Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 04, 2016

Consumer goods sector drives US growth at start of 2016

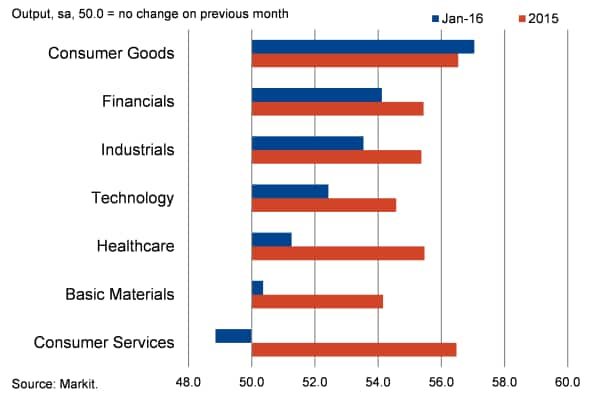

The first public release of US Sector PMI" data from Markit signalled higher output in all of the monitored sectors apart from consumer services during January. Consumer goods was the best-performing of the sectors monitored. It also registered the fastest growth in new orders and was the only sector to see backlogs increase at the start of 2016.

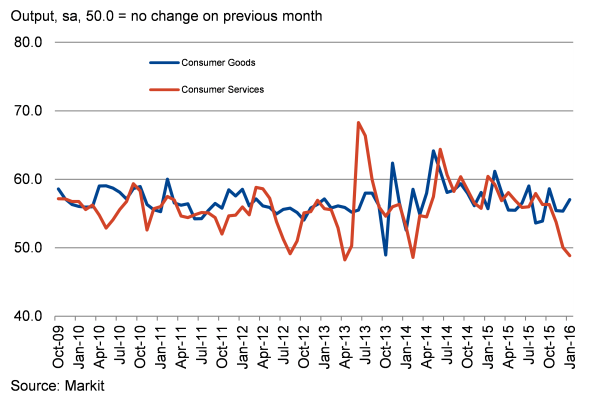

In contrast to its manufacturing counterpart, consumer services was bottom-ranked in January, reflecting the first reduction in output for nearly two years. This contrasted with the trend seen during 2015, when activity rose at the same marked pace as consumer goods output on average. Moreover, new business in consumer services fell for a second month running, signalling a further weak trend in activity as the first quarter progresses.

Output meanwhile rose solidly in financials and industrials at the start of 2016, and firms based in the technology, healthcare and basic materials sectors all also saw modest expansions in output.

US Sector PMI

Consumer-led growth in 2015

The January results follow a year in which the sector data signalled broad-based growth of the US economy, with all of the surveyed sectors recording solid expansions on average in 2015. However, while consumer goods and services led the growth rankings across the year as a whole the data point to weakness in tourism & recreation in recent months, with the strength of the dollar and the threat of terrorism being possible contributory factors.

Other strong performers last year included financials, healthcare and industrials. Technology and basic materials lagged behind slightly, but still saw robust growth overall.

US Consumer Goods vs Consumer Services PMI

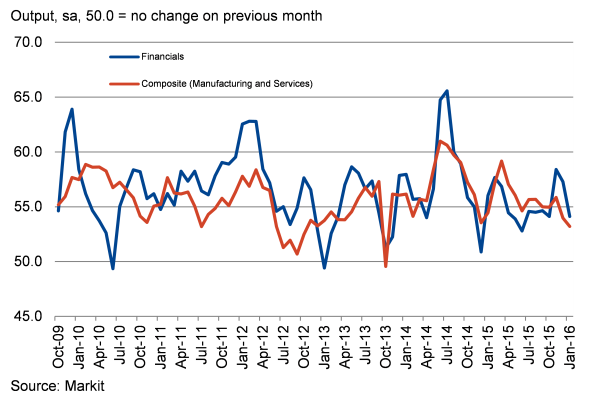

Hiring strongest in financials

Despite its outperformance with regard to output and new work, consumer goods producers were still outperformed by financial services companies when it came to job creation at the start of 2016. The rate of hiring in financials in January was the steepest since September 2014.

