Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 04, 2015

Calm returns to European equities

One month on from the announcement of the Greek bailout deal, the European equity market is back on winning form; this has seen investors lower their risk perception of the region's indexes and add to their exposure.

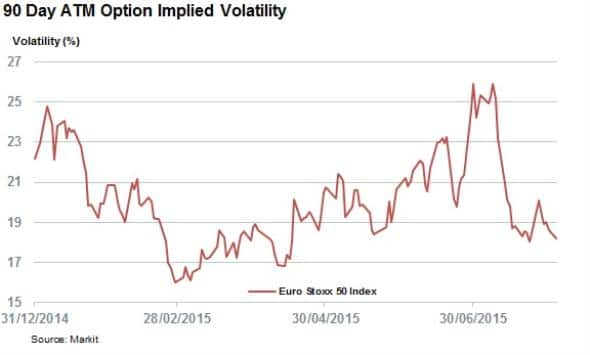

- 90 day at the money implied volatility for Euro Stoxx 50 options down by 30% from July high

- The Stoxx Bank index implied volatility hit a new yearly low on July 23rd

- ETF investors added to their European exposure at the fastest pace in four months in July

The resolution of the Greek crisis has seen the European equity market roar back to life after a setback which saw the Euro Stoxx 50 index lose as much as 14% from its early April peak. While the index has still not fully recovered the ground lost over the subsequent two and a half months, it is currently trading 10% higher than the lows seen in the first week of July.

While abating contagion fears have no doubt played a part in the rebound seen in the eurozone's equities, the improving economic situation as gauged by the recent strong PMI reading should not be ignored. This consistent growth was also reflected in last week's spate of European corporate earnings, which largely came in above expectations.

The improving situation has also been reflected in investor's volatility expectations for the Eurostoxx 50 index.

Options implied volatility

90 day At The Money (ATM) implied volatility for options written against the Euro Stoxx 50 index has fallen by 30% in the last month to 18.2% as of Monday's close. The current levels indicate that the options market is pricing in the lowest level of volatility for European large caps since the start of Greek deterioration.

90 day ATM volatility for Euro Stoxx 50 options had topped out a four year high of 25% in the height of the Greek situation. This underscores the level of nervousness around eurozone equities at the time.

Bank shares now less risky

Banks which make up the Stoxx Bank index have seen an even large reversal of investor sentiment, as options which track the index have seen their 90 day ATM volatility fall to a new 12 month low off the back of the Greek resolution.

The difference between the 90 day ATM volatility of Euro Stoxx 50 options and those written against the Stoxx Bank index has also halved since the start of the year. This indicates that investors are viewing the current economic and political situation as much less likely to deliver wide swings for European banks.

ETF investors rejoin the fray

The improving investor sentiment picture was also reflected in fund flows into products that track the eurozone. The 600 eurozone focused ETFs saw $5.9bn of inflows over July, their best inflow month since the March.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-equities-calm-returns-to-european-equities.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-equities-calm-returns-to-european-equities.html&text=Calm+returns+to+European+equities","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-equities-calm-returns-to-european-equities.html","enabled":true},{"name":"email","url":"?subject=Calm returns to European equities&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-equities-calm-returns-to-european-equities.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Calm+returns+to+European+equities http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04082015-equities-calm-returns-to-european-equities.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}