earnings update.

Energy shorts continues to cover

Energy stocks, which were the high conviction short play of the opening months of the year, have continued to ward off short sellers heading into the election as demand to borrow their shares has fallen by 9% in the last month. This covering has been led by the high conviction names as every S&P 500 energy constituent that still features among the 20 most shorted firms has seen covering in the last month.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-equities-us-short-sellers-hold-fire-heading-into-election.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-equities-us-short-sellers-hold-fire-heading-into-election.html&text=US+short+sellers+hold+fire+heading+into+election","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-equities-us-short-sellers-hold-fire-heading-into-election.html","enabled":true},{"name":"email","url":"?subject=US short sellers hold fire heading into election&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-equities-us-short-sellers-hold-fire-heading-into-election.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+short+sellers+hold+fire+heading+into+election http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04112016-equities-us-short-sellers-hold-fire-heading-into-election.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}