Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 01, 2016

China manufacturing recovery accompanied by rising price pressures

China's manufacturers are enjoying their best quarter for over three-and-a-half years, but are also facing sharp rises in input prices due to surging raw material costs.

The Caixin General Manufacturing PMI for China, compiled by Markit, dipped slightly from 51.2 in October to 50.9 in November. However, with the index down only marginally from what was a 27-month high in October, the survey is indicating that the manufacturing sector is enjoying its best performance for just over three-and-a-half years so far in the fourth quarter.

November saw both production and new orders grow at slower rates than October, but in each case the rate of expansion was the second-highest since July 2014.

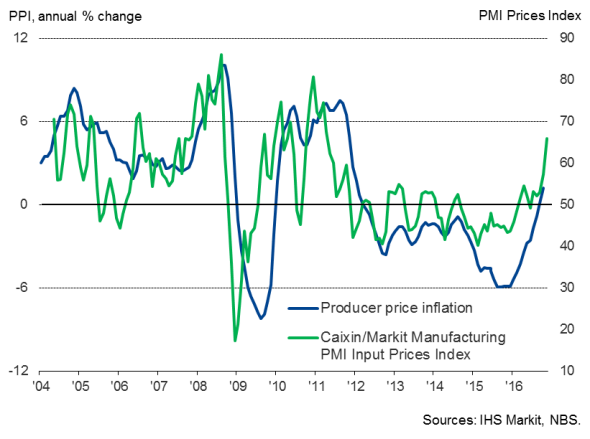

Chart 1: Producer prices

Price hikes

While the November survey showed welcome signs of the manufacturing economy continuing to revive from the malaise seen through 2015 and the first half of 2016, the data also highlighted the extent to which the manufacturing revival has been accompanied by rising prices.

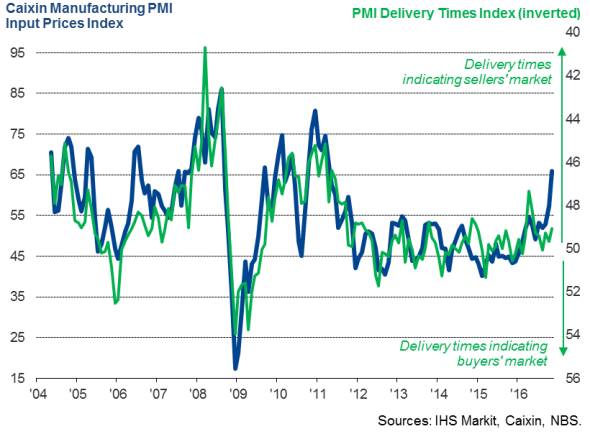

Chart 2: Manufacturing prices & capacity constraints

The November PMI survey saw manufacturers' input costs surge higher, showing the largest monthly increase since March 2011 (see chart 1). By contrast, input prices had been falling sharply at the start of the year, when production had also been in decline.

Firms are having increasing success in passing these higher costs on to customer, in many cases made easier by the upturn in demand. Average prices for goods leaving the factory gate rose sharply in November, increasing at the steepest rate since February 2011.

Chart 3: Consumer price inflation & capacity constraints

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-economics-china-manufacturing-recovery-accompanied-by-rising-price-pressures.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-economics-china-manufacturing-recovery-accompanied-by-rising-price-pressures.html&text=China+manufacturing+recovery+accompanied+by+rising+price+pressures","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-economics-china-manufacturing-recovery-accompanied-by-rising-price-pressures.html","enabled":true},{"name":"email","url":"?subject=China manufacturing recovery accompanied by rising price pressures&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-economics-china-manufacturing-recovery-accompanied-by-rising-price-pressures.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+manufacturing+recovery+accompanied+by+rising+price+pressures http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122016-economics-china-manufacturing-recovery-accompanied-by-rising-price-pressures.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}