Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Mar 04, 2015

Brazil's CDS spreads jump above Latam peers

Fading commodities prices have stalled Brazilian growth, leading credit markets to treat the country's debt with increasing suspicion.

- Brazilian CDS spreads now trade over 126bps wider to the rest of the LATAM universe

- Bond investors seem less worried as Real dominated sovereign bonds have tightened since the start of the year

- Petrobras bonds have inverted after the oil producer became embroiled in a corruption scandal

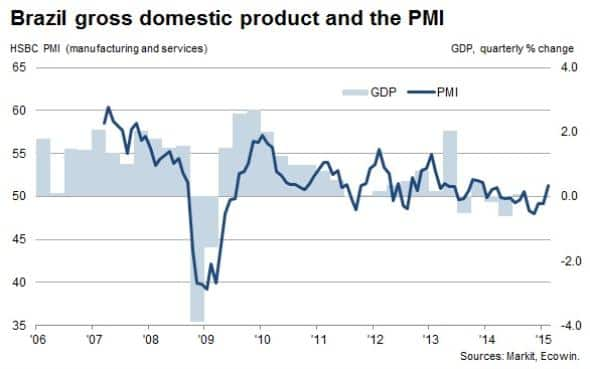

Brazil's export driven economic model helped the country rebound strongly from the financial crisis. The recent multi year lows seen in the price of oil, soy and iron ore, Brazil's three largest exports, have put the brakes on growth. The country looks set to see flat growth this year, according to a recent estimate from the country's finance minister. This trend has exacerbated the slide in the Brazil's currency which has nearly halved in value against the dollar from its highs in 2011.

This faltering growth was reflected in the country's recent PMI survey results as the HSBS Brazil Composite Output Index indicated that output fell for four straight months leading up to February. The latest February survey indicated that the country's output managed to return to growth, albeit it at a much slower pace than in the commodities-driven boom times.

But these faltering growth figures have seen credit markets treat Brazilian debt with increased suspicion.

CDS spread set Brazil apart

Unease about the country's stagnant growth prospects has seen Brazil's CDS spread surge in recent years and the five year spread recently hit its highest level in more than five years at the end of last month when it touched 253bps. This recent high is more than two and a half times the levels seen only two years ago when the commodities boom started to fade.

This rise in CDS spreads also sets Brazil apart from the rest of the Latin American sovereign borrowers, which have seen their CDS spreads trade roughly flat since the start of the year. In fact the extra spread required protect Brazilian bonds compared to the average of Mexico, Chile, Peru, Columbia and Panama hit 142bps at the end of February, up from less than 10bps in 2010.

Bonds still hold up

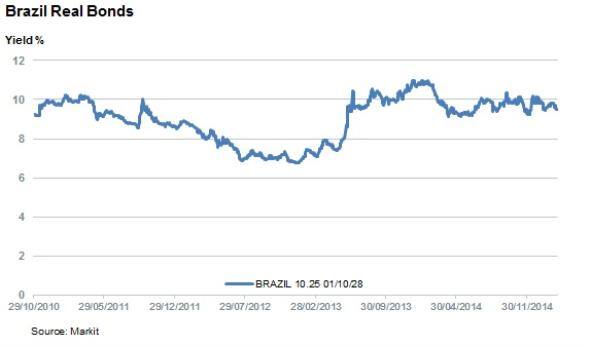

While CDS investors are increasingly wary of Brazilian debt, bond markets don't appear particularly worried. Yields on Brazil's 2028 real denominated bonds have been contracting since the start of the year, despite the 15% surge in the country's CDS spread. Significantly, the current 9.5% yield quoted by market makers is over 150bps tighter than in February of last year.

A similarly dated 2027 dollar issuance has widened somewhat, but the 40bps of extra yield required by investors is not drastic, given the recent real devaluation and falling growth.

Yield on Petrobas jumps

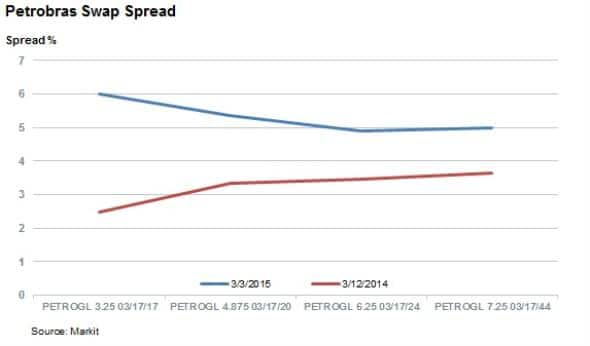

One area of the fixed income market that has reflected the country's dimming growth is Petrobras. The state controlled leader which is currently embroiled in a corruption scandal further adding to its woes given oil's recent plunge. Both these factors saw ratings agencies strip the national giant of its investment grade status which has sent the extra yield required by investors to hold Petrobras bonds up sharply.

Investors are now demanding a staggering 6% of extra yield in order to hold Petrobras' 2017 US denominated bonds over similar dated US treasuries. While this spread has come in slightly in recent days as the company announced an asset sale, it still stands 350bps wider than12 months ago.

Interestingly, longer dated bonds which have also seen their spreads compared to reference debt surge, now trade with a lower spread than the 2017 bonds. Such inversions are usually seen as a sign of distress in bond markets.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Credit-Brazil-s-CDS-spreads-jump-above-Latam-peers.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Credit-Brazil-s-CDS-spreads-jump-above-Latam-peers.html&text=Brazil%27s+CDS+spreads+jump+above+Latam+peers","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Credit-Brazil-s-CDS-spreads-jump-above-Latam-peers.html","enabled":true},{"name":"email","url":"?subject=Brazil's CDS spreads jump above Latam peers&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Credit-Brazil-s-CDS-spreads-jump-above-Latam-peers.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brazil%27s+CDS+spreads+jump+above+Latam+peers http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04032015-Credit-Brazil-s-CDS-spreads-jump-above-Latam-peers.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}