Activist Surveillance

Yes, please send me more information about your Investor Activism Advisory Services.

Is your company prepared for rising investor activism?

Investor Activism Campaign Volume Hit a New Record High in 2023

2023 was another very busy year for activists, as they launched a total of 1,151 campaigns, up slightly from the full-year 2022 total of 1,083. ESG continues to be a prominent theme, making up 82% of campaign objectives in 2023.

Access our latest infographic for a deeper view of 2023 activism campaign activity, including regional and industry totals, ESG-focused initiatives, and how many campaigns were marked as successful or settled.

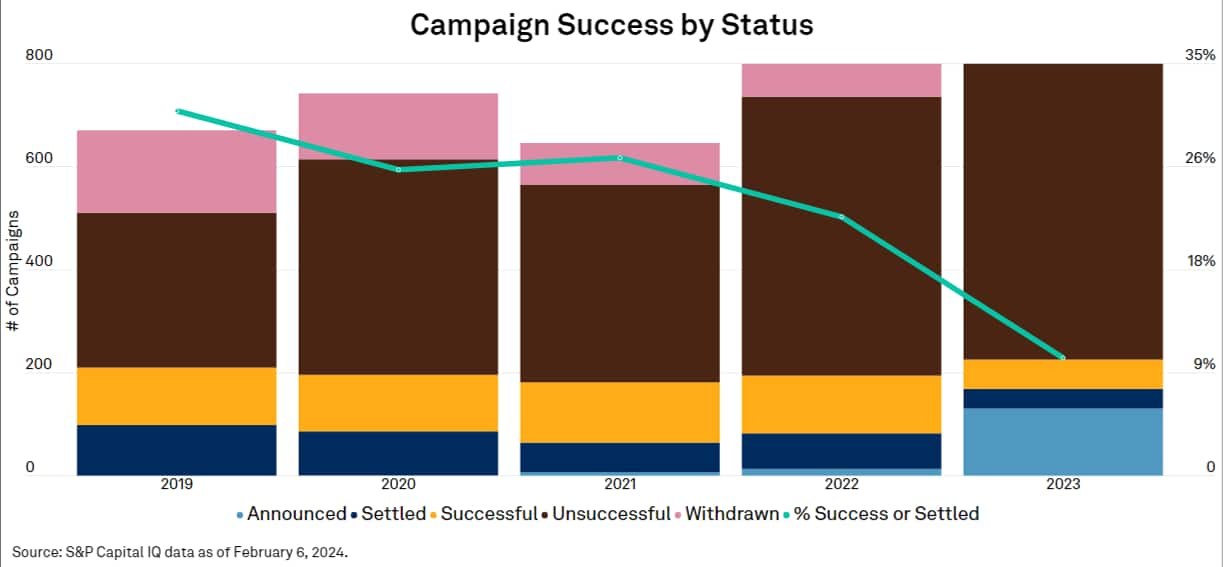

Rate of Success for Investor Activism Campaigns

While there is an increasing trend in ESG-related investor activist campaigns and the volume of campaigns launched in general, 2023 featured the lowest success or settle rate over the past four years with 10%, down from 31% in 2019. The Information Technology sector had the highest success or settle rate of 19.3%, while the Energy sector produced the most unsuccessful campaigns with 74%.

Read full report:Investor Activism Data | S&P Global Market Intelligence (spglobal.com)

More Shareholder Activism Trends

Private Engagement: Increasingly, activists are opting to engage privately with companies, often seeking to settle their demands through a negotiated agreement.

BOD & Regulatory Trends: Activists continue to win board seats at an aggressive pace; the first half of 2023 provided an early indicator that new universal proxy rules are making it easier for activists to win board seats.

2023 Campaigns:

- NRG Energy-Activist investor Elliott calls for new CEO at NRG Energy

- AQN-Starboard says the sale of Algonquin Power's renewables business can help it reduce leverage and provide "a safer dividend."

- Shake Shack-Engaged Capital Proxy Battle

Activism Defense: Preparation and Vigilance

Our Activist Surveillance team recommends taking the right steps and asking the right questions:

- Establish a core internal Activist Team

- What structural protections does your company have and how effective are they?

- How does your company engage with its stakeholders?

- Which areas of your company are an activist likely to attack?

- What are the responsibilities of various constituencies?

- Third parties: Does your company have a strategic defense group in mind? (PR, Legal, Proxy, Banking)?

- Be your own activist

Our Checklist for the Most Common Criteria for Activist Screening

- Stock Price Performance

- Capital Structure

- Activist investor already in the Sector

- Candidate for Sale

- Candidate for Break-Up, Restructuring

- Negative Headline Risk

- Vulnerable to Takeover

- Current Shareholder Base Analysis

- Corporate Governance Issues

- Target new, long-term shareholders who align with company goals

- Management Stability/Board Tenure

Now is the time to talk to S&P Global Market Intelligence

From Ipreo to IHS Markit to now S&P Global Market Intelligence, our Investor Relations Solutions Advisory team understands the importance a strong IR program has for corporate issuers.

Given that all activist situations provide unique challenges, we have the capability to tailor our reporting based on the key concerns of the Management and Investor Relations teams. Our Activist Surveillance team analyzes daily settlement flows using our proprietary surveillance methodology to monitor potential activist involvement in the stock. Our findings are aggregated in a brief, board-ready report daily. The report includes the most up-to-date settlement analysis, as well as overall trends observed since the latest public filing information, and long-dated options, swaps, and over-the-counter options.

"S&P Global's knowledge of activist tendencies and early activist identification is second to none. It was S&P Global who alerted us to the activist action, even though our company also had a proxy firm engaged at the time. S&P Global continues to be one of our most trusted advisors." -Fortune 300 Consumer Services - SVP of Investor Relations

"I've used multiple surveillance teams in the past, and the S&P Global team is the best I've worked with. Activist investors have been very active in my industry, and the S&P Global team has been extremely accurate in tracking activists' trading in my stock." -Mid-Cap Specialty Chemicals - Chief Financial Officer

Additional Insights on Investor Activism

Webinar On-Demand: Evolution of Investor Activism: What's Next?

IR in Focus Podcast on Investor Activism

For information on our full line of Investor Relations &

Sustainability Solutions, find us at:

Investor Relations Solutions | S&P Global

(spglobal.com)

Investor Relations Solutions from S&P Global Market Intelligence

We connect our clients to the capital markets to accelerate their progress.