November 6, 2014 - Weekly Pricing Pulse

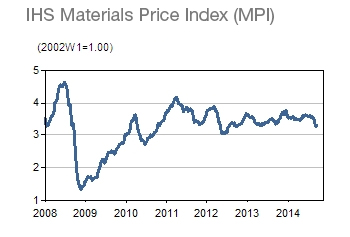

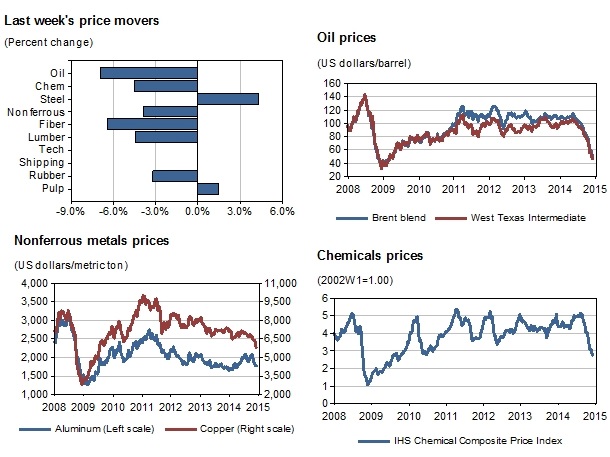

The IHS Markit Materials Price Index (MPI) strengthened 0.5% last week, with a sharp weekly rise in freight rates offsetting further softness in chemical markets.

Rates for capesize bulk carriers departing South America and Australia for China have surged over the past two weeks, driven primarily by tighter available tonnage and stronger chartering activity by the big-three iron ore miners. BHP Billiton, Rio Tinto and Vale have been competing for market share, boosting production despite a lack of demand, and pushing the price of iron ore to five-year lows. It is worth noting that despite the abrupt turnaround in freight rates, on a level basis they have not yet breached year-to-date heights.

Diverging monetary policy was on full display last week, with the most predictable action being the end of the Federal Reserve's third quantitative easing program. Brazil and Russia surprised markets with stronger-than-expected rate hikes, while Sweden cut rates to zero in a further attempt to stave off deflation. However, it was the Bank of Japan that caught markets off guard, with a surprise expansion of its own stimulus program. The move helped to lift the dollar and sink most exchange-traded commodities last Friday. In the absence of rebounding demand, and with liquidity signals caught in the crosswinds, dollar-denominated commodities are unlikely to drift upwards over the coming weeks.

Related Sites

Pricing and Purchasing – Supply Management

Global Pricing Summary - Week of 6 November 2014

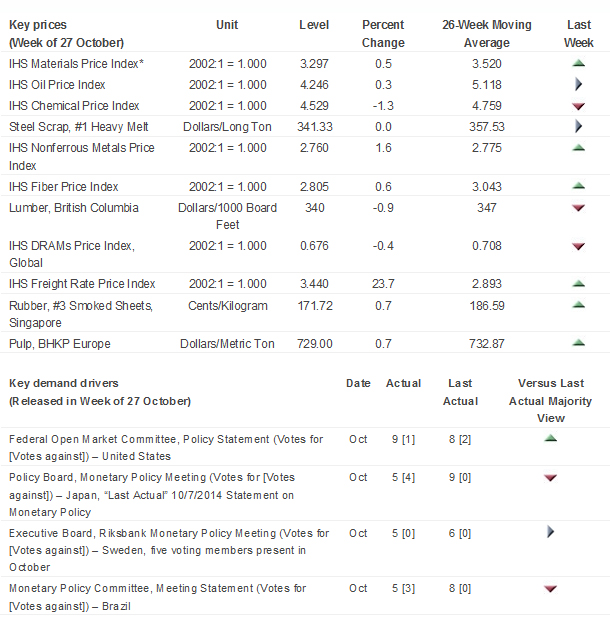

Key Prices & Demand Drivers