Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Dec 02, 2016

Glencore turnaround welcomed by CDS market

When a company announces that it is increasing the amount paid out to shareholders, it is not typically greeted with enthusiasm by credit investors. But Glencore is no ordinary company in the CDS world, and its announcement on December 1 wasn't a standard change in financial policy.

The Swiss firm said that it would be resuming dividend payments after a hiatus of more than a year. Back in September 2015, Glencore was under enormous pressure as it groaned under the weight of its high debt burden and struggled to cope with falling commodity prices. Five-year CDS spreads widened from 350bps to 850bps in the space of two weeks. Glencore's investment grade rating was vulnerable, and bondholders had the whip hand. The dividend was stopped and the company was forced into selling more equity, there by diluting shareholders.

Today's announcement marks the start of a shift in financial strategy, which will obviously be welcomed by equity investors. But the dividend resumption doesn't tell the whole story. Glencore's turnaround - surely one of the more successful in recent times - was driven by bondholder-friendly actions such as asset sales and reductions in capital expenditure. This enabled the firm to reduce debt to more manageable levels.

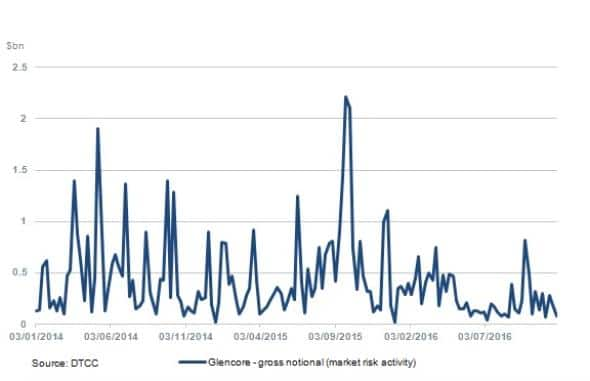

Glencore's remarkable progress is reflected in the company's CDS spreads. In January of this year the five-year spreads was quoted in excess of 1,100bps. By December 1 it was 184bps, its tightest level since July 2015. During its time of distress Glencore was often the most heavily traded name in the corporate CDS universe. In the current day, though still liquid, its volumes are unexceptional. This reflects its credit improvement, as well as the rise in commodity prices (Glencore was sometimes viewed as a proxy for commodit risk).

It was the widest name in the Markit iTraxx Europe for some time - now that honour belongs to Unicredit, closely followed by Deutsche Bank and Mediobanca. Credit investors will expect that Glencore continues on its impressive path and reduces debt even further.

Gavan Nolan | Director, Fixed Income Pricing, IHS Markit

Tel: +44 20 7260 2232

gavan.nolan@ihsmarkit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-credit-glencore-turnaround-welcomed-by-cds-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-credit-glencore-turnaround-welcomed-by-cds-market.html&text=Glencore+turnaround+welcomed+by+CDS+market","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-credit-glencore-turnaround-welcomed-by-cds-market.html","enabled":true},{"name":"email","url":"?subject=Glencore turnaround welcomed by CDS market&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-credit-glencore-turnaround-welcomed-by-cds-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Glencore+turnaround+welcomed+by+CDS+market http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02122016-credit-glencore-turnaround-welcomed-by-cds-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}