Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 04, 2017

UK construction PMI pulls back from 17-month high to end Q2 on softer note

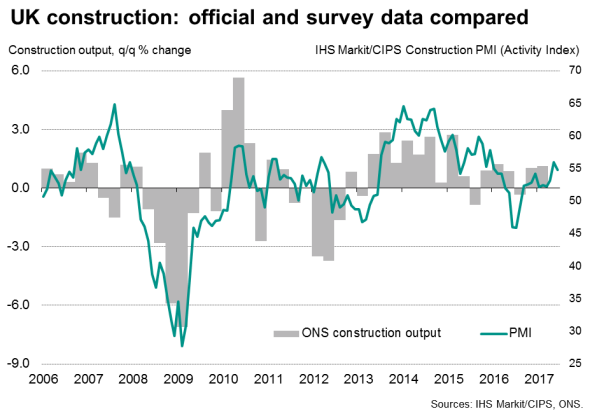

UK construction activity continued to grow at a strong rate in June, the rate of expansion slowing compared with the impressive performance seen in May but nevertheless rounding off the best quarter for one-and-a-half years.

The IHS Markit/CIPS Construction PMI, an overall indicator of the extent to which business activity in the sector has changed from one month to the next, fell from a 17-month high of 56.0 in May to 54.8 in June. The PMI is based on survey responses from around 170 construction firms of varying sizes.

Broad-based growth, led by housing

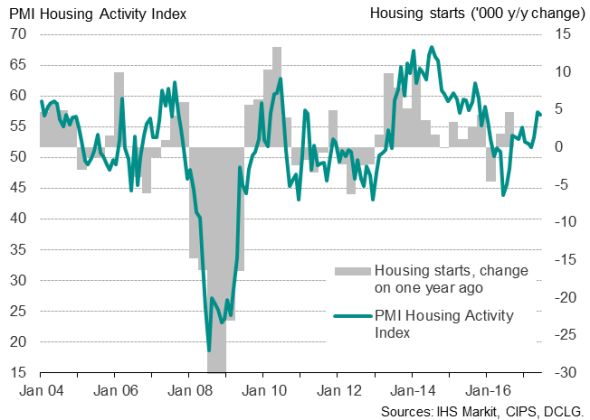

House building activity showed the largest expansion of the three major sectors covered by the PMI survey for the second month running. The data suggest that home builders are enjoying the sweetest growth spell since 2015.

House building

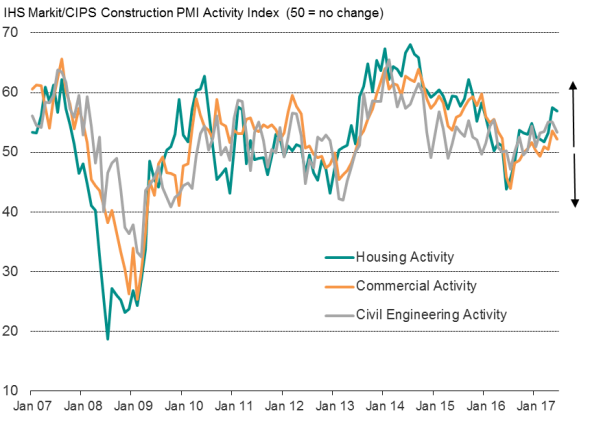

Commercial activity also continued to show signs of reviving, albeit to a lesser extent than signalled in May, contrasting with the declines and stagnations seen through much of late last year and the opening months of 2017.

Rising commercial construction suggests that companies have an improved appetite for investing in fixed assets such as factories, offices and retail space, and bodes well for investment spending to increase again in the second quarter after the 0.6% rise seen in the first quarter (according to official GDP data).

Civil engineering likewise continued to grow in June, albeit also showing some waning in the rate of expansion.

Construction activity by sector

Sources: IHS Markit.

Warning indicators

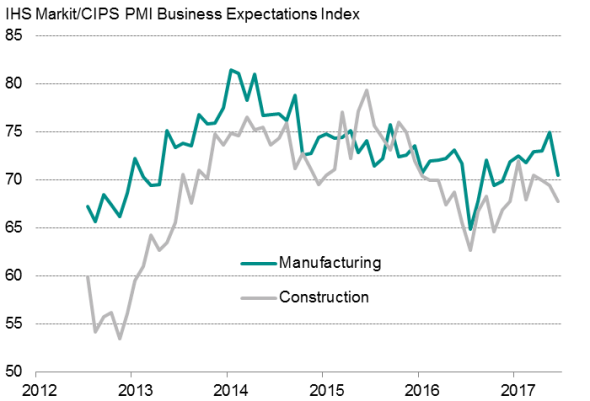

Despite the sustained robust growth indicated in June, the survey is flashing some warning lights to indicate that the pace of expansion could moderate further in coming months. Growth in new orders weakened compared to May, as did job creation and construction firms' purchasing activity. Optimism about future business conditions meanwhile slipped to a six-month low.

The construction PMI data come on the heels of the sister manufacturing survey which likewise showed growth slowing in June, ending an otherwise solid quarter on a somewhat disappointing note.

Both manufacturing and construction surveys therefore raise questions about whether the robust expansion signalled of the second quarter will be repeated in the third quarter.

Future expectations

Source: IHS Markit.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072017-Economics-UK-construction-PMI-pulls-back-from-17-month-high-to-end-Q2-on-softer-note.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072017-Economics-UK-construction-PMI-pulls-back-from-17-month-high-to-end-Q2-on-softer-note.html&text=UK+construction+PMI+pulls+back+from+17-month+high+to+end+Q2+on+softer+note","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072017-Economics-UK-construction-PMI-pulls-back-from-17-month-high-to-end-Q2-on-softer-note.html","enabled":true},{"name":"email","url":"?subject=UK construction PMI pulls back from 17-month high to end Q2 on softer note&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072017-Economics-UK-construction-PMI-pulls-back-from-17-month-high-to-end-Q2-on-softer-note.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+PMI+pulls+back+from+17-month+high+to+end+Q2+on+softer+note http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04072017-Economics-UK-construction-PMI-pulls-back-from-17-month-high-to-end-Q2-on-softer-note.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}