Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 03, 2015

Market volatility halts bonds returns

Continued volatility in bond markets has dented bond returns and investor sentiment.

- Sovereign bonds across in Europe and the US cut year to date gains

- HY bonds held up amid the sovereign bond selloff; both US HY and EU HY posted positive total returns

- Global fixed income ETFs lost AUM $666m last month

Market movements

Volatility grips eurozone

- A volatile start to the month saw sovereign bonds in the eurozone selloff. Across the three major currencies, only UK gilts provided positive performance, returning 0.4%. German bunds and US treasuries returned -1.1% and -0.3% respectively.

- European sovereigns bonds in the core (Germany and France) outperformed those in the periphery (Italy, Spain, Portugal and Ireland), but total returns lag year to date (ytd).

- Markit iBoxx € Corporates lost 0.46% on the back of negative credit return (-31bps). Spreads in Markit iBoxx € High Yield increased in March, leaving the total return flat at 0.15%. € High Yield B remains the best returning European rating bucket, up 4.98% this year.

- European ABS saw a positive return last month of 1.62%, now up 6.45% ytd, higher than European corporates and sovereigns.

- US HY held up better than US IG, with total returns for the month at 0.1% and -0.5% respectively.

- US HY and US sovereigns were positively correlated last month (0.22), whereas one year correlation shows a negative trend (-0.25).

- In emerging markets, Russian bond returns slowed last month as oil prices stabilised, but remains 21.3% in the positive ytd.

- Inflation linked bonds across the three major currencies saw negative returns, with Germany returning -2.3%, they remain positive ytd.

ETF market activity review

Fixed income ETFs see rare monthly outflows

- Global fixed income ETFs saw $666m of outflows last month, but AUM remains $45.6bn up ytd

- The US fixed income ETF market experienced outflows of $84m during May. Treasury ETFs saw outflows of $2.1bn. The iShares Short Treasury Bond ETF experienced $1.7bn of outflows.

- European fixed income ETFs also saw overall outflows of $899m last month. Sovereign, Corporates saw the largest outflows; $544m and $522m respectively. Investors were however attracted to HY, as the iShares $ High Yield Corporate Bond UCITS ETF saw $229m of new inflows.

- In contrast to the US and Europe, fixed income ETFs exposed to Asia saw $317m in net inflows

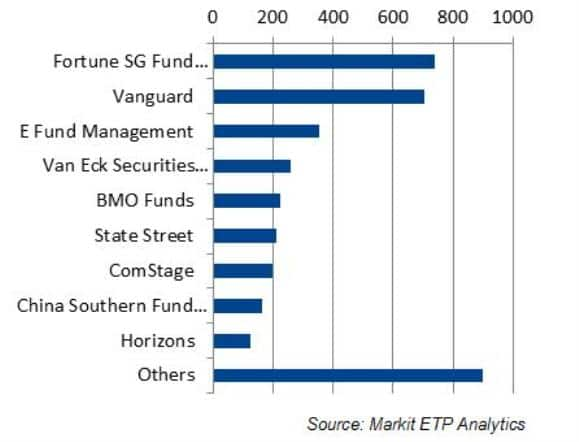

Top 10 Fixed Income ETF providers by positive inflows in May ($mm)

- Chinese issuer Fortune was able to attract the biggest chunk of total inflows to its fixed income ETFs in May when it attracted $740m of net inflows

New ETF launches in May

- May saw four new ETF issuances in the US and Europe.

- PIMCO was the most prolific new issuer, launching two new products; the PIMCO Euro Short Maturity Accumulation Source UCITS ETF and PIMCO Short-Term High Yield Corporate USD acc Bond Index Source UCITS ETF.

Ivelin Angelov | Fixed Income Analyst, Markit

Tel: +442070646207

ivelin.angelov@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-credit-market-volatility-halts-bonds-returns.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-credit-market-volatility-halts-bonds-returns.html&text=Market+volatility+halts+bonds+returns","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-credit-market-volatility-halts-bonds-returns.html","enabled":true},{"name":"email","url":"?subject=Market volatility halts bonds returns&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-credit-market-volatility-halts-bonds-returns.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Market+volatility+halts+bonds+returns http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-credit-market-volatility-halts-bonds-returns.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}