Perception Analytics

Yes, please send me more information about your Perception Analytics Studies

What are your investors thinking right now?

While many clients leverage S&P Global's full-scale Perception Studies to benchmark investor sentiment annually, companies also find value in tapping into real-time market feedback for pressing C-suite and Board questions using S&P Global's Street Beat offering.

Our Street Beat product provides in-depth investor feedback at a lower price point and on an accelerated timeline, whether you need to know what your investors expect for an upcoming event, want to measure immediate sentiment about your earnings results, or are dealing with market-moving news.

Best-Practice Checklist for Sustainability Engagement

Our team has conducted 30+ Sustainability Perception studies over the last three years. Through in-depth research, the team identified general best practices for engaging with institutional investors on Sustainability topics. Here is a summary:

"KYI" -

Know Your Investor

"KYI" -

Know Your Investor

Most buy-side firms have an integrated, collaborative process, so it is important to include both investment and Sustainability, corporate governance, or stewardship contacts in the meeting. Practice the "3

Ts"

Practice the "3

Ts"

Topical, Timely and Tailored are three measures critical to ensuring that your Sustainability messaging resonates. Awareness is

Key

Awareness is

Key

Proactive engagement to bring awareness to your company's Sustainability profile can make a difference in how you are perceived.

Read the full checklist here

Do you know what your investor base is really thinking?

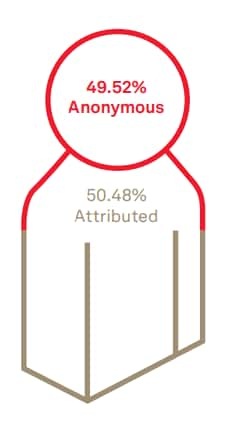

50% of the investors we interview opt to have their feedback anonymized.

We can help you understand how investors perceive your company.

Perception Analytics from S&P Global Market Intelligence helps corporate issuers understand how investors and analysts perceive their company, how effectively their corporate messaging strategy is resonating with the Street, and what the market expects going forward.

Over the last decade, the team has conducted studies for over 800 companies across 36 sectors and recorded the number of investors who opt to have their feedback anonymized versus those who choose to be attributed. Almost half of the investors we interview opt to have their feedback anonymized, citing the ability to provide candid, sensitive, and constructive feedback without the fear of tarnishing existing relationships with Investor Relations, C-suite executives, and Board members.

Read the full report here

Expertise for Every IR Need

Serving more than 2,500 corporate issuers across our suite of services, we understand the impact of a strong IR program. As we have grown from Ipreo to IHS Markit to now as S&P Global Market Intelligence, our Investor Relations & Sustainability data, analytics, web-based platforms, and IR expert analysts help IROs and their management teams connect to the capital markets to accelerate their progress.

Learn more about our full line of Perception Analytics services at Investor Perception Analytics Solutions | S&P Global (spglobal.com) or find us at Investor Relations Solutions S&P Global Market Intelligence Investor Relations Solutions | S&P Global (spglobal.com)

We connect our clients to the capital markets to accelerate their progress.