Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Aug 02, 2017

Trump's Wall Street rally rings hollow

Dow Jones hits all-time highs based on shares with international exposure

- Since the election, firms with more offshore sales outperform the market

- Tech shares are most likely to have greater foreign exposure

- Short sellers less skeptical of internationally-exposed stocks

President Donald Trump believes his political turmoil has no bearing on US stocks - this claim rings hollow, as data shows that firms with greater offshore sales have performed better since the election. Naturally, these shares offer a hedge against the domestic uncertainty which defines the Trump era.

Change of Heart

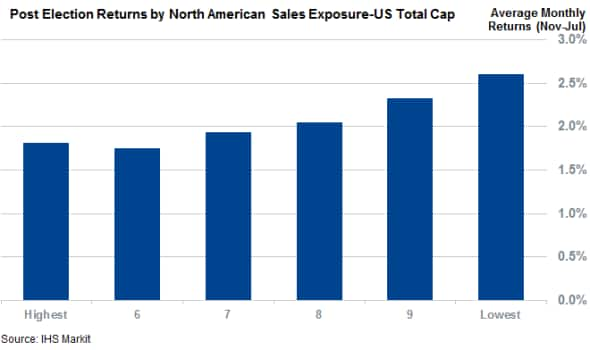

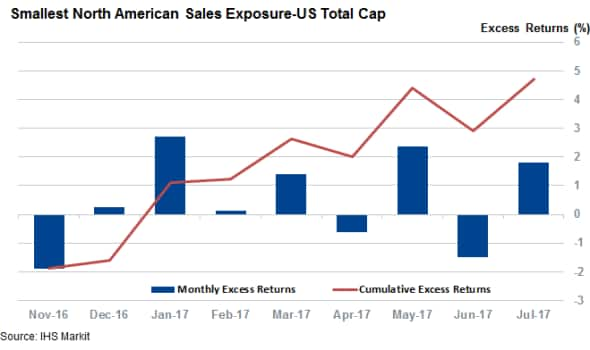

In the weeks following the election, investors preferred shares with low overseas exposure. The top 10% of US shares by international revenue underperformed their market peers by 1.9% in November; however, this was only a momentary setback, and internationally-exposed shares have since recovered all lost ground.

Since December 2016, US shares with the largest portion of overseas revenue returned a monthly average of 2%, according to IHS Markit Research Signals. Compared with the majority of constituents from the IHS Markit Research Signals US Total Cap list - which derive the entirety of their revenues domestically - these returns are more than double.

For four of the six subsequent months, overseas-exposed US stocks have outperformed the market by a combined 4.6%.

The desire to gain shelter from a turbulent domestic environment isn't the only likely tailwind for US cosmopolitan stocks. The falling dollar has made export-dependent companies more competitive, and boosted the value of foreign profit streams.

Tech less exposed

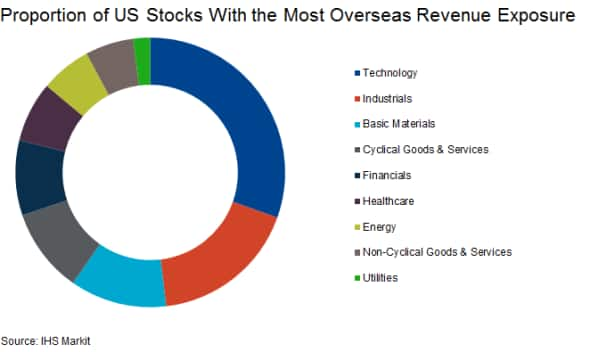

Tech firms have disproportionally benefited from overseas exposure; they are heavily represented among the group of US shares that derive the most revenue from outside North America.

In fact, there are 105 tech firms represented in the latest sector rankings - 44 more than industrials, which are the second most represented sector.

Materials firms, such as chemical and aluminum producers, complete the three sectors most likely to draw revenues from overseas.

Short sellers taking part

Short sellers haven't been willing to take on the other side of the rally - they have a lower than average exposure among internationally-exposed shares.

While only 10% below the overall universe of shorts, this positioning is significant. It indicates the rally over the last few months may still have legs, and has so far failed to attract skepticism of a perceived bubble market.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082017-equities-trump-s-wall-street-rally-rings-hollow.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082017-equities-trump-s-wall-street-rally-rings-hollow.html&text=Trump%27s+Wall+Street+rally+rings+hollow","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082017-equities-trump-s-wall-street-rally-rings-hollow.html","enabled":true},{"name":"email","url":"?subject=Trump's Wall Street rally rings hollow&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082017-equities-trump-s-wall-street-rally-rings-hollow.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trump%27s+Wall+Street+rally+rings+hollow http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02082017-equities-trump-s-wall-street-rally-rings-hollow.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}