Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 03, 2017

UK PMI indicates 0.5% GDP growth at start of Q1

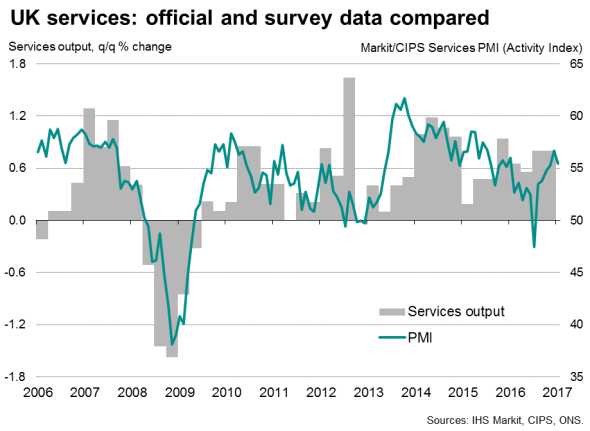

UK business activity growth slowed in January after a strong end to 2016, with the pace of job creation waning as inflationary pressures continued to intensify. However, the January PMI surveys still point to a buoyant start to 2017 for the economy, and optimism about the coming year has hit its highest in one-and-a-half years, suggesting that the slowdown may only be temporary.

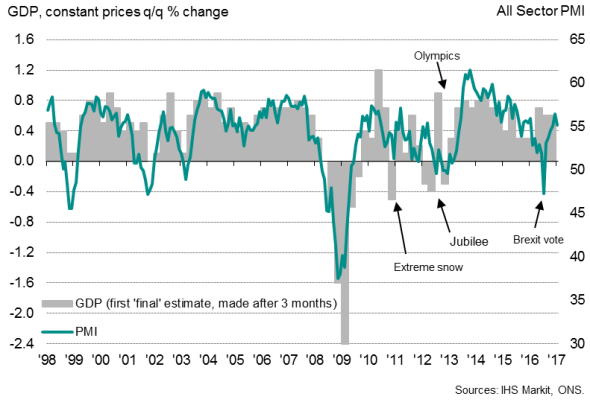

The Markit/CIPS ‘all-sector’ PMI fell from December’s 17-month high of 56.5 to 55.2 in January. The current reading is nevertheless indicative of GDP rising by a robust 0.5% in the first quarter if current growth is sustained in coming months, adding some justification to the Bank of England’s recent upgraded outlook for the economy in 2017.

UK economic growth and the PMI

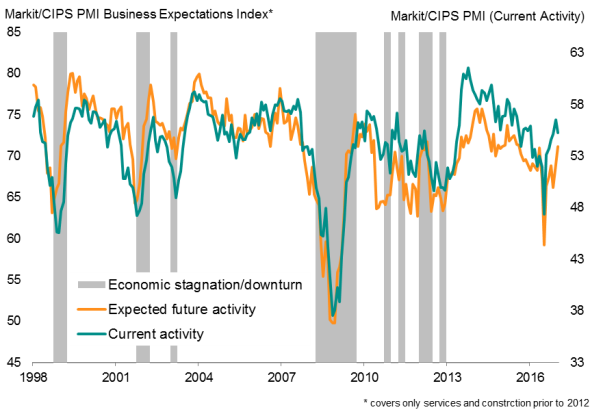

New future activity index

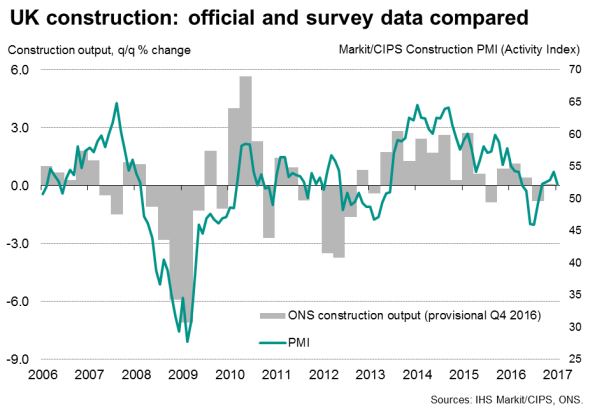

Although manufacturing output expanded at the fastest rate since May 2014, growth slowed to three- and five-month lows in services and construction respectively. All sectors nevertheless reported improved business optimism in January.

Business confidence

The January survey includes a new series which tracks expectations about firms’ business activity levels in 12 months’ time in all three main sectors of the economy. This contrasts with the other PMI variables as it is the only index based on subjective replies. Whereas Output, New Orders and all other PMI indices are based on questions asking how actual levels changed in the current month, the Expectations Index is based on firms’ views on the outlook.

The data for the Expectations Index have been collected on a monthly basis since July 2012, meaning the index already has a four-and-a-half year history[1].

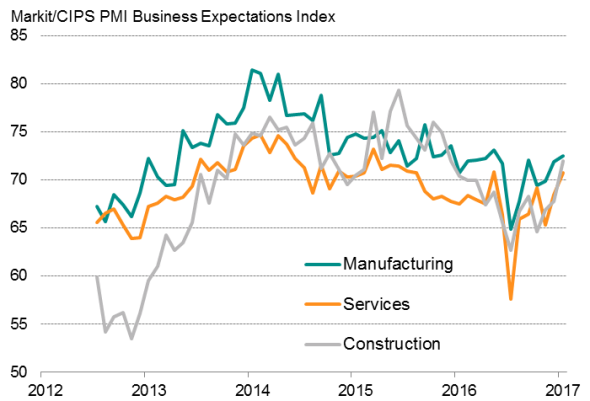

The January reading showed optimism about the year ahead to have moved up to its highest since August 2015. Optimism rose to the highest since prior to the EU referendum in manufacturing and services, while a 13-month peak was seen in construction.

