Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 02, 2015

Global factory activity growth hits four-month high

Activity in the world's factories picked up in February, growing at the fastest rate since last October. The J.P.Morgan Manufacturing PMI, compiled by Markit from its business surveys, rose further from December's 16-month low, up for a second successive month from 51.7 in January to 52.0 in February.

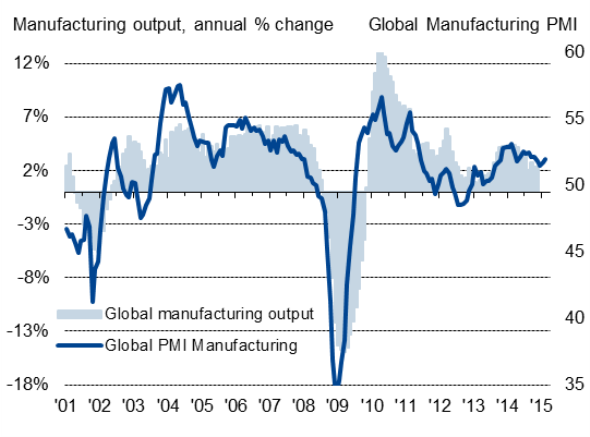

Global manufacturing output

The PMI was bolstered by output growing at the fastest rate since last August. The survey's Output Index is running at a level broadly consistent with global factory production rising at an annual rate of almost 3%. However, such growth remains disappointing by historical standards, especially pre-global crisis. Furthermore, new order growth was unchanged on the relatively lacklustre pace seen in January, held back by near-stagnant exports. The latter points to weak global trade flows.

Employment growth was also unchanged, with global manufacturing job creation remaining stuck at the disappointingly meagre pace seen throughout much of the last year.

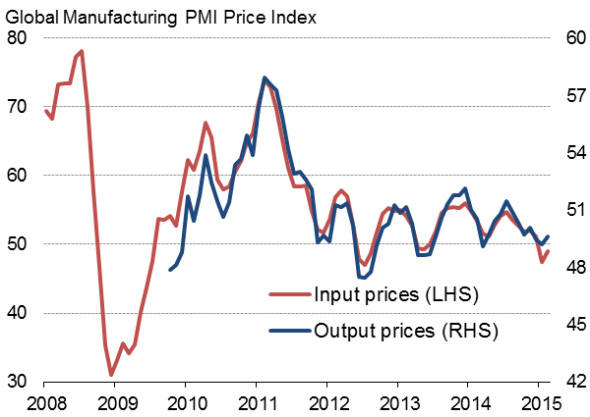

Deflationary pressures ease

Average input costs meanwhile fell for a second successive month, though the decline was only modest and less than the decrease seen in January. Output prices also fell, down for a third month running, but the rate of decline likewise eased.

The easing in the rate of decline of input and selling prices suggests that global deflationary pressures, fueled by the 50% drop in the price of oil since the middle of last year, weakened during the month.

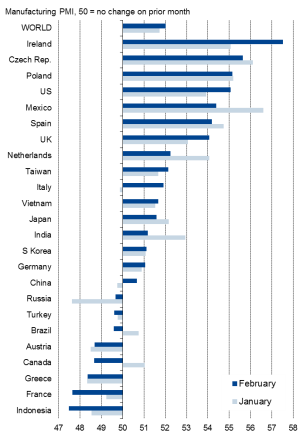

Ireland heads growth rankings

Activity rose in 16 countries while eight others saw manufacturing downturns in February. Ireland reclaimed the top spot, displacing Mexico, followed by the eastern European economies of the Czech Republic and Poland.

Manufacturing PMI ranking

The US moved back up to fourth place and the UK to seventh position - the large relative sizes of these economies, especially the former, serving as a major source of global manufacturing growth once again.

The worst performance was seen in Indonesia, where the PMI hit a record low. Elsewhere in Asia, the PMI surveys also provided little in the way of encouraging news for manufacturers. Growth slowed to a seven-month low in Japan, while China saw ongoing near-stagnation (albeit with the PMI lifting above the 50.0 no change level for the first time since October). Only meagre growth was meanwhile seen in India, South Korea, Vietnam and Taiwan.

The divergence of growth trends in the euro area was again highlighted by a deepening downturn in France contrasting with Ireland's growth spurt.

Canada, hit by falling global commodity-related activity, was also notable in seeing a steep deterioration in February, its first decline since March 2013 and contrasting with the robust expansion seen in the United States, where growth reached a four-month high.

Manufacturing PMI

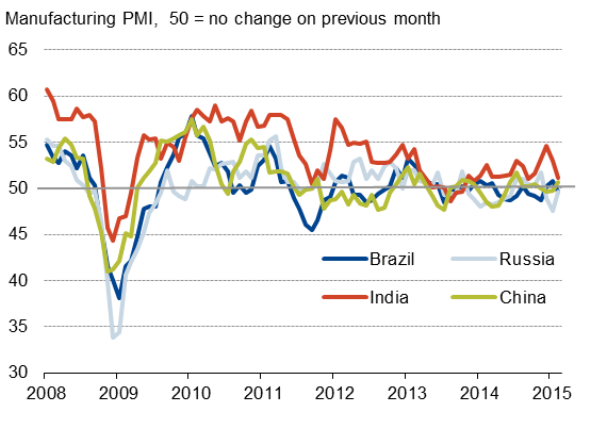

Emerging markets

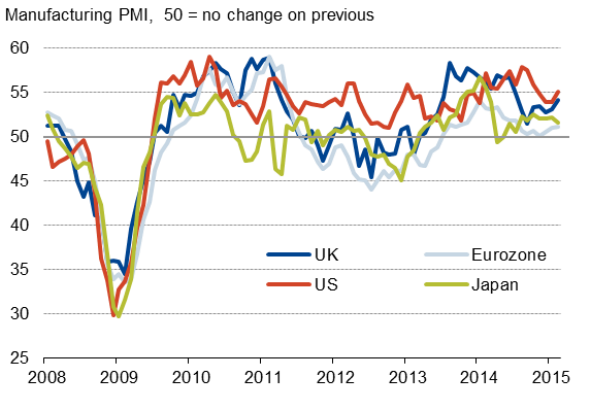

Developed world

Factory prices

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Global-factory-activity-growth-hits-four-month-high.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Global-factory-activity-growth-hits-four-month-high.html&text=Global+factory+activity+growth+hits+four-month+high","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Global-factory-activity-growth-hits-four-month-high.html","enabled":true},{"name":"email","url":"?subject=Global factory activity growth hits four-month high&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Global-factory-activity-growth-hits-four-month-high.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+factory+activity+growth+hits+four-month+high http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f02032015-Economics-Global-factory-activity-growth-hits-four-month-high.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}