Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

CREDIT COMMENTARY

Jun 02, 2016

Brexit fears jolt sterling bond liquidity

As the UK's EU referendum approaches, associated uncertainty has seen risk in the sterling corporate bond market rise, with liquidity taking a blow.

- Sterling corporate bonds have seen credit spreads underperform euro peers so far this year

- Sterling corporate bond liquidity deteriorated in March, at the height of Brexit fears

- But current sterling bond liquidity metrics are stronger than this time last year

Sterling denominated corporate bonds saw risk rise significantly at the beginning of the year amid heightened market volatility. This was compounded by Brexit fears, which also negatively affected liquidity in the market.

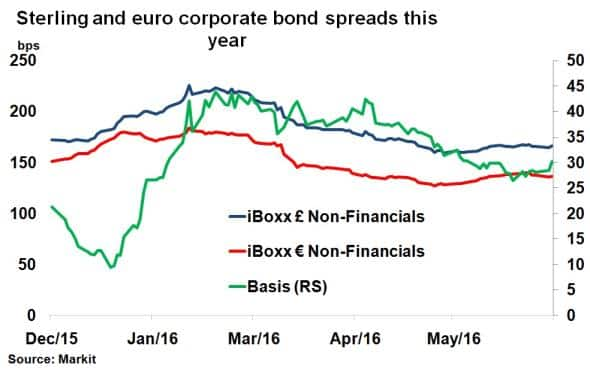

The Markit iBoxx " Non-Financials index saw its index spread (interest over gilts) widen to over 220bps in February, from 172bps at the start of the year. Likewise, euro denominated corporate bonds also saw risk rise at the beginning of the year as market volatility gripped markets. This also coincided with growing Brexit fears, which resulted in sterling corporate bonds spreads underperforming euro denominated counterparts.

This underperformance was evidenced by the widening basis between the spread on the Markit iBoxx " Non-Financials index and the Markit iBoxx " Non-Financials index so far this year. The past few months has however seen the probability of a Brexit diminish, and the basis has tighten but remains at 30bps, from just 9bps in January.

Sterling corporate bond liquidity

The heightened risk in sterling denominated corporate bonds, and underperformance versus their euro denominated peers has also coincided with a deterioration in liquidity metrics.

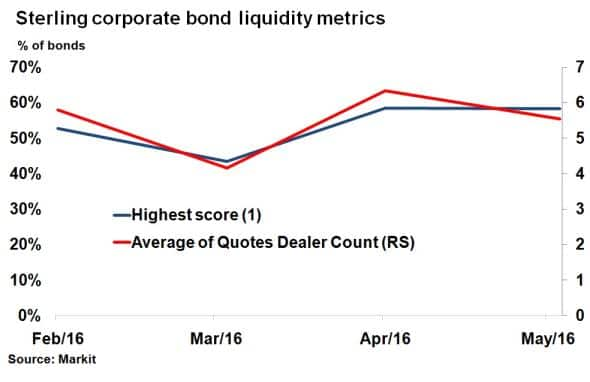

Taking the constituents of the Markit iBoxx " Non-Financials index, Markit's liquidity metrics show deterioration in March before a bounce as Brexit fears eased in April and May. The average number of dealers quoting sterling corporate bonds fell to 4.1 in March, before rebounding to 6.3 in April. Apart of the liquidity metrics is the Markit liquidity score, a broader measure which takes into account bid/ask spreads, maturity and number of sources, which saw numbers worsen. The number of sterling corporate bonds ranked with a liquidity score of 1 (1 being the highest and 5 being the lowest) dropped to 43% in March before climbing to 58% in April and May.

Stronger this year

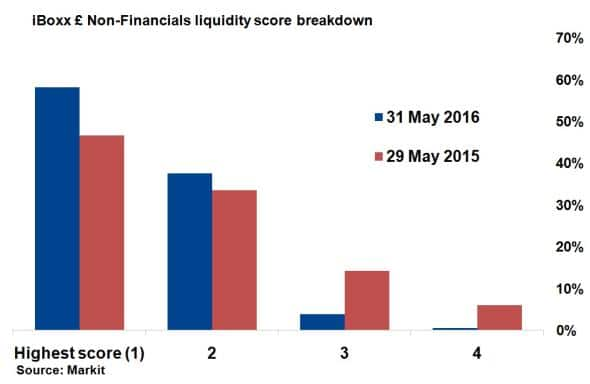

Despite concerns over potential Brexit induced volatility, liquidity metrics show an improvement year over year in the sterling corporate bond market. This is welcomed since the last few years have seen liquidity in the sterling corporate bond market get weaken.

In May last year, 47% of the constituents of the Markit iBoxx " Non-Financials index had a liquidity score of 1, compared to 58% currently, suggesting improvement year over year.

Neil Mehta | Analyst, Fixed Income, Markit

Tel: +44 207 260 2298

Neil.Mehta@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062016-Credit-Brexit-fears-jolt-sterling-bond-liquidity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062016-Credit-Brexit-fears-jolt-sterling-bond-liquidity.html&text=Brexit+fears+jolt+sterling+bond+liquidity","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062016-Credit-Brexit-fears-jolt-sterling-bond-liquidity.html","enabled":true},{"name":"email","url":"?subject=Brexit fears jolt sterling bond liquidity&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062016-Credit-Brexit-fears-jolt-sterling-bond-liquidity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Brexit+fears+jolt+sterling+bond+liquidity http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02062016-Credit-Brexit-fears-jolt-sterling-bond-liquidity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}