Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 19, 2024

By Chris Williamson and Jingyi Pan

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The earliest insights into economic conditions across major developed economies in April will be tracked with flash PMI releases on Tuesday, while key official data updates in the coming week include US first quarter GDP and core PCE data. The Bank of Japan meanwhile convenes at the end of the week amidst volatility surrounding the Japanese yen. The earnings season will also be in full swing.

Flash PMI data for the US will be closely watched in the coming week, especially on prices after March data warned ahead of the stubborn inflation trend for CPI. While core PCE figures will also be due for a check of the Fed's preferred inflation gauge, any hints of higher than anticipated inflation may add to market jitters over Fed policy. Additionally, Q1 GDP, personal income and spending data will be official releases, helping to add colour on economic conditions. Markets will also be eyeing corporate earnings results, and especially forward guidance, for insights as to how companies are coping in the higher rates environment.

While the Fed may be confronted by stubborn inflation, the eurozone saw inflation cool in March. Any extension of the easing inflation trend will be watched with the upcoming HCOB Flash Eurozone PMI to see if the European Central Bank may become the first of the major central banks to cut rates this year. The UK flash PMI will also be eyed for further signs of recession having ended, but more importantly for inflation cooling to open the door for rate cuts.

In contrast, the Bank of Japan remains on track to lift rates, though Friday's BoJ meeting is widely seen as too early to see a hike. Dovish comments from BoJ officials at the March meeting, where the negative interest rate regime concluded, alongside hawkish tones in the US, have pushed the yen down 9% against the US dollar far this year to its lowest since 1990. This was despite indications of stronger growth in Japan, as seen via the March au Jibun Bank Japan PMI.

Several inflation updates will also be anticipated across APAC economies including for Australia, where the flash PMI will also help assess whether softer price pressures might lead to a rate cut pivot by the Reserve Bank. The HSBC Flash India PMI will meanwhile offer insights into this strong-performing economy.

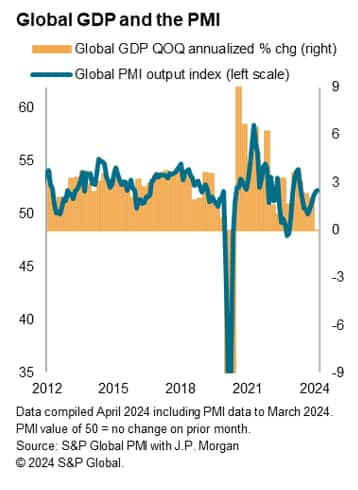

Flash PMI data for April due in the coming week follow an encouraging picture painted by the global PMI surveys in March. At 52.3, the headline global PMI covering manufacturing and services in over 40 economies hit a nine-month high to signal an accelerating pace of expansion.

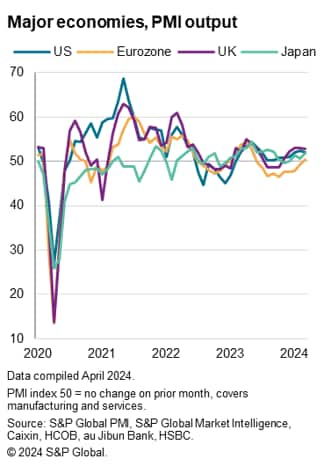

Developed world growth was led by the UK and the US, though in both cases rates of expansion slowed, followed by Japan, which in contrast reported the largest monthly output gain since last September. The eurozone meanwhile returned to growth, albeit with falling factory output acting as a notably strong drag on Germany. Canada bucked the growth trend, remaining in contraction.

The emerging economies meanwhile collectively reported the sharpest growth since May 2023, led again by India, which saw the second-fastest expansion since July 2010. Strong growth was also recorded in Brazil, while more modest but still-solid growth was recorded in Russia and mainland China, the latter enjoying its steepest upturn for ten months.

