Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — March 10, 2025

By Neil Barbour and Iuri Struta

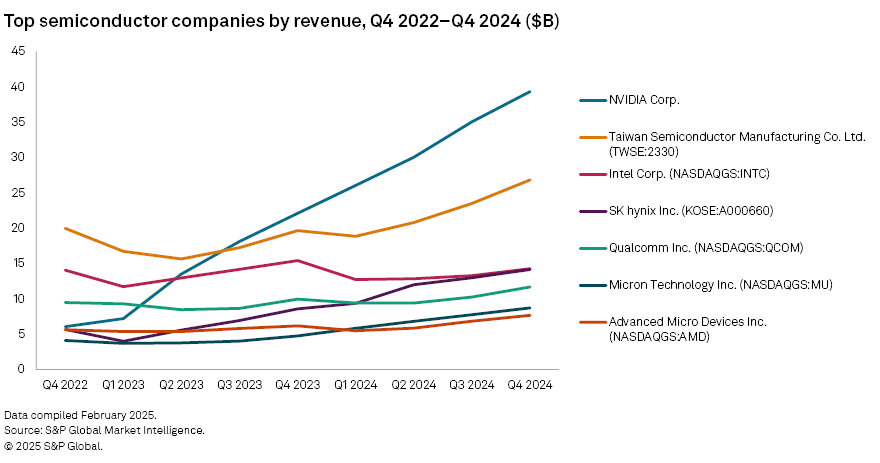

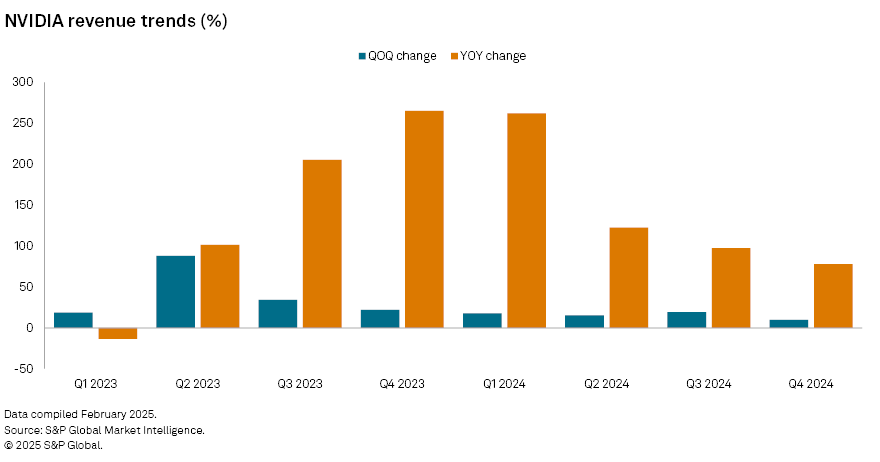

NVIDIA Corp. beat expectations for growth in the fourth quarter of 2024 as the success of its Blackwell platform pushed overall revenue up 77.9% year over year to $39.3 billion, once again widening the gap with its peers in the semiconductor space.

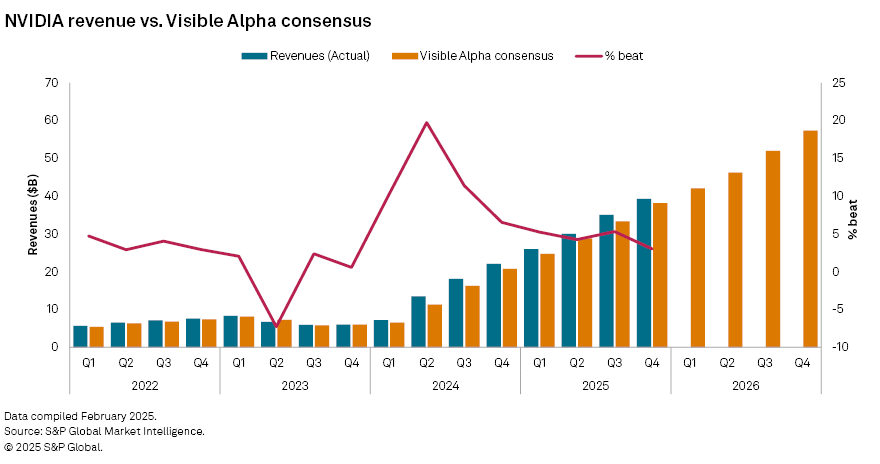

NVIDIA beat the Visible Alpha consensus estimate of $38.18 billion by about 3% compared to the 7% by which it beat the estimate in the year-ago period. The anticipated "air pocket" — or dip in order strength — during the transition from the Hopper generation of chips to Blackwell has been avoided, with the company achieving approximately $11 billion in sales of Blackwell chips.

However, investors remain cautious about the stock due to a few extraneous threats. The company faces growing competition from hyperscalers increasingly looking to design their own chips. There are also questions whether companies need such powerful chips for the high-growth use case of inferencing, the process of producing outputs after a foundation model has been trained.

In the short term, uncertainty about potential tariffs on chip imports as well as President Donald Trump's tougher stance on chip exports to China present risks. NVIDIA revenue from China nearly tripled from the same period in 2024 to about $5.5 billion.

