Investor Targeting Technology and Advisory Services

Yes, please send me more information about your Investor Targeting Services.

Are you meeting with the same institutional investors who never buy your stock?

Our reports show how our investor targeting technologies and analysts can help you dramatically increase investor meeting win rates.

To navigate today's universe of capital spanning 25,000+ investment firms with 100,000+ funds and 160,000+ contacts, actionable intelligence is essential. While the largest firms in key geographical cities may be well known, substantial pools of capital exist among unengaged funds, mid-tier asset managers and tertiary markets.

At S&P Global Market Intelligence, our investor targeting model is scientifically proven to produce results. The service is powered by BuysideIQ, the industry gold-standard for accurately matching issuers with qualified institutional investors at the firm and fund level.

Read more below about our two reports on investor targeting.

Achieving Better ROI, TSR and Volatility Through Data-Driven Investor Engagement

Key Highlights:

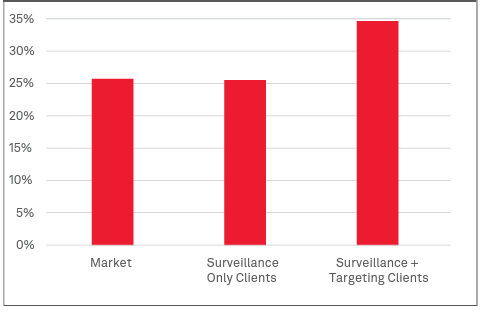

The Investor Relations Solutions team at S&P Global Market Intelligence analyzed calendar's total shareholder return (TSR) and price volatility across thousands of clients and found that IR teams who partnered with us on both Stock Surveillance and Investor Targeting outperformed their peers and the broader market by 9 percent on average and experienced 30% lower stock price volatility. These trends were confirmed for various market cap groups and industries, as well as for prior periods. In the current environment, the teams that are engaging these lesser known, but S&P Global Market Intelligence recommended portfolios are winning in the marketplace.

Total Shareholder Return

Our SPGI's Investor Targeting Model is Scientifically Proven to Produce Results

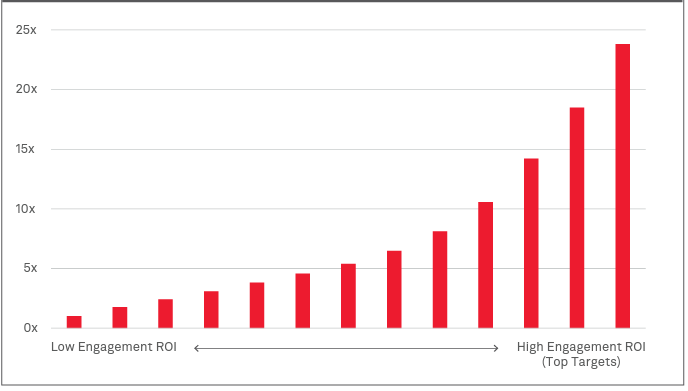

Our IR Solutions team is continuously adapting and bringing new data and approaches to our Targeting analytical model to ensure it is driving tangible results for our IR partners. We hold ourselves accountable through extensive back-testing and model refinement, so IR teams can trust that they are aligning IR and C-Suite time with the investors that have the greatest analytical probability to buy their shares. To illustrate how we isolate the market for a stock, the below chart demonstrates the extent to which our proprietary suitability scores predict significant initiation by investors. As scores rise, the frequency of significant initiation rises asymptotically.

Relative Frequency of Significant Initiation

Takeaways:

A targeted (non-owning) investor that is highly recommended by S&P Global is over four times more likely to initiate a new holding than an investor with a moderate probability for initiating, and over twenty times more likely to initiate than a low probability investor.

In practical terms, in the effort to attract new capital, one day of meetings with investors recommended by S&P Global Market Intelligence will have a higher probability of significant initiations than over a week of meetings with investors that are selected from lower probability pools of capital.

Peer Targeting only covers half of the market for your shares (at best)

Issuers commonly get target investors that hold peers for incremental or new investment in an issuer. This sales strategy is called 'peer' targeting.' While it may seem intuitive to target investors who are likely familiar with the issuer's business (by virtue of owning a peer) our analysis finds that most investment is not connected to investment or investment in an issuer's peers.

Evidence that peer targeting works can come in two forms:

Investors who purchase a member of the peer group while retaining ownership in other members of the group.

- Investors who sell a current position in the peer group in order to replace the investment with another member of the group. This paper indicates the extent to which either scenario explains investor decisions.

Sample Issuers -- We selected 50 issuers from a range of industry, market cap, and region as detailed in Appendix A ("Sample Issuers"). We avoided conglomerates, issuers experiencing significant M&A or a high level of activism, and issuers falling outside conventional industry classifications. A detailed list of issuer characteristics is appended to this report.

Sample Shareholders -- For each issuer in the sample, we examined the top 20 largest active fund owners ("Sample Shareholders"), limited as follows:

- We used only one fund per institution -- the largest owner -- per issuer to avoid double counting funds employing the same portfolio manager.

- We excluded funds with multiple advisors because it is not possible to assign any particular holding to a single contributing advisor.

- We excluded sector funds, which by definition would tend to own peers (sector funds represent 3% all mutual funds).

For part one, we overlaid ownership in peers by Sample Shareholders for each Sample Issuer, counted the peer positions and summed their investment. For part two, we isolated the largest new investor, if any, among the Sample Shareholders and looked to see if the new investor had sold any shares in peers during the previous four quarters.

