November 25, 2016 - Weekly Pricing Pulse

Underlying volatility was muted, as the oil and ferrous subindexes exhibit restraint following several weeks of exceptional activity.

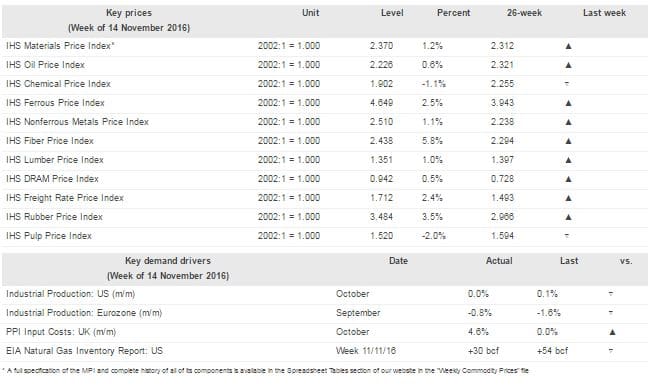

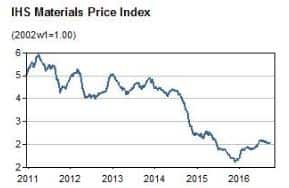

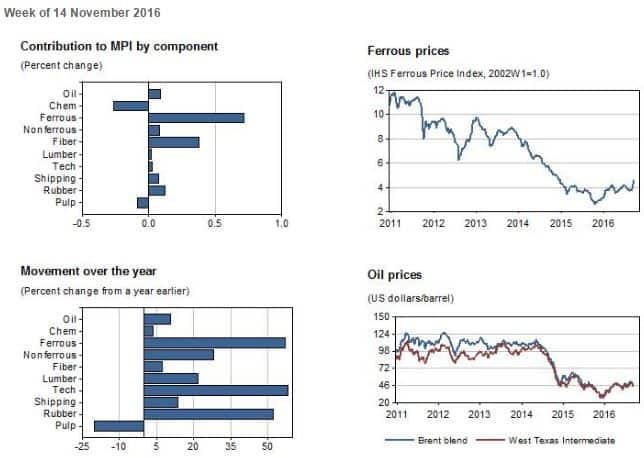

The IHS Materials Price Index (MPI) rose 1.2% this past week, its largest increase since the middle of August. Oil broke out of a four-week downtrend, with strength also provided by rubber, which rose 3.5%, and fiber prices, which jumped 5.8%.

Following a period of intense volatility, commodity markets were far calmer last week. Oil prices rose 0.6%, with sentiment a bit more positive on prospects for an OPEC production agreement. The ferrous subindex, which for the past two weeks had seen huge gains because of rallies in coal and iron ore, moved up another up 2.5% last week. The largest mover this week, however, was the fiber subindex, which jumped 5.8% driven by rising polyester prices.

Last week saw several significant macroeconomic data releases, although commodity markets were still being directed by reaction to the US election. Eurozone industrial production fell during September, down 0.8%, as consumer durables production slumped 5.6% after a spike in August. However, industrial production is particularly volatility in the third quarter due to the timing of plant shutdowns for the summer holidays. In October, US industrial production was flat month on-month, although the manufacturing component gained 0.2%. In the United Kingdom, input costs surged 4.6% month on month, as the weaker pound, combined with increasing commodity prices, finally began to affect producers. Our expectation is that the headline index will remain fairly flat in the coming weeks, perhaps even eking out slight gain. That said, we continue to see a period of volatility around a mid-December US interest-rate increase.

Global Sourcing Survey

We invite you to participate in our fifth annual Global Sourcing Survey.

Supply chains are fragile and susceptible. As a procurement professional, you know it is vital for global executives to have visibility into their supply chains and to proactively measure and react to risk. In this annual survey we aim to take the pulse of the global supply chain in the following areas:

- Identify how prepared businesses are for a disruption

- Determine how companies’ sourcing strategies will change in 2017

- Identify companies’ strategies for outsourcing to China or other locations

The survey will take approximately 15 minutes to complete. Please be assured that your individual responses will remain confidential and that results will only be published in aggregate form. All survey participants will be notified of the resulting benchmark report when it is published.

Please contact Paul Robinson at paul.robinson@ihsmarkit.com with any questions

Thank you. We appreciate your contribution.

Follow this link to the Survey:

Take the survey

Or copy and paste the URL below into your internet browser:

http://ihs.az1.qualtrics.com/SE?SID=SV_9zAUBHvYxelqnd3&RID=MLRP_82nSOk20RTRaGXP&Q_CHL=email

Industrial Materials: Prices

Key Prices & Demand Drivers