Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 04, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in stocks ahead of earnings announcements in the coming week.

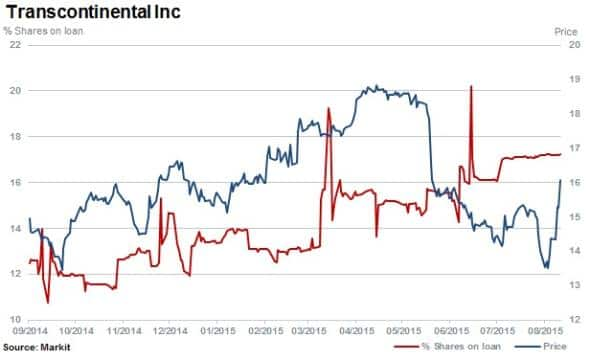

- The largest printer in Canada among the most shorted in North America

- Morrisons is most shorted in Europe as firm becomes a potential target for takeover

- Short sellers attracted to Japanese software and game developers

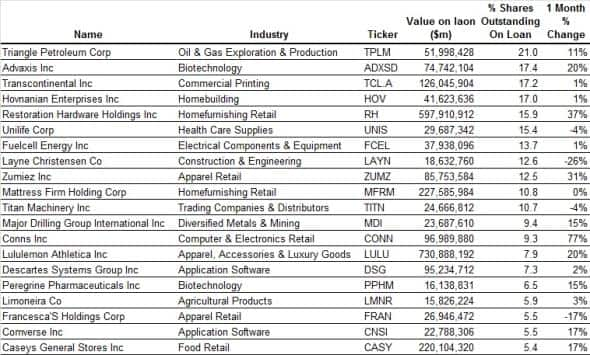

North America

In North America, Triangle Petroleum, an integrated oil and gas firm, was the most shorted ahead of earnings this week with 21% of shares outstanding on loan. The stock has fallen 72% in the past 12 months and despite a recent rally in oil, prices continue to remain at multi-year lows.

Montreal-based printing, packaging and marketing firm Transcontinental is second most shorted with 17.2% of shares outstanding on loan.

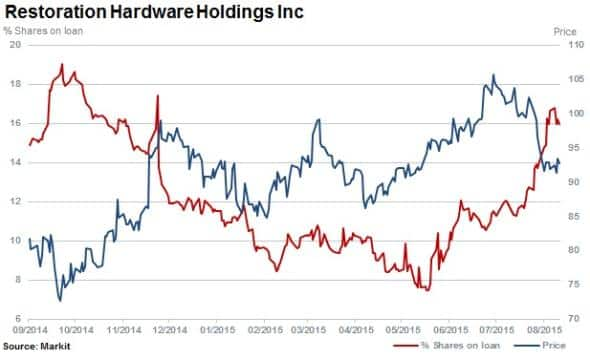

Restoration Hardware witnessed a large surge in short interest ahead of earnings in the past month. . Shares outstanding on loan have increased by 37% to reach 15.9%. Shares are off 12% from recent highs reached in mid July.

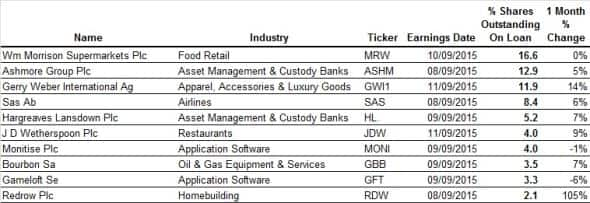

Europe

In Western Europe, retailer Morrisons is the most shorted ahead of earnings with 16.6% of shares outstanding on loan.

Shares in Morrisons have tracked sideways for 12 months after peaking in March 2015 but remain close to five-year lows, while short interest has increased by two thirds as the UK retail price war continued to attract short sellers. Recent reports have surfaced that the firm may have become a takeover target for billionaire Christo Wiese's company Brait, which recently acquired New Look and Virgin Active.

