Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 04, 2016

Global manufacturing subdued by steepest emerging-Asia downturn on record

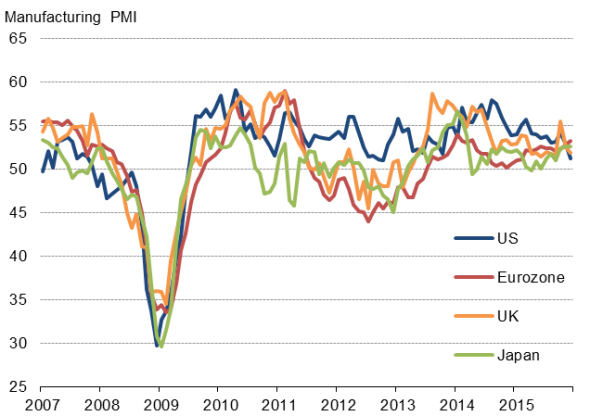

Global manufacturing growth slowed at the end of 2015, ending the worst year since 2012. European countries led the growth rankings, as emerging Asia suffered its worst downturn in more than ten years of data collection.

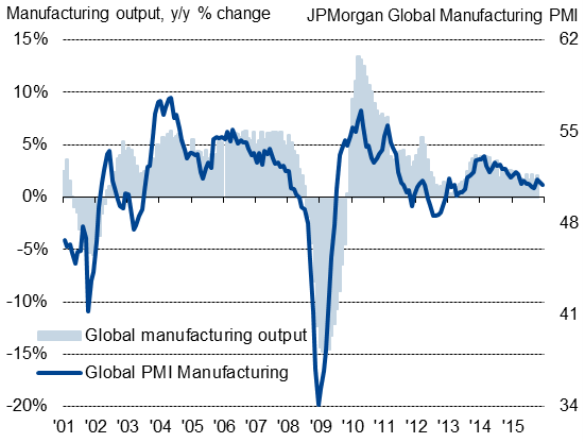

The JPMorgan Global Manufacturing PMI", compiled by Markit, fell from 51.2 in November to 50.9 in December, its lowest reading for three months. The survey data are consistent with global manufacturing output expanding at a modest annual pace of just over 1%.

At 51.2, the average PMI reading for 2015 is down from 52.3 in 2014 and the lowest - albeit by a small margin - since 2012, a year in which global manufacturing suffered a slight decline.

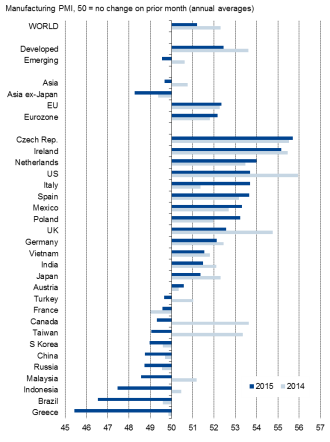

In all, 14 of all 25 countries covered by Markit PMI surveys saw their manufacturing economies expand in 2015, according to average PMI readings, while 11 reported deteriorating business conditions.

Global factory output

Europe dominates 2015 rankings

The Czech Republic enjoyed the strongest manufacturing expansion over the year as a whole, taking over from the US.

Manufacturing PMI rankings

The Czech outperformance - its best annual expansion since 2010 - in part reflected stronger eurozone economic growth. The single-currency area as a whole saw its strongest annual expansion since 2011, with four of the top six manufacturing economies in 2015 being euro members, led by Ireland, followed by the Netherlands, Italy and Spain. While Ireland's growth in 2015 was down slightly on 2014, the Netherlands recorded its best year since 2010 while Italy and Spain both saw the strongest annual gains since 2006.

Nine of the 14 expanding manufacturing economies were found in Europe, joined by the US and Mexico, with the latter's exporters benefitting from the ongoing US expansion.

However, the US saw a marked easing in its manufacturing performance in 2015 compared to the strong expansion seen in 2014, as did the UK, with producers in both countries struggling in the face of appreciating exchange rates. While the US slipped to fourth place in the rankings in 2015, down from the top spot in 2014, the UK fell from fourth to ninth place.

However, the biggest turnaround in performance was recorded in Canada, where the downturn in global demand for commodities saw a strong expansion in 2014 switch to a drop in manufacturing activity in 2015.

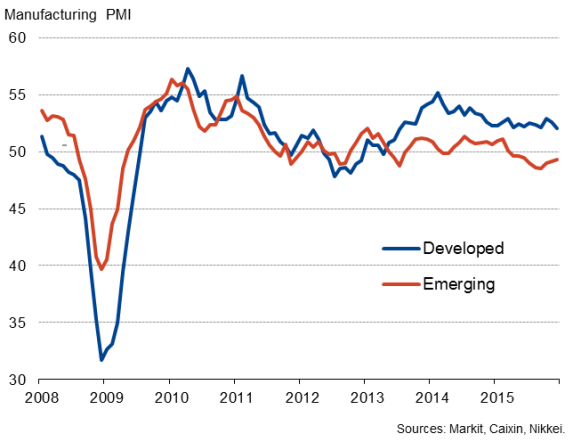

Emerging markets suffer worst performance for seven years

Of the 11 countries that saw a worsening of their manufacturing economies in 2015, nine were emerging market economies. That said, the steepest overall decline was seen in crisis-torn Greece, which reported its worst year since 2012.

Developed and emerging markets

The broad-based poor performance of emerging markets caused the Emerging Market Manufacturing PMI to slip below 50 (on average) in 2015 for the first time since 2008. However, Asia ex-Japan suffered a fourth consecutive annual decline, registering the steepest downturn in the history of data collection that began in 2004.

Developed world

With an average PMI reading of 48.7, China's manufacturers also reported their steepest downturn since data were first available in 2004. Both Taiwan and South Korea endured the largest downturns in manufacturing activity since 2008.

Only three of the 14 expanding manufacturing economies were found in Asia (Japan, India and Vietnam), though each saw only modest expansions.

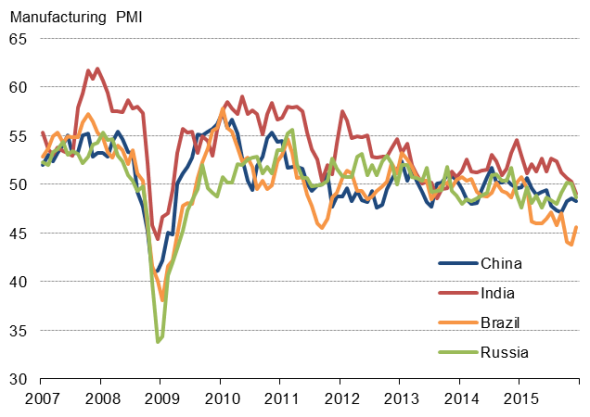

Main emerging markets

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-economics-global-manufacturing-subdued-by-steepest-emerging-asia-downturn-on-record.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-economics-global-manufacturing-subdued-by-steepest-emerging-asia-downturn-on-record.html&text=Global+manufacturing+subdued+by+steepest+emerging-Asia+downturn+on+record","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-economics-global-manufacturing-subdued-by-steepest-emerging-asia-downturn-on-record.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing subdued by steepest emerging-Asia downturn on record&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-economics-global-manufacturing-subdued-by-steepest-emerging-asia-downturn-on-record.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+subdued+by+steepest+emerging-Asia+downturn+on+record http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f04012016-economics-global-manufacturing-subdued-by-steepest-emerging-asia-downturn-on-record.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}