Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 28, 2022

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Worldwide manufacturing and services PMI data will be eagerly anticipated next week for the first indications of early Q4 performance around the globe. Intertwined with the PMI data releases will be central bank meetings across the US, UK, Norway, Australia and Malaysia with further rate hikes expected, especially from the US Federal Reserve. A series of tier-1 economic data including October US payrolls and eurozone Q3 GDP and October flash CPI figures will also be anticipated.

The release of October flash PMIs reinforced concerns of economic slowdown this week with the US and Europe facing heightened risks of recession according to the latest data (see special report). Next week's update on worldwide manufacturing and services data will therefore shed light on whether the rest of the regions face similar pressures at the start of the final quarter of 2022.

Central bankers meanwhile are caught in the crosswinds between elevated price pressures and slowing global economic growth. Despite so, most are set to remain in their resolute to tame inflation with central banks from US to Australia due to raise rates in the meetings next week. The Fed, in particular, is expected to institutionalise another 75-basis points hike, although their path thereafter appears a little less certain. As such, the Fed's rhetoric will be closely watched for hints on the magnitude of future rate hikes. October's payrolls data will also be an important piece of information and may offer indications on the level of concern necessitated from central bankers as the US labour market look set to soften against weaker demand as signalled by the latest PMI data.

Meanwhile the Bank of England is just as certain to act to tame the elevated, albeit easing, price pressures domestically. Despite the lingering uncertainties on the politics front, whereby stability in the months ahead is yet to be guaranteed even with a change of Prime Minister, the BoE looks set to raise rates further into a recessionary environment.

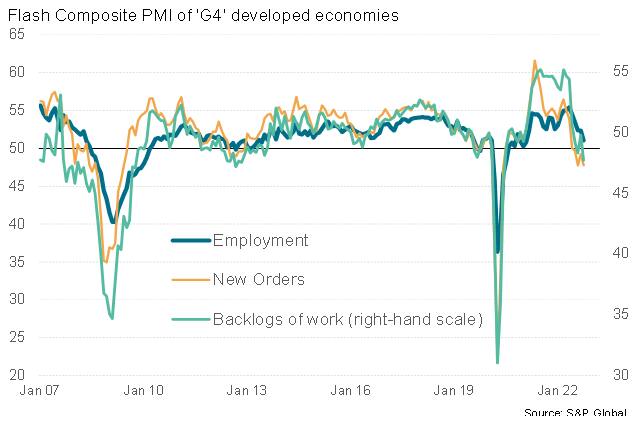

Some comfort has been drawn from the resilience of labour market data amid growing signs of recession, with sustained hiring in key developed economies allaying fears of a deep downturn. However, that resilience is now showing some cracks.

One of the features of the pandemic was a substantial build-up of order book backlogs at companies, where shortages of raw materials and shipping delays prevented firms from meeting customer demand. The auto sector is perhaps the most well-documented example of such an inability to meet demand, due to the lack of semiconductors. These backlogs have been a welcome source of continued growth in 2022, facilitated by improving supply lines.

However, the October flash PMI data reveal that these backlogs have been falling in recent months. The rate of decline has in fact accelerated markedly at the start of the fourth quarter to the steepest for a decade (if the early pandemic shock is excluded). The problem is that there is a dearth of new orders being placed from customers to replace these back-orders. Companies are thus growing concerned that costly excess capacity is now developing. Hence, according to the October flash PMI data, the rate of job creation slowed across the four largest developed economies to the lowest since February 2021, representing a major downshifting of hiring since the survey peaks seen during the second quarter of the year. US jobs are already being cut. Final PMI data due out in the coming week will help further reveal the extent of the global hiring slowdown and give more clues as to the potential depths of recessions.

