Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 04, 2016

Most shorted ahead of earnings

A review of how short sellers are positioning themselves ahead of earnings announcements in the coming week.

- Investors seen possibly hedging rising equity of most shorted Quebecor

- Record short interest maintained in Morrisons despite costly rally to short sellers

- Short interest in Samsung Heavy Industries up by 25% ahead of earnings

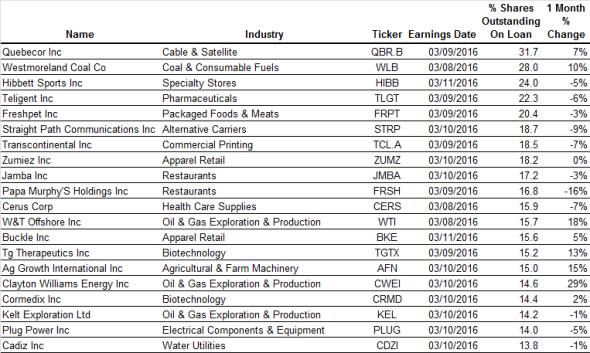

North America

Most shorted ahead of earnings in North America this week is telecoms and media company Quebecor. With 32% of shares outstanding on loan, short interest movements have continued to track stock price movements. This is in part probably due to a number of convertible debentures in issue. Increased shorting activity has been seen as the stock price increased 23% - as convertible debt investors' hedge out their equity exposure.

Second most shorted is Westmorland Coal with 28% of its shares outstanding on loan. The owner of several coal mines in the US and Canada has seen shares fall by 70% in the last 12 months after prices for coal and other commodities collapsed and continue to hover at decade lows.

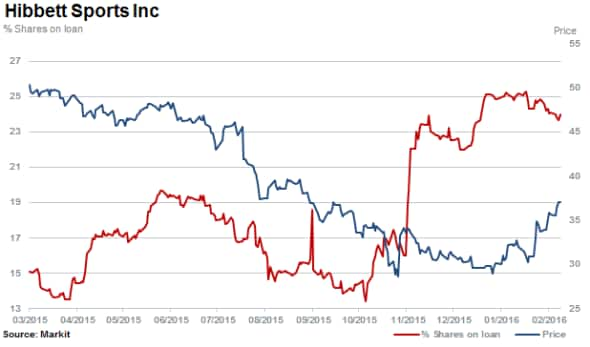

Short sellers have covered positions slightly in third most shorted Hibbet Sports, which has seen its stock rise by almost a fifth in the last three months with a quarter of the firms shares currently sold short.

After covering over a third of total short positions in Freshpet, with shares falling 62% in the past 12 months, short sellers continue to hold a significant position in the company with 20% of shares outstanding on loan.

Fresh Pet has been the target of short sellers since listing in 2014; shares are now down 52% since the company's IPO and 72% down from highs reached in early 2015.

Europe

UK retailer Wm Morrison Supermarkets is the most shorted stock in Europe ahead of earnings with 20% of its shares sold short. Joined by French retailer Casino Guichard with 12% of its shares shorted, short interest across European retailers continues to rise.

Shares in Morrisons have rallied almost 50% since December 2015, recently spurred on by Amazon who partnered with the grocer to deliver an online food service called 'Pantry' in the UK. Despite the costly rise to short positions, short sellers have not as of yet covered and short interest remains near record highs.

Short sellers have however covered a third of positions in Casino Guichard since the beginning of February 2016 with the stock bouncing 12% higher after posting a 44% decline over the last 12 months.

Second most shorted in Europe ahead of earnings is Italian construction firm Astaldi with 16.8% of its shares outstanding on loan. Shares in the firm have continued to fall another 15% after Moody's downgraded the outlook for the company from stable to negative.

Also making use of convertible debt instruments with possible hedging activities impacting short interest levels is Scandinavia airline SAS. With 13.5% of its shares outstanding on loan the firms shares have climbed over 50% in the past 12 months with short interest almost doubling.

Short interest has plummeted in German resource firm K&S ahead of earnings, falling 25% in a matter of weeks with 13% of shares outstanding on loan currently. Shares have risen 17% since hitting a 12 month low in November 2015.

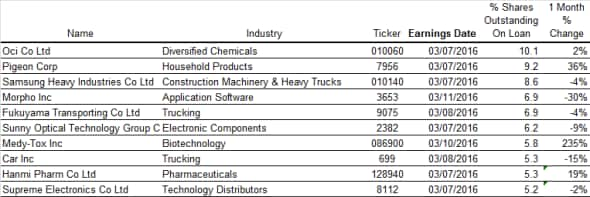

Apac

Most shorted ahead of earnings in Apac is South Korean firm Oci with 10% of shares outstanding on loan. Stock in the chemicals company has surged by 28% in the new year with short interest following suit.

Second most shorted in Apac is Japanese based child care product manufacturer Pigeon Corp. The firm has attracted short sellers in 2015 with short interest rising to 9.2% of shares outstanding on loan.

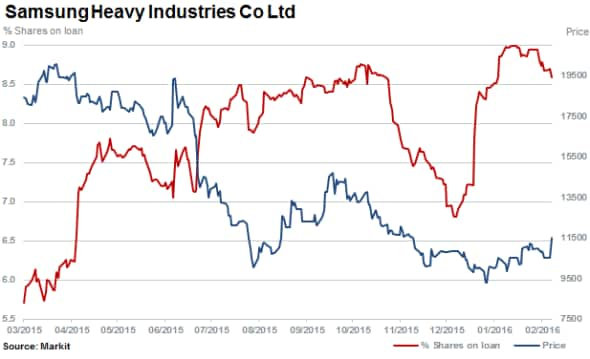

Lastly, rig and shipbuilder Samsung Heavy industries shares are 40% down over the last 12 months with short interest remaining high at 8.6%. The Korean shipbuilder has recently posted significant losses as orders for large vessels continued to decline.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Equities-Most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Equities-Most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}