The March surveys also brought signs of the upturn becoming more broad-based by sector. While still being led by the service sector, the global upturn was buoyed by manufacturing output growing at the sharpest pace since June 2022. Consumer-focused sectors have increasingly joined financial services as growth drivers thanks to improved financial conditions, and manufacturing has benefitted from restocking and a near-stabilisations of global export orders.

Average prices charged for goods and services meanwhile rose worldwide at a steeper rate for a second consecutive month in March, hinting at historically elevated stickiness of consumer price inflation at the global level in the coming months. Upward price pressures were primarily linked to increased labour costs, and were most evident in the service sectors of the UK and US.

Monday 22 April

China (Mainland) Loan Prime Rate (Apr)

Indonesia Trade (Mar)

Taiwan Export Orders (Mar)

Canada New Housing Price Index (Mar)

Eurozone Consumer Confidence (Apr)

Tuesday 23 Apr

Australia Judo Bank Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Singapore Inflation (Mar)

Taiwan Industrial Production (Mar)

Hong Kong SAR Inflation (Mar)

United States New Home Sales (Mar)

Wednesday 24 Apr

South Korea Consumer Confidence (Apr)

New Zealand Trade (Mar)

Australia Inflation (Q1)

Indonesia BI Interest Rate Decision

Germany Ifo Business Climate (Apr)

Canada Retail Sales (Feb)

United States Durable Goods (Mar)

Thursday 25 Apr

Australia, New Zealand Market Holiday

South Korea GDP (Q1, adv)

Malaysia Inflation (Mar)

Germany GfK Consumer Confidence (May)

Turkey TCMB Interest Rate Decision

United States GDP (Q1, adv)

United States Wholesale Inventories (Mar, adv)

United States Pending Home Sales (Mar)

Friday 26 Apr

Australia PPI (Q1)

Japan Tokyo CPI (Apr)

Japan BoJ Interest Rate Decision and Quarterly Outlook

Singapore Industrial Production (Mar)

Mexico Trade (Mar)

United States Core PCE Index (Mar)

United States Personal Income and Spending (Mar)

United States UoM Sentiment (Apr, final)

Saturday 27 Apr

China (Mainland) Industrial Profits (Mar)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

Flash PMI data for April

Flash PMI figures will be released on Tuesday, April 23, for major developed economies including the US, UK, Eurozone, Japan and Australia, in addition to India. The flash data will offer the first look into business conditions at the start of the second quarter following indications of accelerating global growth and rising prices at the end of Q1.

Specifically, inflation remains the big question after global selling price inflation accelerated to a ten-month high with the UK and US amongst which seeing the steepest price hikes, adding uncertainty to the rate cut outlook for the respective central banks.

Americas: US Q1 GDP, core PCE, durable goods orders, personal income and spending data

The first estimate of US Q1 GDP will be published on Thursday with the consensus pointing to a slower, but still robust rate of growth from the final 3.4% quarter-on-quarter (q/q) print at the end of 2023.

Meanwhile the S&P Global Flash US PMI data are set to offer a first look into national growth and inflation conditions in April, which will be monitored alongside the release of March core PCE, the Fed's preferred inflation gauge, at the end of the week. The latter will be watched for any indications of sticky inflation especially after recent hotter-than-expected US CPI data.

EMEA: Eurozone consumer confidence, German Ifo and GfK survey data

The highlight of the week will be flash PMI data released for the eurozone and UK, though a series of confidence data are also anticipated including eurozone consumer confidence and German business climate reports.

APAC: BoJ, BI meetings, Australia CPI

In APAC, the Bank of Japan holds its first monetary policy meeting since ending its negative interest rate policy in March. Although the BoJ is expected to lift rates further, it is likely that the central bank will hold off until the second half of 2024 for their next move amidst uncertainty on the inflation front. Bank Indonesia also convenes midweek with no changes expected until at least the second half of 2024.

Meanwhile inflation data will be due from APAC economies including Australia, Singapore, Hong Kong SAR, Malaysia. Australia's first quarter CPI data are expected to show further signs of easing, consistent with the latest indications from the Judo Bank Australia PMI.

© 2024, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.