Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 04, 2016

US Fed to weigh strong labour market against signs of economic slowdown

An upbeat US jobs report raises the possibility that the Fed will hike interest rates again at its March policy meeting. However, current signs of rising inflationary pressures and a tightening labour market need to be viewed alongside indications that the pace of economic growth may be slowing, and possibly sharply, amid growing concerns about the outlook.

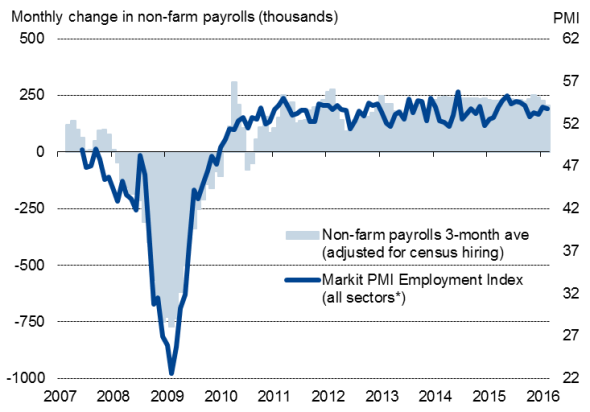

Markit PMI predicted solid February employment growth ...

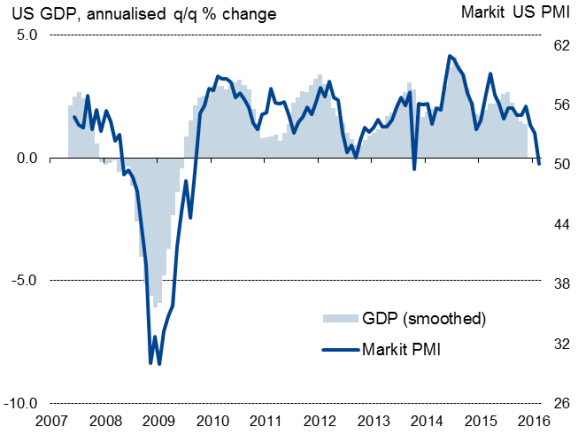

... but also points to slowing economy

The US economy added 242,000 jobs in February, according to the first estimate of non-farm payroll numbers. The report signals a solid pace of hiring and upturn in the rate of job creation compared to January, the number for which was revised up from 151,000 to 172,000.

The Fed will therefore be reassured that the labour market is still tightening, which in theory should feed through to higher inflation, which already appears to be on the rise. The annual rate of consumer price inflation doubled in January from 0.7% to 1.4%, and the Fed's preferred (PCE index) gauge of inflation jumped from 0.7% in December to 1.3%.

While annual pay growth fell to 2.2%, a seven-month low, this will most likely be brushed aside as pay-back from a surge in January. Recent months have seen pay growth trending higher at 2.5%, the fastest since late-2009.

Although the unemployment rate held at an eight-year low of 4.9%, the current pace of job creation should continue to bring the jobless rate down in coming months if sustained, fuelling further wage inflation. However, this is where the uncertainty lies. Survey data have signalled a marked slowing in the pace of economic expansion so far this year, with PMI data showing the weakest monthly expansion since the financial crisis with the exception of the government shutdown of October 2013. Such a marked slowing is normally a precursor to a weakening in the rate of job creation.

The forward-looking indicators from the PMI surveys even point to a risk of the economy stalling or contracting. The surveys not only show order book growth slowing, pointing to waning demand conditions, but also that business confidence has slipped to one of the weakest since the financial crisis.

However, at the moment, the Fed enters its March policy meeting seeing its envisaged scenario for the economy playing out as planned, with the economy continuing to create jobs, wage growth accelerating and inflation on the rise, meaning a rate hike remains firmly on the table.

* Manufacturing only pre-October 2009.

GDP smoothed using centred seven-month average.

Sources: Markit, Commerce Department, Bureau of Labor Statistics.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Economics-US-Fed-to-weigh-strong-labour-market-against-signs-of-economic-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Economics-US-Fed-to-weigh-strong-labour-market-against-signs-of-economic-slowdown.html&text=US+Fed+to+weigh+strong+labour+market+against+signs+of+economic+slowdown","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Economics-US-Fed-to-weigh-strong-labour-market-against-signs-of-economic-slowdown.html","enabled":true},{"name":"email","url":"?subject=US Fed to weigh strong labour market against signs of economic slowdown&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Economics-US-Fed-to-weigh-strong-labour-market-against-signs-of-economic-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+Fed+to+weigh+strong+labour+market+against+signs+of+economic+slowdown http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032016-Economics-US-Fed-to-weigh-strong-labour-market-against-signs-of-economic-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}