Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 02, 2015

Most shorted ahead of earnings

A review of how short sellers are positioning themselves in companies due to announce results in the coming week.

- Low oil prices continue to take toll as American transport firm Greenbrier most shorted

- Possible end to short selling spree for Quindell with short interest at 52 week low

- Japanese retailers are the most heavily shorted firms in Asia

North America

The most short sold company in North America ahead of earnings this week is Greenbrier which manufactures and supplies railroad freight-cars and equipment. Short interest in Greenbrier has increased three fold in the last 12 months to reach 29% of shares outstanding on loan.

After outperforming the general US market in 2014, the transport sector has continued to lose momentum in 2015 post the collapse in the oil prices. Greenbrier specifically cites in a 2014 presentation that the shale oil and gas revolution was a driver of growth in railcar demand. It comes as no surprise that the company sees increasing bearish sentiment as the energy industry cuts capital investment to address the slump in oil price.

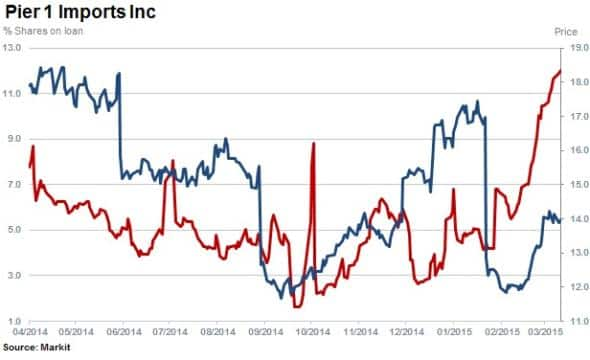

Pier 1 Imports sees second highest short interest in the region after seeing shares outstanding double in the last month to 12%. The increase occurred as the home d"cor importer revised financial guidance lower for the year after experiencing softer sales and higher expenses in the first two months of the year.

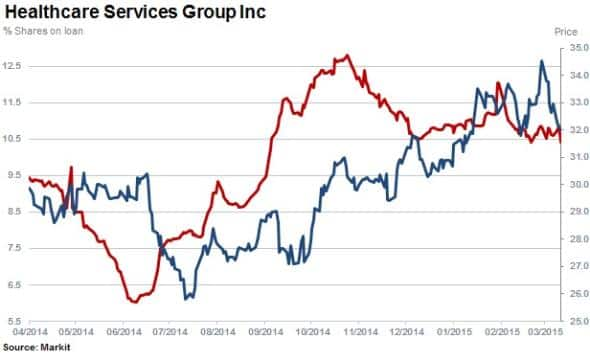

Third most short sold ahead of earnings is Healthcare Services Group with 11% of shares outstanding on loan. The company's shares have rallied by 20% in the last six months but short sellers have largely held the course as short interest have been roughly flat over that period of time.

Finally Alcoa, the traditional harbinger of the earnings season, enters this first quarter earnings season with 2.1% of shares out on loan. This marks a recent low for the company, despite the fact that its shares are down by over 15% for the year to date.

Western Europe

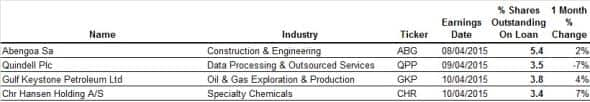

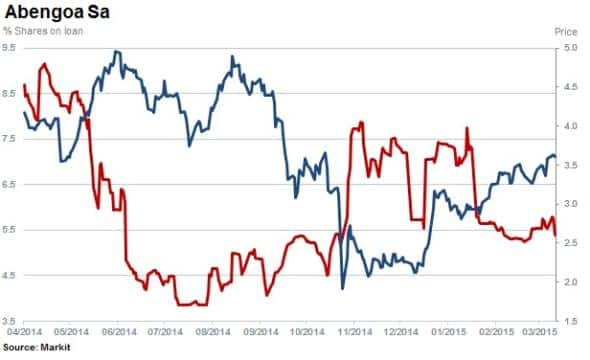

Most shorted in Europe this week ahead of earnings is Spanish construction and engineering firm Abengoa which currently has 5.4% of shares outstanding on loan.

Since the middle of November Abengoa's shares have rebounded by 88% as the firm reassured bond investors about the security offered on the company's green bonds. The share price recovery has seen shorts cover from recent highs in October.

Trade in Quindell's shares was halted for six hours of trade on April 1st 2015 after the beleaguered firm triggered a suspension by incorrectly accounting for the quantum of profits in a business it recently sold to Australian law group Slater & Gordon.

The sale effectively leaves little left in the business after selling 94% of profits in the deal. As the Quindell saga slowly comes to an end, shares outstanding on loan have decreased by 40% to 3.5% and the stock has decreased 76% over the last year after being a consistent target for short sellers.