These factors may help explain the lack of excitement in the stock price following the strong earnings results. The share price closed down 8.5% the day following the Feb. 26 after-market earnings report.

Furthermore, NVIDIA's growth trend is decaying, with quarter-over-quarter improvement below 10% and year-over-year growth well below 100%. To be sure, these are growth rates most businesses would envy, but the slowing momentum may leave some investors with questions about the long-term opportunity, particularly since history shows most technology transitions result in capacity overbuild and resulting supply surpluses.

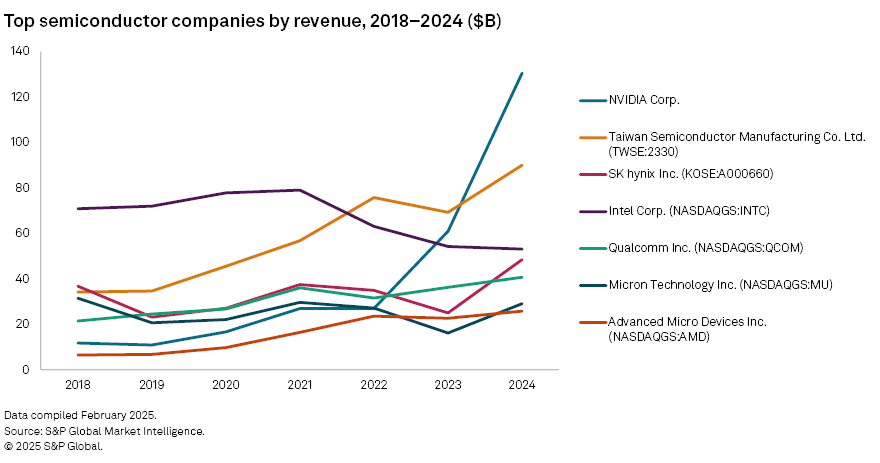

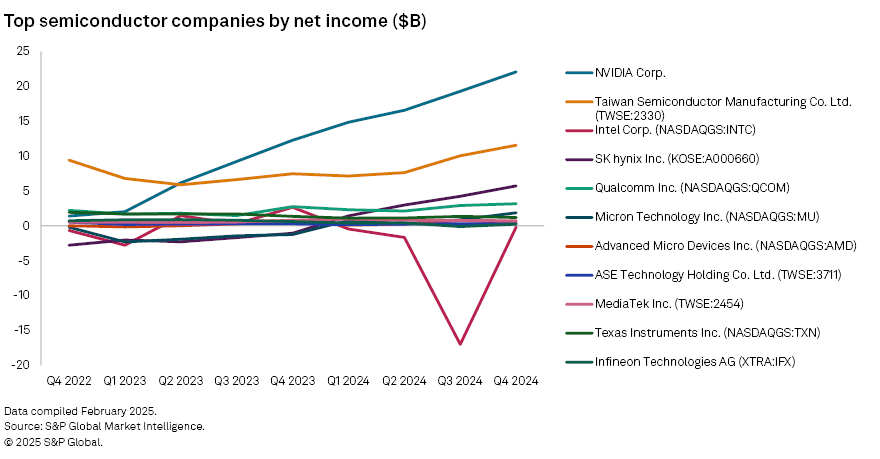

The AI era has catapulted NVIDIA from an also-ran in the semiconductor space with a niche focus on gaming at the turn of the decade to the industry's largest company by revenue in 2024, outpacing even fabrication giant Taiwan Semiconductor Manufacturing Co. Ltd.

The success is driven by its datacenter division, through which NVIDIA sells its graphics processing units (GPUs) to power AI training and inferencing applications.

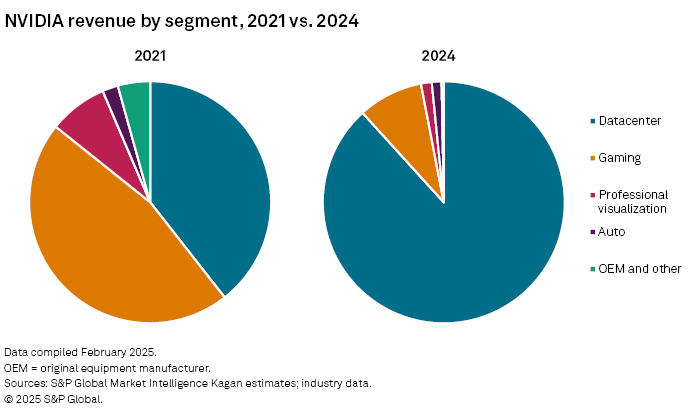

For the full year 2024, 88% of its business was in the datacenter business line, compared to 39% in 2021. Over that same period, gaming revenue, which is composed of add-in boards for consumer PCs and laptops, was steady in the $10 billion to $12 billion range, meaning it accounted for less than 10% of total company revenue in 2024.

Looking at net income shows that NVIDIA's recent run is not just a topline success, but also a profitable one. In the recent quarter, NVIDIA's net income at $22.09 billion was more than double TSMC’s net income and many multiples compared to its peers in the chip design space, such as Advanced Micro Devices Inc. and QUALCOMM Inc.

.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Consumer Insights is a regular feature from S&P Global Market Intelligence Kagan.