Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 02, 2016

UK construction downturn eases in August

UK construction activity fell for a third successive month in August as the industry goes through its toughest spell since 2009. While the sector saw a welcome easing in the rate of decline, uncertainty about the impact of Brexit remains widespread and confidence low by historical standards.

The rise in the construction PMI nevertheless adds to the welcome news provided by yesterday's rebound in the manufacturing PMI to suggest that the risk of imminent recession has fallen considerably. Monday's services PMI will of course be key to gauging the health of the overall economy and any immediate threat of recession or rebound. We also need to wait and see the extent to which August's rebound in the PMI can be sustained in coming months.

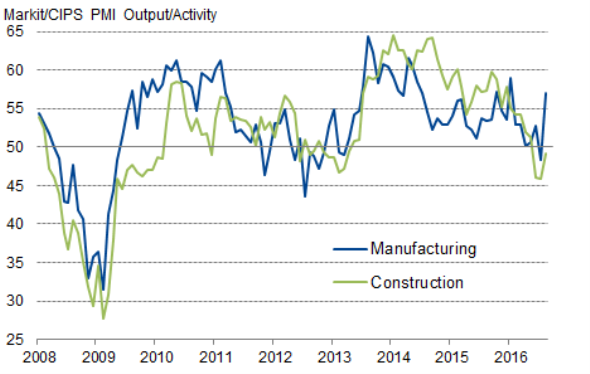

Construction and manufacturing PMIs

The Markit/CIPS Construction PMI rose from 45.9 in July, a low not seen since June 2009, to a three-month high of 49.2 in August. However, the average reading of 47.0 seen over the past three months is the weakest since the final quarter of 2009, during the global financial crisis.

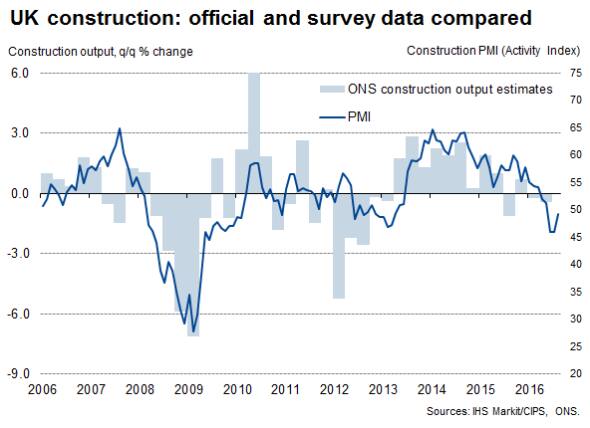

With official data already showing construction to have been in recession in the first half of the year, the PMI suggests that the sector will have continued to contract in the third quarter, acting as a drag on the wider economy.

House building and commercial activity (such as offices, industrial units and retail space) both fell for a third straight month, though rates of decline eased. Civil engineering meanwhile stabilised after July's marked decline.

New orders fell for a fourth month running, though likewise saw the rate of decline moderate as client confidence recovered somewhat compared to July.

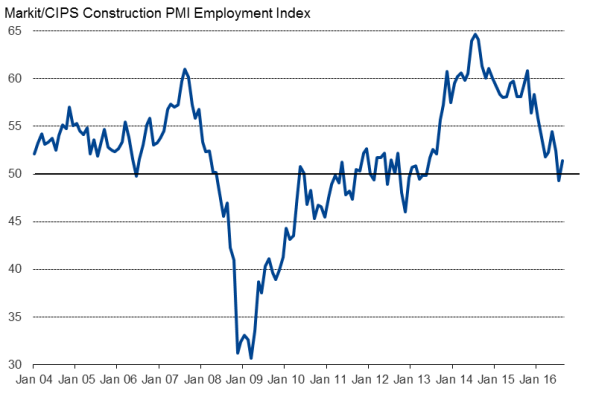

While employment returned to modest growth, the rate of hiring is a shade of that seen in prior years, linked partly to still-weak confidence about the outlook.

Construction employment

The survey also brought more worrying news on inflation, with both manufacturing and construction now reporting the highest rate of growth of input costs for five years, as the weaker pound pushes up the cost of imported materials.

Cut through the noise and volatility of the past few months and the overall picture is one of the construction sector in a moderate downturn, and its disappointing performance so far in 2016 is a far cry from the solid growth seen throughout much of the prior three years. Profits will also be coming under pressure from the combination of weak demand and rising costs. However, August's construction and manufacturing PMI survey results provide encouraging news that any immediate hit to the economy from the uncertainty caused by the EU referendum may be more limited than previously feared.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-economics-uk-construction-downturn-eases-in-august.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-economics-uk-construction-downturn-eases-in-august.html&text=UK+construction+downturn+eases+in+August","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-economics-uk-construction-downturn-eases-in-august.html","enabled":true},{"name":"email","url":"?subject=UK construction downturn eases in August&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-economics-uk-construction-downturn-eases-in-august.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+construction+downturn+eases+in+August http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02092016-economics-uk-construction-downturn-eases-in-august.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}