Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 04, 2016

New election called amid signs of political uncertainty affecting the Spanish economy

Spain is set for a further period of political uncertainty as the deadline passed for the country's political parties to come to an agreement on the formation of a government following the December 20th election. A new vote has been called for June 26th, with parliament likely to meet again towards the end of July. If, as seems likely, the result of the new election is similar to that of the first, it could be late into the third quarter of the year before Spain has a permanent government in place.

At first glance, the lack of a working government does not appear to have had a detrimental effect on the economy. Economic output has continued to grow (GDP was up 0.8% in the first quarter), but there are underlying signs of weakness caused by the political impasse, which look set to worsen as the year goes on. This note discusses some of the signs of trouble.

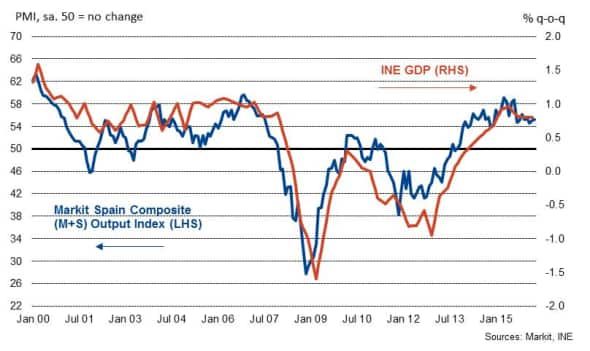

Spanish GDP v PMI

Latest PMI data from Markit signalled a further solid rise in output across the combined manufacturing and service sectors in April. The rate of growth was little-changed from the previous month. However, the rate of new order growth eased to the weakest in seven months, with the rise in the service sector the slowest in almost a year-and-a-half.

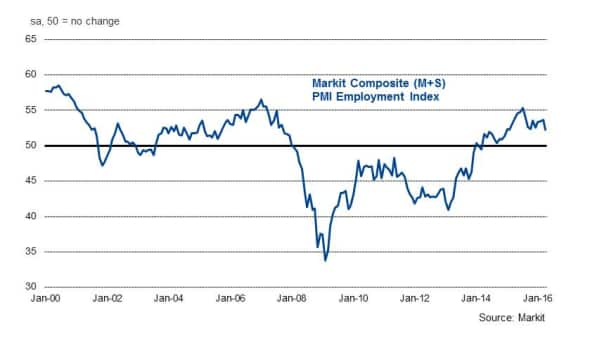

Similarly, the rate of job creation also waned, suggesting that firms have become more reluctant to take on extra staff while the political outlook remains uncertain. Across both manufacturing and services, employment rose at the weakest pace in six months, with services job creation the slowest since January 2015.

If these slowdowns continue, then it will be difficult for output to maintain its current rate of growth as the year goes on. Companies will likely adjust their operating capacity in line with weaker new order growth.

Markit Spain Composite PMI Employment Index

When given the opportunity to comment on business conditions, respondents to the two Spanish PMI surveys highlighted the impact of the political situation on their operations. Among the issues stemming from a lack of certainty regarding the next government are delays from customers in committing to new projects and greater caution among businesses when making investment decisions. These factors will reduce potential output later in the year and beyond.

Spain PMI respondents' additional comments

Source: Markit

Unemployment rises in Q1

A further warning sign was provided by the latest quarterly labour market release which showed a rise in unemployment for the first time since the end of 2014. With the rate of unemployment still above 20% (47% for the under-25s) and the economy apparently growing solidly, we'd expect to be seeing labour market conditions improving much more quickly in normal circumstances.

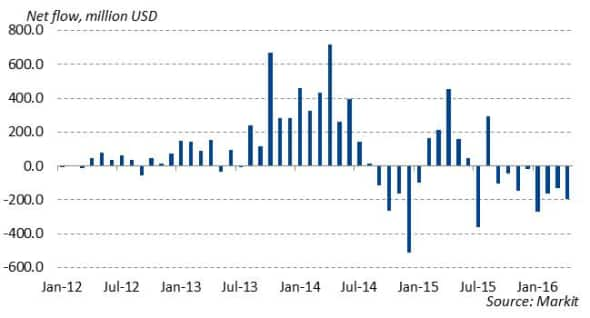

Meanwhile, financial market indicators have also pointed to underlying concerns regarding the future path of the economy. Investor sentiment has deteriorated since the election and there was little sign of an improvement in April. Net outflows have been seen from exchange-traded funds with exposure to Spain in eight successive months, with the latest outflow the strongest since January.

ETP flows for Spain-linked funds

The European Commission has already increased the length of time Spain has to bring its government deficit within the 3.0% of GDP target in the past, and another extension seems likely as a result of there being a lack of government in place to enact reforms needed in order to redress the missed target of 2015. This situation is unlikely to entice investors to increase their exposure to Spain, despite GDP rising solidly.

It remains to be seen how companies in Spain, as well as their customers and investors, will react to the extended period of political stalemate brought about by the failure of the political parties to come to an agreement. The PMI data will provide monthly updates on the latest trends across the manufacturing and service sectors, with data for May published at the start of June.

Andrew Harker | Economics Associate Director, IHS Markit

Tel: +44 149 1461016

andrew.harker@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-New-election-called-amid-signs-of-political-uncertainty-affecting-the-Spanish-economy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-New-election-called-amid-signs-of-political-uncertainty-affecting-the-Spanish-economy.html&text=New+election+called+amid+signs+of+political+uncertainty+affecting+the+Spanish+economy","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-New-election-called-amid-signs-of-political-uncertainty-affecting-the-Spanish-economy.html","enabled":true},{"name":"email","url":"?subject=New election called amid signs of political uncertainty affecting the Spanish economy&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-New-election-called-amid-signs-of-political-uncertainty-affecting-the-Spanish-economy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=New+election+called+amid+signs+of+political+uncertainty+affecting+the+Spanish+economy http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04052016-Economics-New-election-called-amid-signs-of-political-uncertainty-affecting-the-Spanish-economy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}