Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 02, 2015

Apac ETFs enjoy record high $250bn AUM

As the assets managed by Apac-focused ETFs reach an all-time high, individual investors have remained cautious of high risk names.

- Record high inflows send Japanese ETFs' AUM higher, surpassing $160bn

- The Apac region excluding Japan has also seen strong inflows, pushing the AUM mark past $78bn

- Investors are still avoiding the riskiest names in the region; firms whose CDS spreads have widened the most have seen negative returns

ETF Investors backing Abenomics

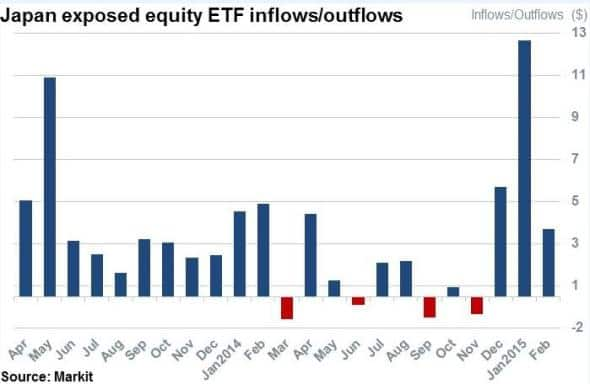

While the Bank of Japan (BoJ) attempts to inflate prices and stimulate growth, fund inflows into Japanese ETFs reveal that ETF investors are pinning their hopes on Abenomics' success as record inflows propel equity AUM to reach all-time highs of $160bn.

Investors however may have to exercise some patience as oil's price decline has effectively cancelled out the recent inflationary effects of the expansionary monetary policy efforts of the BoJ. The Nomura Nikkei 225 Stock Index Listed Fund ETF is the largest ETF exposed to Japan by AUM, representing approximately 14% of the total AUM. The fund has rewarded investors so far as NAV has increased by 29% in the last 12 months alone.

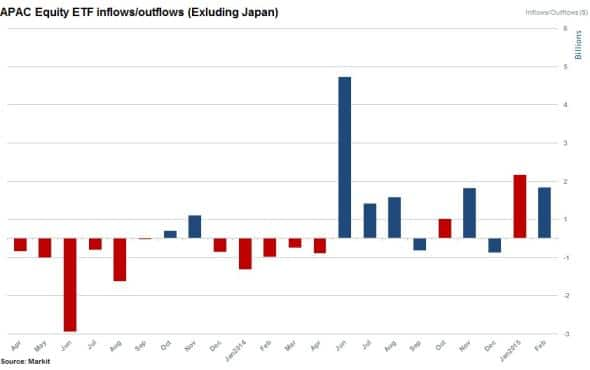

While the Japanese ETF market has seen almost two years of relentless fund inflows, the Apac region in general has witnessed strong inflows over the last 12 months with AUM approaching $80bn. In 2015 total Apac ETF AUM surged towards $250bn; representing 9% of all global exchange traded products.

Apac investment signals

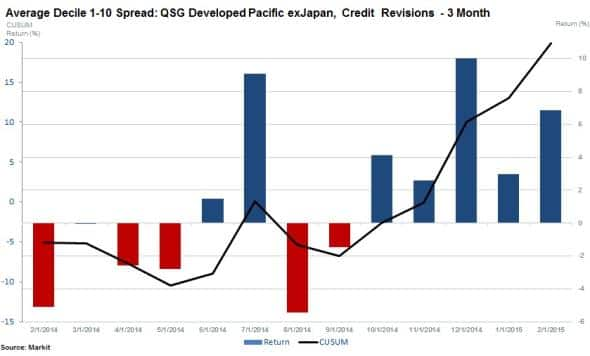

Analysis of Markit's Research Signals factor returns for February 2015 reveals that investors are still not in full risk on mode as evident by the strong negative returns of the worst ranked companies in the Credit Revisions - 3 month factor.

Equity investors have been taking some signals from credit markets as demonstrated by the performance of the Credit Revisions - 3 Month factor. The factor analyses the change in CDS spread levels over the previous three months to determine the changing view of credit risk priced in by the credit market.

In February, investors who were short the worst ranked stocks in the tenth decile (relatively less credit worthy names)and long the first decile of stocks in the universe would have yielded a healthy monthly return of 6.8%. Analysing the factor's last 12 months of returns reveals an average monthly return spread of 1.5%. The factor has also had a particularly strong past five months, seeing a cumulative return of 26% - raising the 12 month cumulative return to 19.8%.

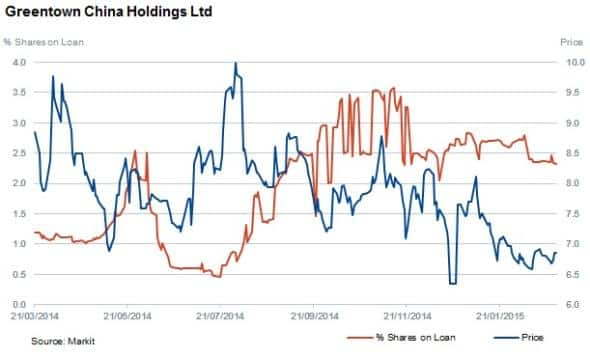

Analysing single names within the tenth decile of the factor rankings reveals that there is currently a large concentration of Chinese property firms. One of these names, which are currently the most shorted of the tenth decile, is Greentown China holdings. The company develops real estate including residential villas and apartments. The company's shares have declined by 30% over the last 12 months, with shares out on loan peaking at 3.5% in 2014. Short sellers have since covered slightly, with shares out on loan hitting 2.3% at present.

The Chinese property market continues to show weakness as signs of a slowdown in 2014 continue into 2015. Oversupply and dwindling demand have resulted in prices falling and market participants calling for an end to urbanisation.

Relte Stephen Schutte | Analyst, Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-equities-apac-etfs-enjoy-record-high-250bn-aum.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-equities-apac-etfs-enjoy-record-high-250bn-aum.html&text=Apac+ETFs+enjoy+record+high+%24250bn+AUM","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-equities-apac-etfs-enjoy-record-high-250bn-aum.html","enabled":true},{"name":"email","url":"?subject=Apac ETFs enjoy record high $250bn AUM&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-equities-apac-etfs-enjoy-record-high-250bn-aum.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Apac+ETFs+enjoy+record+high+%24250bn+AUM http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-equities-apac-etfs-enjoy-record-high-250bn-aum.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}