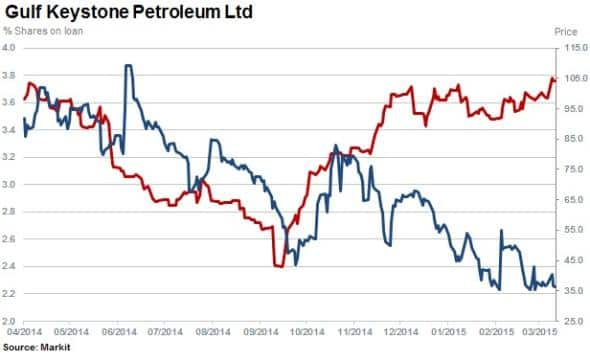

Rounding out the light earnings week is Gulf Keystone whose short interest has climbed to 3.8% after its shares plummeted. The oil and gas exploration and production firm has attracted short sellers as global oil prices collapsed and remain depressed.

Asia Pacific

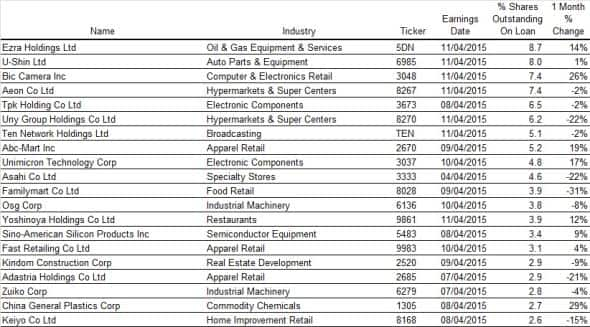

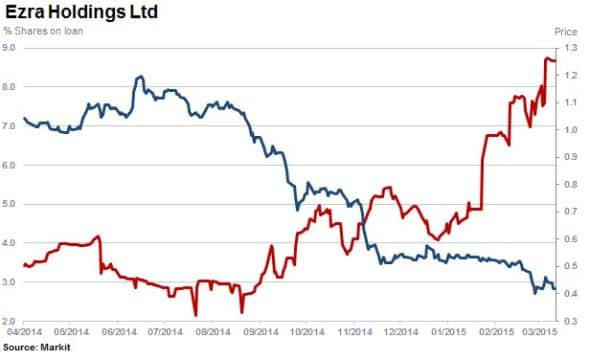

Most shorted ahead of earnings in Apac is Ezra Holdings which has seen a 14% increase in short interest over the last month to 8.7% of shares outstanding. This is over twice the levels seen only a year ago.

The Singapore based firm provides offshore support and solutions to the oil and gas industry. Ezra now has 70% of the shares which can be lent out to short sellers out on loan, meaning short sellers will find it increasingly hard to add to their positions.

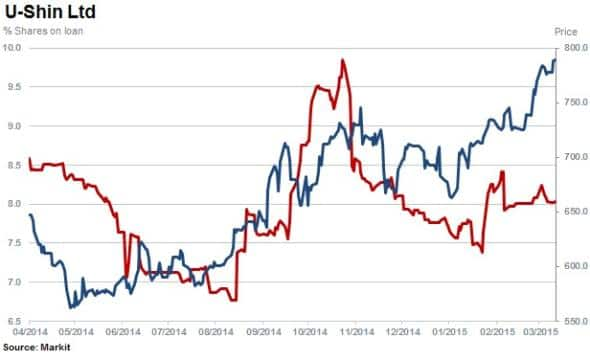

In recent weeks, short sellers have returned to Japanese industrial and automotive component manufacturer U-shin. The company's stock price has risen by 25% in the last 12 months. Short sellers covered their positions in November last year but have since returned as U-Shin share price hit a new annual high.

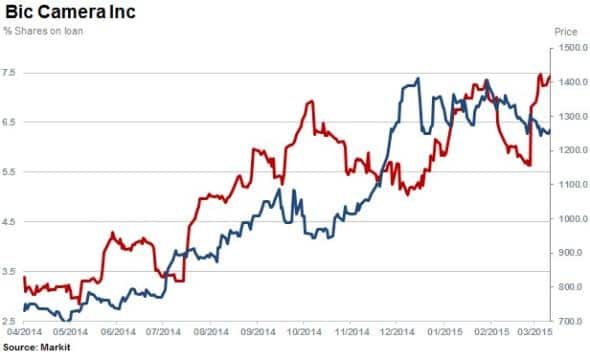

Audio visual retailer Bic Camera has seen steady increases in both short interest and its share price over the past 12 months. Shares outstanding on loan have more than doubled to 7.4% while its stock price has increased by 92%. The company is expected to report lower revenue and earnings growth for the year ending August 2015 according to consensus forecasts; something which short sellers have been anticipating.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-equities-most-shorted-ahead-of-earnings.html&text=Most+shorted+ahead+of+earnings","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"email","url":"?subject=Most shorted ahead of earnings&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-equities-most-shorted-ahead-of-earnings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Most+shorted+ahead+of+earnings http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02042015-equities-most-shorted-ahead-of-earnings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}