Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 03, 2014

The return of volatility?

Recent spread actions suggests that volatility may be returning, while the index roll on October 6th could accentuate fluctuations.

- Relatively large swings in spreads

- Direction of monetary policy diverging between US and Europe

- Credit indices roll on Monday

Credit markets have become accustomed to low volatility, but recent spread action hints that times are changing.

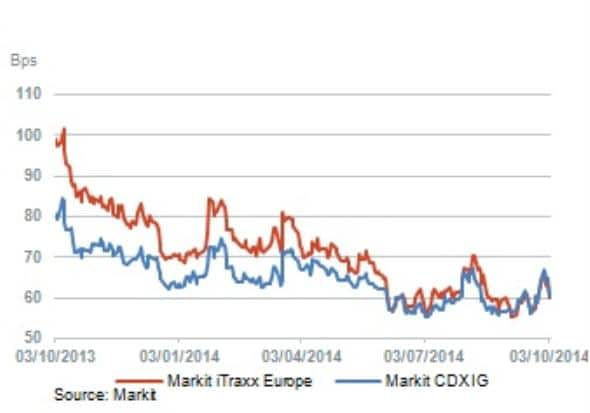

North American CDS, as represented by the Markit CDX.NA.IG index, traded in a relatively broad range during the third-quarter. The index hit 55bps in early July, its tightest level since October 2007. But it soon began to widen and little more than a month later was trading at 67bps. The European equivalent, the Markit iTraxx Europe, followed a similar pattern and traded in a 56-70bps range.

The first spell of widening was triggered by geopolitical risk, predominantly the conflict in Ukraine. Technical factors have probably played a larger role in the second reversal during the latter part of September. The mere presence of quarter-end may have prompted participants to take risk off the table, as is often the case. The departure of fund manager Bill Gross form PIMCO may also have caused some volatility in both cash and derivatives markets.

That's not to say fundamentals were irrelevant. Geopolitical risk is omnipresent, from the recent referendum in Scotland, to the protests in Hong Kong and the upcoming Brazilian elections. Emerging markets have experienced a tough third-quarter, and remain vulnerable to negative news flow.

But monetary policy remains the key driver of risk appetite, and some investors will no doubt see the recent reversal as an opportunity to increase long positions. The Federal Reserve may be tapering its quantitative easing programme, but the clamour for the ECB to start its own government bond purchase is growing. Deflation is a real concern for European policymakers, and if the ECB responds with further measures to expand its balance sheet, history tells us risk assets should benefit.

On Thursday, Mario Draghi outlined the ECB's plans to buy ABS and covered bonds, or "private QE" as it is sometimes called. There is considerable pressure on the asset purchase programme to succeed, not least because the recent take up of the first four-year TLTRO was a disappointing €82.6bn. But it will be a tall order for the ABS and covered bond purchase programmes to meet the ECB's implied target of increasing its balances sheet by €1 trillion.

Capital rules disincentivise holding ABS, and it would need changes in Basel II and Solvency II to make the asset class more attractive and encourage issuance. The market expects full QE - purchases of government bonds - to commence next year, though there are formidable legal obstacles in Germany that make it far from certain.

The lack of clarity on the ECB's eligibility rules for the ABS programme dampened the ECB's announcement and initially led to CDS spreads widening. But sentiment was already shifting on Friday before a bumper US Jobs report ensured that the week ended on a high. The US unemployment rate is now at 5.9%, the first time it has dipped below the 6% threshold since July 2008.

Index Roll

The majority of CDS indices roll on October 6th. This was later than the initial date of September 22nd due to the ISDA 2014 protocol adherence date being pushed back.

Markit iTraxx Europe

Five of the excluded names (Gecina, Linde, Unibail, Swiss Re and SES) didn't make the cut due to insufficient liquidity. Electrolux, Henkel and Kingfisher all had less than €100 million in outstanding debt. Imperial Tobacco didn't meet the rating criteria.

Fig. 1 New names in Series 22

Fig. 2 Names excluded from Series 22

Markit iTraxx Crossover

The Markit iTraxx Crossover is expanding from 60 names in Series 21 to 75 names in Series 22. The majority of additions have been included from the supplementary list.

Many investors feel that the relatively small number of CDS names in the European high-yield universe doesn't adequately reflect the large number of issuers in the cash market. The expansion of the Crossover should help to rectify this, as the inclusion of a name in the index can make it more attractive to market participants and therefore increase liquidity.

Fig.3 New names in Series 22

Fig. 4 Names excluded from Series 22

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Credit-The-return-of-volatility.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Credit-The-return-of-volatility.html&text=The+return+of+volatility%3f","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Credit-The-return-of-volatility.html","enabled":true},{"name":"email","url":"?subject=The return of volatility?&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Credit-The-return-of-volatility.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+return+of+volatility%3f http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03102014-Credit-The-return-of-volatility.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}