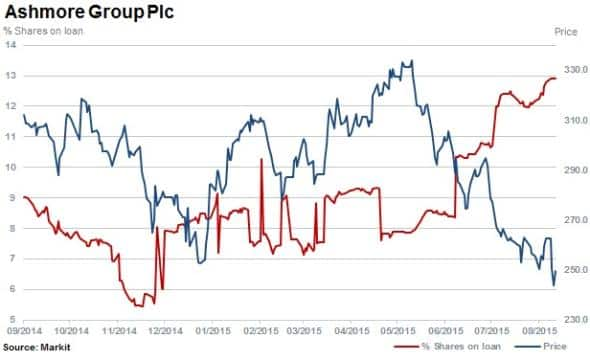

Investment management firm Ashmore Group is the second most shorted stock in Europe with 12.9% of shares outstanding on loan ahead of earnings. Since the beginning of June shares have fallen by 25%and attracted 60% more in short positions. The group has suffered from emerging markets exposure and the recent market sell off, but less so compared to peers.

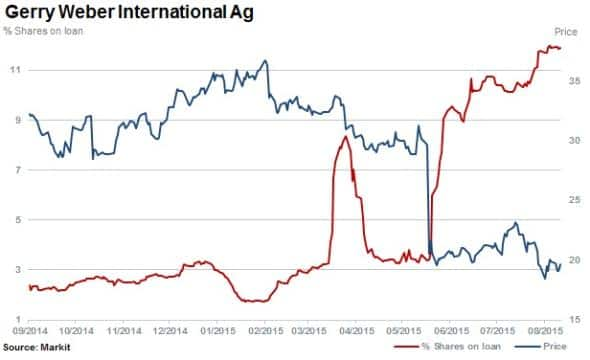

German fashion retailer Gerry Weber's shares plummeted 30% on June 9th 2015 after the firm announced it was "not entirely isolated" from negative trends in the industry. The company cited falling demand in German sales and pressure on Russian and Eastern European volumes. Shares outstanding on loan have more than doubled to 11.9%.

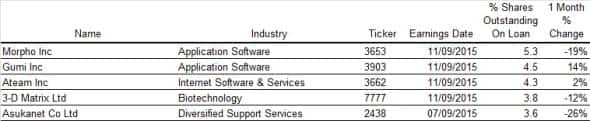

Apac

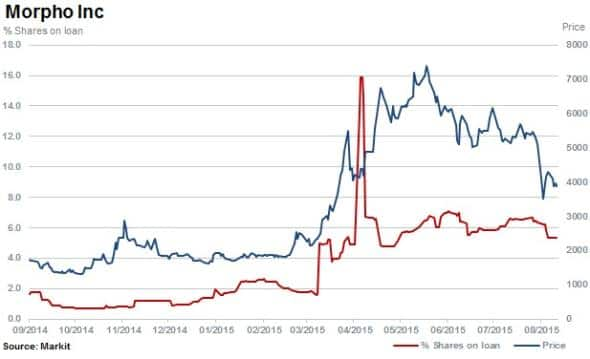

Most short sold in Apac is the Japanese image processing software developer Morpho. Short sellers have covered positions from a high in April of 16% of shares outstanding on loan to 5.3% as shares peaked in June. Subsequently shares have fallen by 47%.

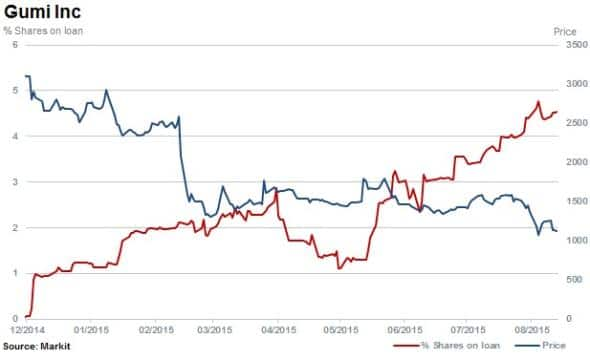

Shares in recently listed Tokyo based game developer Gumi have fallen 62% year to date and have continued to attract short sellers with shares outstanding on loan increasing to 4.5%.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04092015-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}