Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 03, 2015

UK economic slowdown broadens out to service sector

A marked slowing in the rate of growth signalled by the UK PMI surveys raises doubts about the ability of the economy to rebound from the weakness seen at the start of the year, killing off the chances of any imminent hiking of interest rates by the Bank of England.

However, the survey data also point to an upturn in inflationary pressures, which should alleviate worries about deflation becoming entrenched, though suggests that the return of rising prices could stymie consumer spending later this year.

2015 growth worries

UK economic growth slowed sharply in May according to the PMI surveys. Businesses reported the slowest pace of expansion since December and the second-weakest monthly rate of growth for two years.

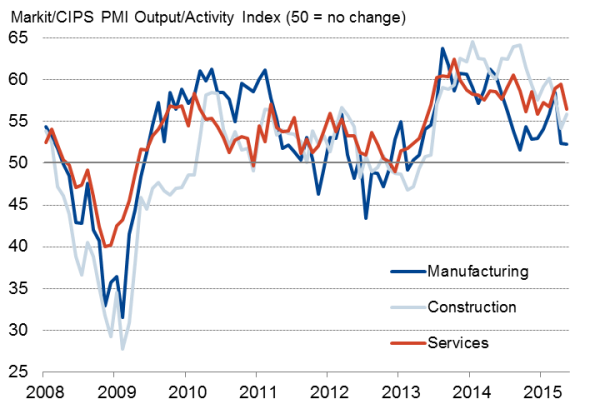

Disappointingly modest rates of expansion in manufacturing and construction persisted into May, but were accompanied by a marked easing in service sector growth during the month. The service sector consequently joined manufacturing and construction in seeing one of the slowest rates of growth in the past two years.

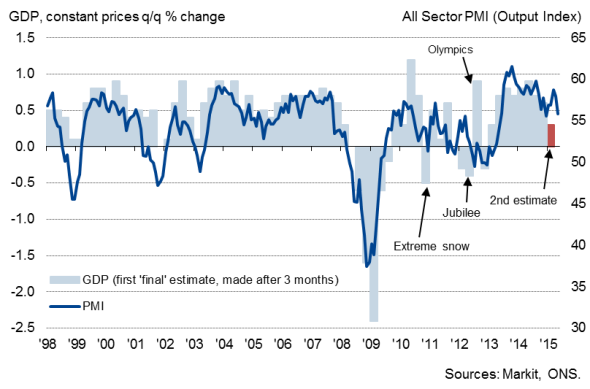

The combined Output Index of the three PMI surveys fell from 58.0 in April to 55.8 in May, taking the second quarter average so far to 56.9, broadly consistent with a 0.5% quarterly rise in GDP (but a rate of just 0.4% in May alone). While that would represent an improvement on the 0.3% growth seen in the first quarter, it is below the rates seen throughout last year and adds to the sense that economic growth could disappoint in 2015.

UK PMI and economic growth

Business activity by sector

Source: Markit.

The Bank of England has recently downgraded its projection for the current year from 2.9% to 2.5%, but even this lower growth target would require GDP to rise by just over 1% in each of the final two quarters of the year (a feat not seen since 2005) if the economy musters a mere 0.5% expansion in the second quarter.

Hopes are therefore pinned on first quarter growth being revised higher to help the UK achieve growth of 2% or more in 2015. PMI data certainly suggest that the final estimate will come in higher than the current 0.3% increase signalled by the ONS's second estimate (see chart). PMI and "final' GDP data only tend to differ significantly if the economy is affected by unusual events such as the Olympics and extreme weather.

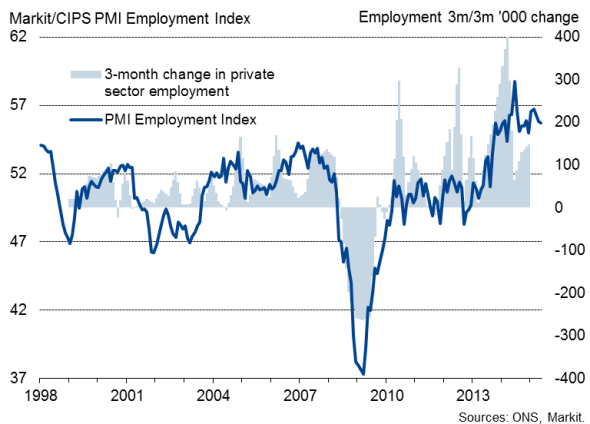

Jobs boost as confidence lifts higher

The surveys also indicated that employment growth ticked lower in response to a slowdown in order book growth, but continued to signal historically robust job gains as many companies reported that the slowdown looked likely to be temporary. Business expectations lifted markedly higher to reach a nine-year high in construction and also nudged up in the service sector as many companies blamed recent weakness on uncertainty caused by the general election.

Although down on the rates of job creation seen in the first quarter, the PMI continues to signal employment growth of around 200,000 per quarter, which should help drive unemployment down further from the current seven-year low of 5.5% in coming months.

Employment

Inflationary pressures build

An upturn in the survey's price indices meanwhile suggest that inflation will turn up again soon, after having shown falling consumer prices in the 12 months to April for the first time since 1960. Average prices charged for goods and services rose for the first time in three months in May, as companies passed higher costs on to customers. Average input prices showed the largest monthly rise since last September, in turn often linked to the pass-through of higher oil prices though also reflecting rising wage pressures.

However, while helping to allay fears about deflationary forces becoming entrenched in the UK economy, the prospect of prices starting to rise again suggests the prop to consumer spending growth received from low inflation in recent months will start to fall away, dampening economic growth. Both the manufacturing and services PMI showed growth to have been reliant on consumer-oriented sectors in May.

Policy pause

The survey data therefore leave question marks over the health of the UK economy and its likely growth trajectory, suggesting policymakers will need to await further data before making any decisions on when to make the first hike in interest rates and thereby start the process of normalising monetary policy.

Inflation looks likely to start rising in the second half of the year, but on the other hand recent official growth data have disappointed and the PMI data point to only a muted rebound in the second quarter. Policymakers will therefore most likely want to see firmer evidence of robust economic growth before taking the first step to hiking interest rates.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-UK-economic-slowdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-UK-economic-slowdown.html&text=UK+economic+slowdown+broadens+out+to+service+sector","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-UK-economic-slowdown.html","enabled":true},{"name":"email","url":"?subject=UK economic slowdown broadens out to service sector&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-UK-economic-slowdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+economic+slowdown+broadens+out+to+service+sector http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03062015-Economics-UK-economic-slowdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}