Developed world employment and order books

Monday 31 October

Philippines Market Holiday

South Korea Industrial Output (Sep)

Japan Industrial Output (Sep)

China (Mainland) NBS Manufacturing PMI (Oct)

Thailand Manufacturing Production and Trade (Sep)

United Kingdom Mortgage Lending and Approvals (Sep)

Eurozone HICP (Oct, flash)

Eurozone GDP (Q3, flash)

United Kingdom Nationwide House Price (Oct)

Tuesday 1 November

Philippines Market Holiday

Worldwide Manufacturing PMI Surveys* (Sep)

Australia RBA Cash Rate (Nov)

Indonesia Inflation (Oct)

Hong Kong Retail Sale (Sep)

United States ISM Manufacturing PMI (Oct)

United States JOLTS Job Openings (Sep)

Wednesday 2 November

South Korea CPI (Oct)

Japan BOJ Meeting Minutes (Sep)

Philippines Manufacturing PMI* (Oct)

Germany Trade (Sep)

Germany Unemployment (Oct)

Germany S&P Global/BME Manufacturing PMI* (Oct)

Eurozone S&P Global Manufacturing PMI* (Oct)

United States ADP National Employment (Oct)

United States Fed Funds Target Rate (2 Nov)

Thursday 3 November

Japan Market Holiday

Worldwide Services & Composite PMI Surveys* (Sep)

Australia RBA Meeting Minutes (Nov)

Australia Trade Balance (Sep)

Malaysia Overnight Policy Rate (Nov)

Switzerland CPI (Oct)

Norway Key Policy Rate (Nov)

Eurozone Unemployment Rate (Sep)

United Kingdom BOE Bank Rate (Nov)

United States International Trade (Sep)

United States Initial Jobless Claims

Canada Trade Balance (Sep)

Friday 4 November

Japan au Jibun Bank Services and Composite PMI* (Oct)

Philippines CPI (Oct)

Thailand CPI (Oct)

Germany Industrial Orders and Manufacturing Output (Sep)

Germany S&P Global Services and Composite PMI* (Oct)

Eurozone S&P Global Services and Composite PMI* (Oct)

United Kingdom S&P Global/CIPS Construction PMI* (Oct)

Eurozone Producer Prices (Sep)

United States Non-Farm Payrolls, Unemployment, Average Earnings (Oct)

Canada Unemployment Rate (Oct)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

October manufacturing and services PMIs

Worldwide manufacturing and services PMIs will be released in the coming week following the October flash PMI updates, which revealed heightened recession risks in the US and Europe (see special report). Meanwhile Japan was the only major developed world economy to reflect expansion, buoyed by service sector improvements. Overall confidence across US to Japan nevertheless slumped while the job market softened. Manufacturing, services and composite PMI data will therefore be tracked across the world for indications on the health of the global economy at the start of the fourth quarter.

Americas: Fed FOMC meeting, October payrolls data

A busy week ahead for the US economic calendar is packed with both the November Fed FOMC meeting and labour market data. The latest consensus pointed to another 75 basis points (bps) rates hike by the US Federal Reserve even as the latest flash PMI data showed the US private sector falling sharply into contraction territory. Indications on the path post the 2 November meeting will be closely observed and we expect the pace of rate hikes to slow, subjected to changes in the inflation outlook.

On the labour market developments, the consensus calls for a 200k addition to non-farm payrolls in October, easing from the 263k registered for September. Unemployment rate is expected to tick up slightly to 3.6% while average hourly earnings is expected to continue rising at a pace of 0.3% month-on-month (MoM).

Europe: Eurozone Q3 GDP, inflation data, UK, Norway interest rate decisions

Besides PMI data to allude to October economic conditions, the market will be looking to official eurozone Q3 GDP data and October flash inflation figures next week.

Central bank decisions in the UK and Norway will also be unveiled with the market expecting a 75-bps hike by the Bank of England to 3.0%. While the elevated price pressures will drive the BoE to move, the central bank will be hiking into a contractionary environment.

Asia-Pacific: Australia, Malaysia interest rate decisions

Central bank decisions in Australia and Malaysia will be anticipated in the coming week. For the Aussie central bank, cash rate is expected to tick up further by 25-bps to 2.85%

Flash PMI Data Signalled Heightened Recession Risks in the US and Europe - Chris Williamson

South Korea's Economy Slows in Third Quarter of 2022 - Rajiv Biswas

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.