Importantly, we used peer groups created by the issuer; ie., we did not pick the peer groups, nor did we know which peers, or how many peers, were in each peer group prior to selecting a Sample Issuer. We did not review the shareholder base of any Sample Issuer prior to selection. Finally, we used the results from every issuer selected unless either the peer group had three of fewer peers, or the issuer was not meaningfully owned by at least 20 active funds consistent with the conditions described above.

Key Findings:

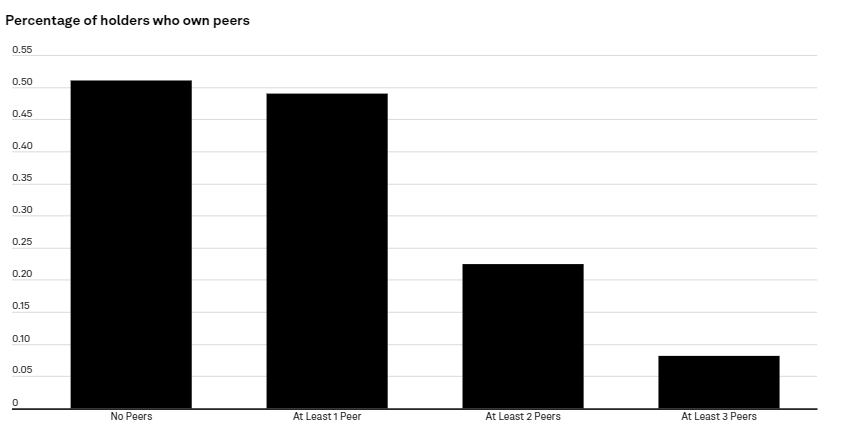

Among the issuers included in our study, the median count of peers held by the issuers' largest fund owners was zero (most of the owners of most sample companies did not own peers.)

- For the typical issuer, 73% of shares outstanding were held by investors that did not own a peer.

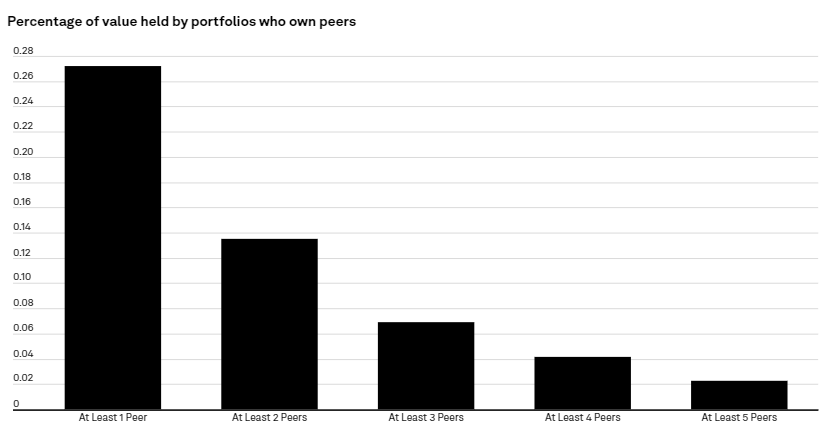

- Of the minority of portfolios that owned peers, the investment in the peer group was less than 2% for the majority (57%) of them.

- In no case did we observe an investor selling a peer in the same period during which the investor purchased the issuer.

- Alternative marketing strategies would likely improve effectiveness.

Key Finding 1

Key Finding 2

Conclusion

While peer targeting may seem intuitive - why not pitch Coke to a holder of Pepsi ? - brokers and issuers are likely to expand their potential market by employing alternative fundamental targeting strategies. Brokerages, which tend to be organized along industry lines, may be well-served by overcoming any institutional bias to limit marketing efforts to an industry silo. Likewise, issuers are likely to have more productive meetings with non-holders if they temporarily suppress their instinct to compete with peers, in this case, for their investors.

We are not suggesting that an issuer's peers have no relevance to portfolio managers. Surely portfolio managers consider industry outlook and an issuer's valuation and performance relative to competitors. Moreover, our research does not consider the possibility that a portfolio manager may make a decision to purchase a peer before deciding upon which one; in which case industry would be the primary driver of investment. In this paper, we simply conclude that most of the time current investment in company A is not well explained by investment (or divestment) in company A's peers, and therefore future ownership cannot be reliably predicted by investment (or divestment) in company A's peers.

Read the full analysis here.

Now is the time to talk to S&P Global Market Intelligence

From Ipreo to IHS Markit to now S&P Global Market Intelligence, our Investor Relations Solutions Advisory team understands the importance a strong IR program has for corporate issuers. We partner with issuers to maximize company valuation by prioritizing the most appropriate investor interactions to promote continuous demand for shares.

Additional Resources

Join us at our Webinar | Accelerated IR: Taking a Proactive Approach to Shareholder Acquisition

In conjunction with Rose & Company, please join our panel of experts to discuss the evolving landscape of investor engagement and successful shareholder management and acquisition.

Register for this webinar and on-demand replay

IR Expert Series: Investor Targeting and the Sustainability Frontier

Our IR Expert Series provides insights from S&P Global Market Intelligence experts on pressing topics facing corporate issuers and investor relations teams.

In this edition, hear from Michael Miller and Morgan Bodell from our Investor Relations Solutions Team as they discuss key components to a strong sustainability program and insights for IR teams looking to develop their sustainable targeting. Watch the 5-minute video interview.

For information on our full line of Investor Relations & Sustainability Solutions, find us at: https://www.spglobal.com/marketintelligence/en/mi/products/investor-relations-solutions.html