Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Oct 02, 2015

Peripherals buck trend; Treasury yields tumble

Within a heightened risk environment, European peripherals have proven rewarding. Meanwhile in the US, a low payrolls number sends Treasury yields sharply lower.

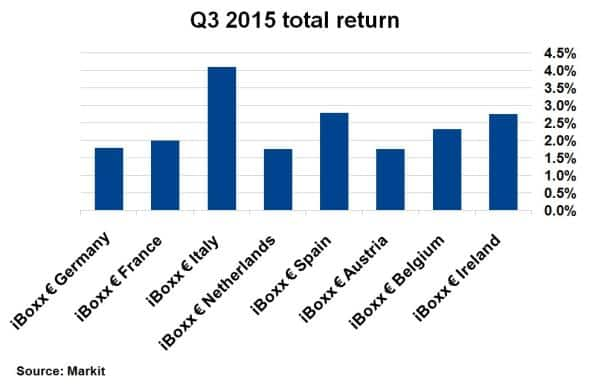

- Spanish and Italian government bonds have returned 2.8% and 4.1%, respectively, over the last quarter

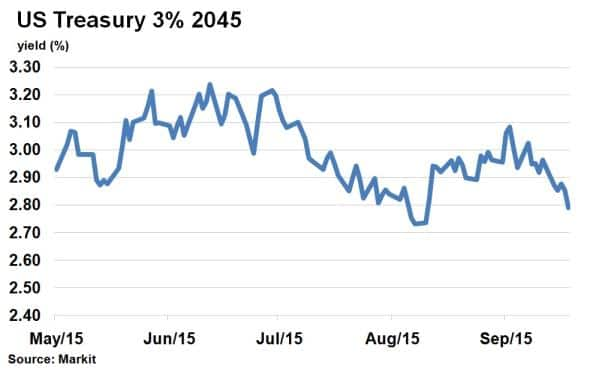

- A lower than expected payrolls number has sent the US 10-yr Treasury yields below 2%

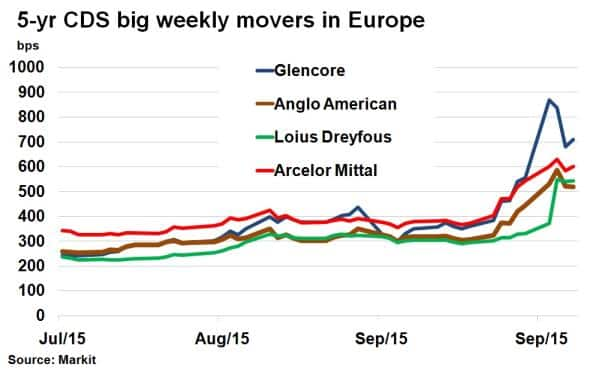

- Louis Dreyfous saw its CDS spread widen 64% this week, compared to Glencore's 28%

Peripherals

The past few months have seen heightened risk among corporate credit in Europe. The Markit iTraxx Europe Main index, a credit index tracking 125 European investment grade names, is at its widest since October 2013. Even in cash, bond spreads are at their widest since August 2012, according to the Markit iBoxx € Corporates Non-Financials index.

Bond returns have been squeezed, especially among the riskier high yield sector. Safe haven assets have proved fruitful, with German bonds having returned 1.25% over the past month.

The best performing bond sector in Europe, however, has been the peripherals. According to Markit's iBoxx indices, Spanish and Italian government bonds have returned 2.8% and 4.1%, respectively, over the last quarter. This performance highlights the change in attitude towards European peripheral nations, which have seen spreads wider than core Europe ever since the European debt crisis in 2011.

Spanish sovereign bonds have had a particularly buoyant week with the spread on the Markit iBoxx Spain index tightening 12bps, representing a total return of 0.5%. Even though Catalan nationalists won 48% of votes supporting independence, failure to win a majority has limited their chances of creating a succession state. Investors reacted positively on the news, which was deemed credit positive.

US jobs slip

Monthly non-farm payrolls indicated that the US economy added 142k new jobs. This was a lower than expected number, pushing first rate hike expectations into March next year, according to fed funds futures.

10-yr Treasury yields were down 10bps to 1.94%, the first time the yield has dropped below 2% since April 28th. The two year 0.625% 2017 US Treasury, seen as the most sensitive to short term interest rates, saw yields fall 8bps to 0.55%, according to Markit's bond pricing service.

Longterm US treasuries had already seen yields fall 20bps [VC1] over the past fortnight as inflation expectations in the US fell back. The latest jobs report has suppressed yields (and the term premium) a further 6bps to 2.75%.

The fall in borrowing costs across the term spells bad news for central bankers looking to raise interest rates as soon as possible. Volatility arising from weak commodity prices has already caused concern for the Fed and with fundamentals slowing down, the bond market is betting on lower rates for longer.

Contagion

While Glencore was the main perpetrator for heightened credit risk among European corporates this week, some credits caught up in the contagion actually saw credit spreads move much wider.

Louis Dreyfous, a global merchandiser of commodities, saw its 5-yr CDS spread widen from 330bps to 542bps, representing a 64% change. In comparison, Glencore, which has been dominating news headlines, saw a 28% widening of its CDS spread. Another name caught up in this week's risk aversion was steel miner Arcelor Mittal, which saw an 11% widening.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-credit-peripherals-buck-trend-treasury-yields-tumble.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-credit-peripherals-buck-trend-treasury-yields-tumble.html&text=Peripherals+buck+trend%3b+Treasury+yields+tumble","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-credit-peripherals-buck-trend-treasury-yields-tumble.html","enabled":true},{"name":"email","url":"?subject=Peripherals buck trend; Treasury yields tumble&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-credit-peripherals-buck-trend-treasury-yields-tumble.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Peripherals+buck+trend%3b+Treasury+yields+tumble http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02102015-credit-peripherals-buck-trend-treasury-yields-tumble.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}