Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Oct 01, 2014

High fees low returns in Asia

Asian shares which command the highest fees to short sell have continued to underperform the rest of the market over the summer months.

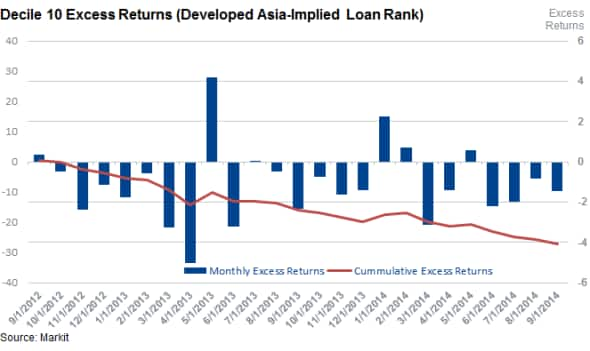

- Developed Asian shares which cost the most to short have underperformed the rest of the market by a cumulative 27% in the last two years

- Hong Kong firms are the most targeted by short sellers willing to pay a premium to borrow their shares

- Japanese firms make up the majority of the ten companies with the largest short interest amongst the expensive to borrow group

Fees charged to short shares are one of the many areas of the securities lending market that prove cumbersome for

non industry participants to measure. This single number accounts for factors such as demand to borrow a security and the availability of that instrument in lending programs. As such, shares which command the highest fee to borrow in the securities lending market can be inferred to be the subject of the most negative investor sentiment.

Revisiting our Asian fee note we put out in April, we see that the shares which command the highest borrow fee in the securities lending market (those with the most negative sentiment) have continued to underperform since the spring. This note is based on the Markit Research Signal Implied Loan Rate factor, which is based on the Markit Securities Finance indicative loan fee which measures the cost charged to hedge funds to sell a share short.

Expensive to short shares underperform

The top 10% most expensive shares to short in the Markit Developed Pacific universe have underperformed the market by a cumulative 27% in the 24 months leading to the end of March. This builds on a trend uncovered in April, by which point the companies in the most expensive to short group had underperformed the market by 19.6%.

The summer looks to have been profitable for Asian short sellers, as the shares in the most expensive to borrow group have underperformed for each of the last four months. While no one month stands out in the latest string of underperformance, the factor has uncovered an average 1.5% of monthly underperformance across the 190 or so firms which make up the most shorted group.

This performance is only relative however, as shares in the most expensive group still managed to notch up a positive average monthly return of 0.78%. This average monthly performance is over 50bpslower than that seen among the shares in the second least shorted group.

Hong Kong shares most expensive

Looking at the composition of the most shorted 10th decile group, Hong Kong-based shares make up the greatest proportion. There are currently 70 Hong Kong domiciled shares in the most shorted 10th decile group, over 50% more than the second most represented country, South Korea.

Real Estate continues to be a popular sector in this particular market as evident by the fact that the area is joint first among most represented Hong Kong firms in the 10th decile. This is led by short favourite Evergrande which has seen shorts redouble in the last few months. The firm now has the second most bearish rank and has seen demand to borrow rise to more the 10.3% of its shares outstanding over summer. On a performance basis, the firm looks to have made a good short, as its currently down by nearly a quarter since April.

The other sector to see six Hong Kong firms in the most shorted group, Pharmaceuticals, is led by Bloomage Biotechnology and United Laboratories among the most shorted names.

Japanese firms also see heavy shorting

Of the companies in the most expensive to borrow group, those domiciled in Japan are the most likely to feature among the companies with the highest aggregate short interest as measured by the proportion of shares out on loan.

Six of the top ten most shorted firms in the most expensive to borrow group are domiciled in the country. This includes tech firm Gree, the most shorted company in the expensive to borrow group, as well as retailer Sanrio which has just under 14% of shares out on loan.

Simon Colvin | Research Analyst, Markit

Tel: +44 207 264 7614

simon.colvin@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-equities-high-fees-low-returns-in-asia.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-equities-high-fees-low-returns-in-asia.html&text=High+fees+low+returns+in+Asia","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-equities-high-fees-low-returns-in-asia.html","enabled":true},{"name":"email","url":"?subject=High fees low returns in Asia&body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-equities-high-fees-low-returns-in-asia.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=High+fees+low+returns+in+Asia http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01102014-equities-high-fees-low-returns-in-asia.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}