Business expectations by sector

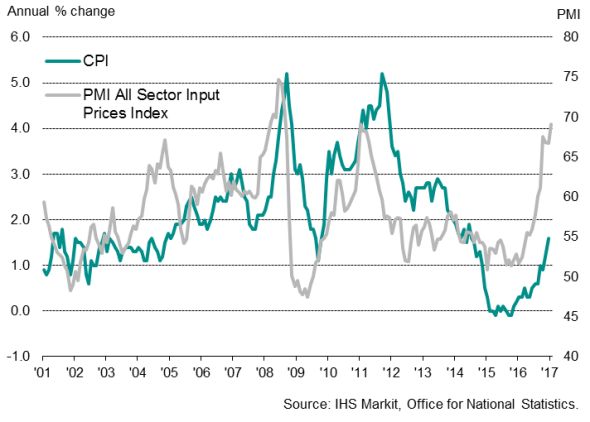

Input cost inflation at joint post-crisis high

The main area of concern in the survey is the extent to which companies’ costs are rising. The rate of input cost inflation across the three sectors accelerated sharply in January to its joint-highest since before the global financial crisis, hitting a record high in manufacturing, a pot-crisis high in construction and a six-year peak in services.

Cost increases were linked to higher wages as well as increased import prices arising from the pound’s depreciation and stronger global commodity prices, notably with the increased price of oil pushing up transport and energy costs. These higher costs are feeding through to higher selling prices, which will inevitably put upward pressure on consumer prices. Average prices charged for goods and services rose in January at the fastest rate since April 2011.

UK inflation

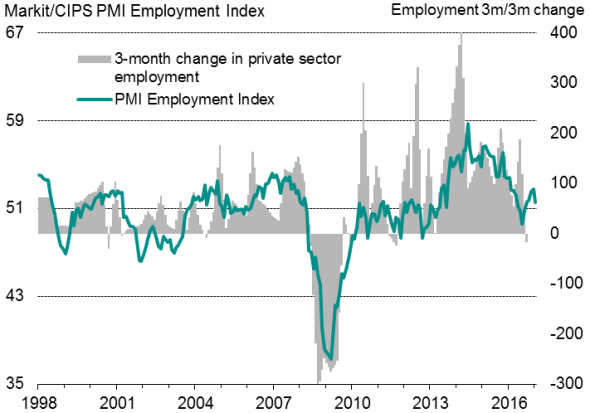

Hiring curbed by cost worries

There’s also evidence that higher costs are deterring companies from taking on extra staff. The January surveys found employment to have increased at the slowest rate since August. Only construction companies stepped up their hiring at the start of 2017, with only very modest rates of job creation seen in services and manufacturing.

Employment

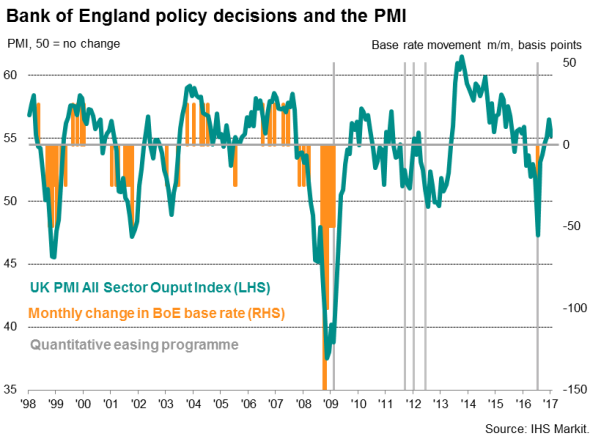

Policy outlook

The survey data highlight the issues that the Bank of England will face in 2017, battling rising inflation while offering support to the economy in uncertain times.

The solid pace of economic growth signalled by the surveys and the upturn in confidence about the year ahead suggest that businesses continue to shrug off any Brexit worries. The survey data come on the heels of the Bank of England’s updated view that the economy will grow 2.0% in 2017 instead of a previously-forecast 1.4%. Moreover, the degree to which costs and prices are rising threatens to test the tolerance of some policymakers in terms of the extent to which they will be prepared to ‘look through’ what’s likely to be a marked upturn in inflation in 2017.

However, any tightening of policy still looks unlikely in the foreseeable future given the unpredictability of Brexit negotiations and the potential for rising prices and weaker jobs growth to curb consumer spending.

[1]note that longer histories are available for services and construction sector business expectations

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022017-economics-uk-pmi-indicates-0-5-gdp-growth-at-start-of-q1.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022017-economics-uk-pmi-indicates-0-5-gdp-growth-at-start-of-q1.html&text=UK+PMI+indicates+0.5%25+GDP+growth+at+start+of+Q1","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022017-economics-uk-pmi-indicates-0-5-gdp-growth-at-start-of-q1.html","enabled":true},{"name":"email","url":"?subject=UK PMI indicates 0.5% GDP growth at start of Q1&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022017-economics-uk-pmi-indicates-0-5-gdp-growth-at-start-of-q1.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+PMI+indicates+0.5%25+GDP+growth+at+start+of+Q1 http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f03022017-economics-uk-pmi-indicates-0-5-gdp-growth-at-start-of-q1.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}