January 22, 2016 - Weekly Pricing Pulse

Commodity bears have taken prices to new lows in early 2016. If trends continue, valuable concessions can be obtained over coming weeks.

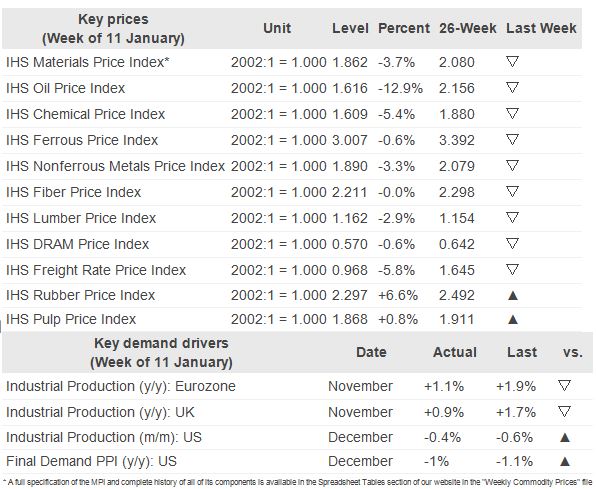

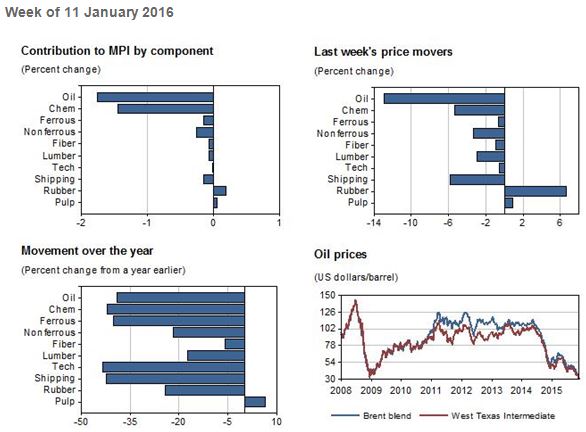

Despite showing some optimism towards the end of 2015, 2016 is off to a brutal start across commodity and financial markets. Last week the MPI recorded its second consecutive decline of the year, falling by 3.7%. The index is now down by 4.5% since the beginning of the year, taking the figure back to the lows of December 2003. The negative momentum mostly came from oil, which saw a near 13% decrease, while chemicals were knocked back by more than 5%. There was some very limited support from rubber and pulp. Otherwise, ferrous metals appear to be holding up better, having only decreased slightly—following four consecutive gains in recent weeks.

The drop in oil grabbed the headlines, as the timing of Iran's oil production ramp-up seems to have come as a surprise. This news was one of the primary drivers taking crude prices to below $30/barrel. Shanghai financial markets continued to fall, along with drops on Wall Street. Furthermore, the prospect of sustained renminbi weakness also weighed on commodity demand expectations.

Even though low oil prices have traditionally been interpreted as providing a boost to the real economy, the decline of commodity and energy-related stocks has resulted in a near 10% fall in the S&P 500 during the course of 2016 alone. Looking ahead, Chinese GDP and industrial production numbers are coming out this week, thus exposing commodity markets to even more weakness in case the data disappoints.

Industrial Materials: Prices

Key Prices & Demand Drivers