Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Sep 01, 2015

China shaves European dividends

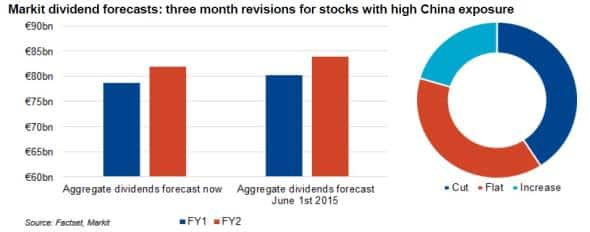

Three months of tumultuous and declining equity markets in China,has led Markit Dividend Forecasting to trim €1.5bn off expected dividends for European firms with high sales exposure to China.

- Total dividends from firms with material sales exposure still to grow to €78.7bn

- Anglo American's and Glencore's maintenance of dividend payments among those at risk

- German auto makers and European banks face large sales exposure

To receive the full report, please contact us. Recently released PMI data indicates that operating conditions in China have deteriorated by the fastest rate in over six years. Weak PMI data accompanies slowing economic growth with Chinese regulatory agencies battling to shore up slumping equity markets.

Dividends trimmed

Markit Dividend Forecasting has lowered forecasts for European blue chips with material exposure to China. Across companies in the EuroStoxx50, SMI and FTSE 100, Markit Dividend Forecasting has reduced expected payments from the region by €1.5bn for the next financial period.

Despite downward revisions of 40% of companies within this group over the past three months, year-on-year expected dividend growth remains healthy at 7.5% with two thirds of firms expected to see an increase.

In total, Markit Dividend Forecasting expects €78.7bn in dividends for the current fiscal year up from €73bn last year.

Antofagasta, Standard Chartered and Reckitt Benckiser are expected to reduce their dividends. All have already confirmed cuts. Ten stocks are expected to maintain flat payments and are viewed most at risk. Notably mining giants, Glencore, Anglo American and BHP Billiton all now have forecast yields of over 7%.

Basic resources hurting

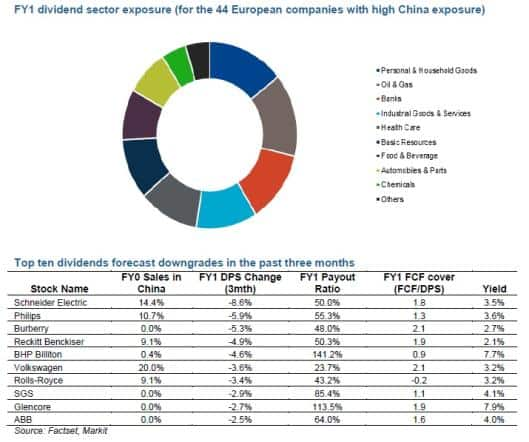

Unsurprisingly, basic resource companies are among the most exposed to the Chinese economy. Commodities prices have fallen strongly in the past few months, mainly due to lower Chinese demand. Several European companies within EuroStoxx 50, SMI and FTSE 100) have significant sales exposure to China.

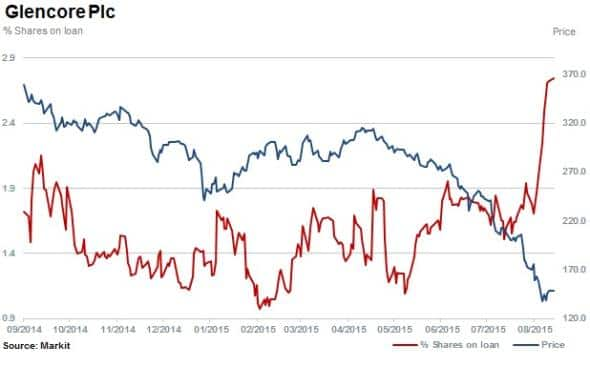

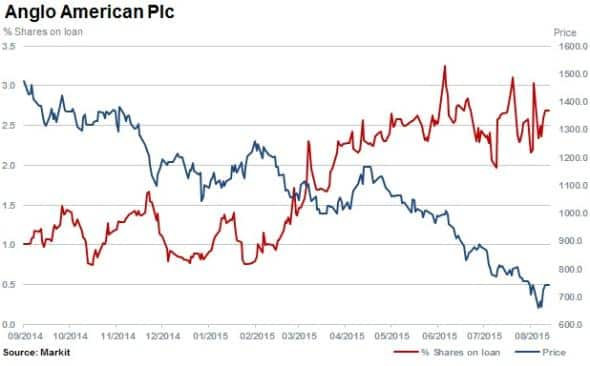

Strong balance sheets and capital expenditure cuts should sustain dividends at Rio Tinto and BHP Billiton. However, dividends for Anglo American and Glencore's are less certain with their stock prices trading dramatically lower in recent months.

