Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Nov 02, 2017

Philippines manufacturing sector enjoys strong start to the fourth quarter

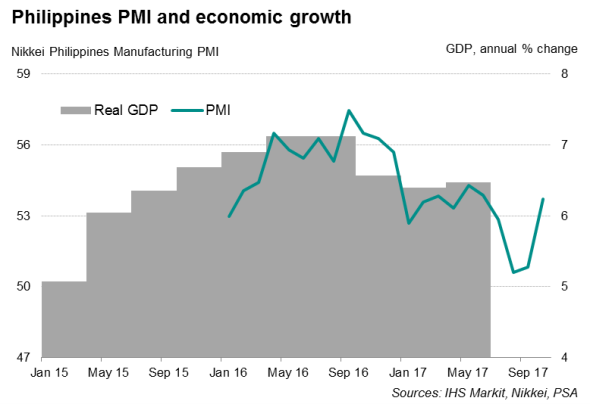

The Philippines manufacturing economy showed a flurry of activity at the start of the fourth quarter following two months of subdued growth, according to the latest Nikkei PMI data. Demand strengthened noticeably, which supported jobs growth.

However, the upturn was marred by rising inflationary pressures which could feed through to consumer prices, thereby putting further pressure on the Bangko Sentral Pilipinas (BSP) to tighten monetary policy.

The headline Nikkei Philippines Manufacturing PMI" rose to 53.7 in October, from 50.8 in September, signalling a strong improvement in growth compared to the third quarter. Forward-looking indicators suggest that growth is likely to gain further momentum towards the end of the year.

Order book volumes rose sharply, growing at the fastest rate since May, while firms also raised purchasing activity to the greatest extent so far this year, anticipating higher output in coming months. Although business confidence slipped, it remained elevated.

Price pressures

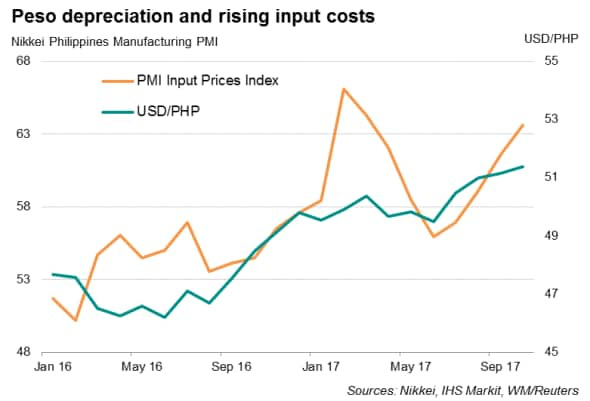

The recent weakening of the peso has posed a problem for Filipino manufacturers, especially those that rely on imported inputs for production. Input cost inflation picked up sharply in October, reaching a seven-month high. Anecdotal evidence suggested that imported raw materials, such as paper, fuel and industrial materials, were more expensive.

In response to higher costs, firms raised selling prices in order to protect profit margins. Charges for Philippine manufactured goods increased at the fastest rate since the survey started in January 2016.

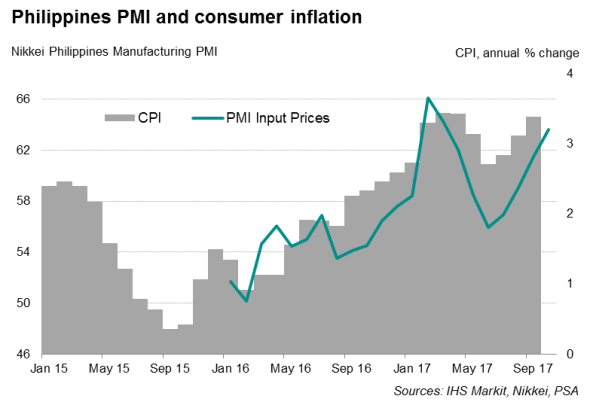

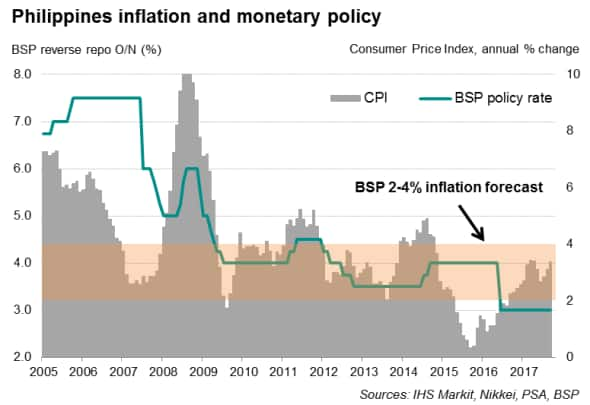

The signals from the survey that inflationary pressures are building suggests that consumer inflation may soon trend above the central bank's inflation expectations of 2.0-4.0%.

In its recent quarterly inflation report, the BSP acknowledged upside risks to its inflation outlook, citing rising global oil prices and the recent depreciation of the peso. Therefore, a further pick-up in the price trend may compel the central bank to consider tightening monetary policy, especially with key interest rates currently at a record low.

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112017-Economics-Philippines-manufacturing-sector-enjoys-strong-start-to-the-fourth-quarter.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112017-Economics-Philippines-manufacturing-sector-enjoys-strong-start-to-the-fourth-quarter.html&text=Philippines+manufacturing+sector+enjoys+strong+start+to+the+fourth+quarter","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112017-Economics-Philippines-manufacturing-sector-enjoys-strong-start-to-the-fourth-quarter.html","enabled":true},{"name":"email","url":"?subject=Philippines manufacturing sector enjoys strong start to the fourth quarter&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112017-Economics-Philippines-manufacturing-sector-enjoys-strong-start-to-the-fourth-quarter.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Philippines+manufacturing+sector+enjoys+strong+start+to+the+fourth+quarter http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02112017-Economics-Philippines-manufacturing-sector-enjoys-strong-start-to-the-fourth-quarter.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}