US Financials vs Composite PMI

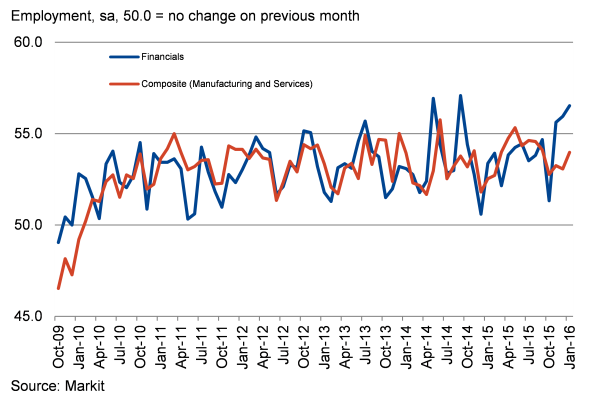

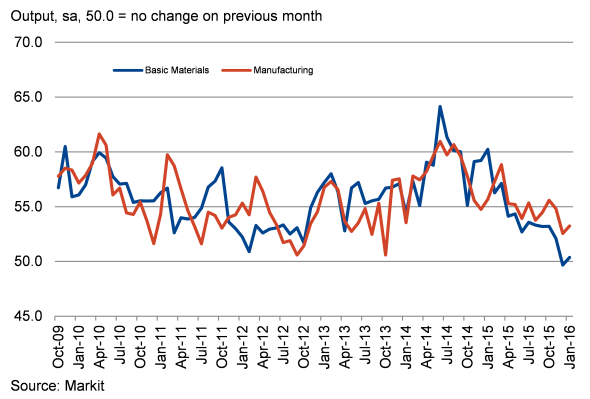

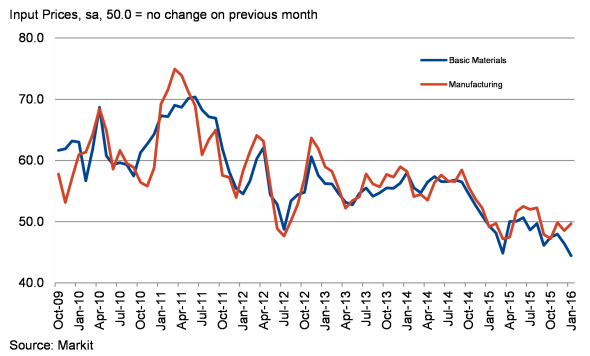

Basic materials facing challenging conditions in 2016

Tellingly, employment stagnated in basic materials. January was the first period since data collection began (October 2009) in which staffing levels had failed to increase. With output also barely rising, the outlook for the sector in 2016 appears clouded with uncertainty.

Underlying the fragility of the basic materials sector in January was a series-record fall in input costs, reflecting lower commodity prices, particularly oil and metal-related. As a result, pricing power remained weak, with charges rising only fractionally.

US Basic Materials vs Manufacturing PMI

For more information on US Sector PMI data, please contact economics@markit.com.

Philip Leake | Economist, Markit

Tel: +44 149 146 1014

philip.leake@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Economics-Consumer-goods-sector-drives-US-growth-at-start-of-2016.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Economics-Consumer-goods-sector-drives-US-growth-at-start-of-2016.html&text=Consumer+goods+sector+drives+US+growth+at+start+of+2016","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Economics-Consumer-goods-sector-drives-US-growth-at-start-of-2016.html","enabled":true},{"name":"email","url":"?subject=Consumer goods sector drives US growth at start of 2016&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Economics-Consumer-goods-sector-drives-US-growth-at-start-of-2016.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Consumer+goods+sector+drives+US+growth+at+start+of+2016 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04022016-Economics-Consumer-goods-sector-drives-US-growth-at-start-of-2016.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}