Falling commodity markets have attracted increased short interest to both stocks, showing a spike in short interest in the past three months.

German automakers

Volkswagen and BMW have exposure to China of 20% and 18% respectively. The largest auto dividend payer Daimler has the lowest Chinese exposure at 10%. Management at all three companies are cautious about China in coming months. However, cash flows and balance sheets remain strong with limited downside to dividends expected.

Estimates for Schneider Electric and Philips have been revised 5% lower following lower earnings expectations. For Philips (11% of sales in China), no dividend growth is expected this year and even with a flat payment this represents a payout ratio ahead of target.

ABB has not cut its dividend distribution since 2006 and has increased its dividend during periods of volatile earnings. China represents 13% of the revenues and the company announced in July that orders declined 4%, reflecting a challenging market and weaker demand in oil and gas in China and the US.

ABB says it will concentrate on portfolio optimisation. The company paid out approximately 55%-63% of its profits for the last four years by increasing its dividend in the range of 2%-8%. Therefore another dividend increase of 2% is expected reflecting a payout ratio of 67%.

Standard Chartered and HSBC have the biggest exposure to China in terms of sales (including Hong Kong) at 42% and 28%, respectively. Standard Chartered recently cut its dividend by 50% due to lower earnings. The bank does substantial business in Asian emerging markets. In addition its recently announced restructuring could take more time in light of disappointing PMI figures.

Uncertainties are growing about HSBC's progressive dividend policy. But the firm's focus on reducing costs while growing capital is likely to support a dividend payout ratio of c.60%.

Consumer and Luxury goods companies are expected to keep delivering stable dividend growth, despite the China slowdown. Companies in this sector are relatively well diversified, have robust free cash flows and healthy balance sheets.

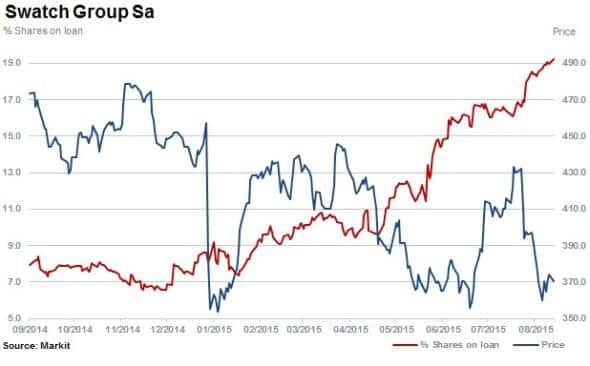

Swatch has cut its dividend only once, by 6% in FY09, when the earnings dropped by almost 63%. The firm has a progressive dividend policy and in FY14, the dividend was held flat with a payout ratio of 30% as earnings declined by 27%.

34% of Swatch's revenues are generated in China and given the probability of a deteriorating situation in that region, Markit Dividend Forecasting has maintained expectations in line with last year's distribution.

While Swatch's dividend payment may indeed be maintained, short sellers have been quick to voice their opinions on the firm's exposure to Chinese consumers.

Relte Stephen Schutte, Analyst at Markit

Tel: +44 207 064 6447

relte.schutte@markit.com

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-equities-china-shaves-european-dividends.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-equities-china-shaves-european-dividends.html&text=China+shaves+European+dividends+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-equities-china-shaves-european-dividends.html","enabled":true},{"name":"email","url":"?subject=China shaves European dividends | S&P Global &body=http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-equities-china-shaves-european-dividends.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+shaves+European+dividends+%7c+S%26P+Global+ http%3a%2f%2fwww.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01092015-equities-china-shaves-european-dividends.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}